Also see:

- Confirmed: CVS accepts credit cards for PayPal My Cash reloads in NYC

- How to pay bills with PayPal My Cash + Business Debit Card + RadPad + Evolve Money

- Get an Easy 1% Cash Back on Your Rent and Other Debit Card Purchases

Out and Out reader Jack commented:

Had trouble today for the first time loading my PayPal my cash card with a credit card at CVS.

Once the lady scanned the PayPal My Cash card the computer prompted her as CASH ONLY. She refused my credit card.

Did they finally hardcode?

I wanted to follow up because I had a similar experience here in New York City.

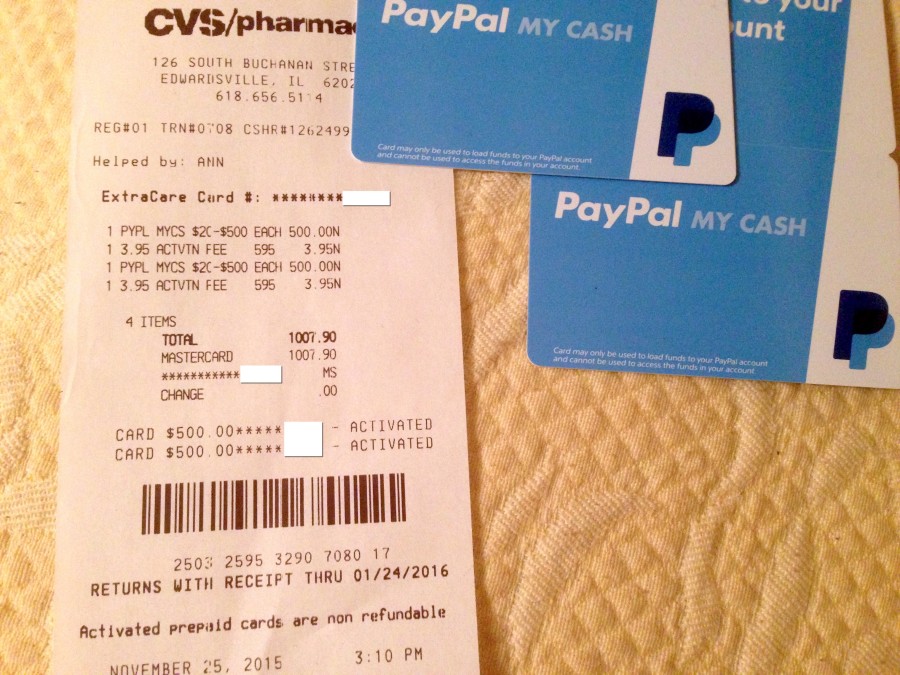

I went to a CVS on Houston Street, handed over 2 PayPal My Cash cards, and requested $500 on each, for a total of $1,007.90 after activation fees.

The cards scanned without a problem, and the total popped up.

I swiped my new Citi Prestige card, hoping to help meet the $3,000 minimum spending requirement this way, and then pay with rent with RadPad and the PayPal Business Debit MasterCard.

Like Jack, I got a similar prompt on the register. I asked if she wouldn’t mind just trying to swipe the card. It wasn’t declined. It simply didn’t process.

She said it looked like cash only – no credit cards allowed.

So I set out to try a store in southern Illinois over the Thanksgiving break.

Success! But it’s very YMMV

Same as always, I went to the register, stated my business, and it came time to pay. Always kinda nerve-wracking when they start looking at your credit card.

But the cashier was friendly, and mentioned that people load up their PayPal My Cash cards all the time at that location.

I pressed “Credit” on the payment machine, swiped my Citi Prestige (again, that moment where the bank may decline the transaction), and the receipt spit out.

Easy.

So easy, in fact, that I went in after Thanksgiving to do it again.

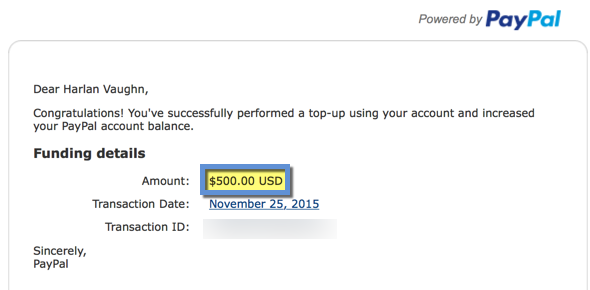

I had no problem loading the cards online at paypal.com/cash.

I loaded up $500 each day for a few days in a row until the cards were empty.

What’s it mean?

It’s obviously not hard-coded into the CVS system. Not if some stores are still loading them up.

But it does mean you’ll need to find a CVS where it’s possible to load up. There doesn’t seem to be a pattern to which stores allow credit cards and which do not.

It still definitely works. But it does seem to’ve gotten more difficult.

Is it worth it?

This is great for meeting minimum spending requirements and generating some extra points and miles.

Plus, when you use the PayPal Business Debit MasterCard, you earn an easy 1% back on purchases, which covers the activation fees on the cards. So the points and miles are literally free.

In that regard, yes, it’s totally worth it.

But you should NOT for any reason withdraw the money to your bank account. If you do, you can very likely have your account frozen by PayPal, and it will be a long process to get the money back. And you could lose your PayPal account.

So only do this if you intend to use the PayPal balance for purchases, or the PayPal Business Debit MasterCard. Paying your rent with RadPad is still a solid method for spending the funds.

What else is left?

A friend of mine reports success in loading a Serve account with a Vanilla Visa gift card at a Dollar General store (this is also possible at some Family Dollar stores, too).

Better yet, you can buy Vanilla Visa gift cards with a credit card at Dollar General or Family Dollar – and then load them to your Serve account there, too. A one-stop shop for MS!

Take caution though, and do NOT withdraw the money from Serve to another bank account because AMEX will shut your account down, especially for higher amounts.

Serve has a robust bill pay function (you can pay anyone or anything) so you shouldn’t have any issues with spending the balance.

Bottom line

PayPal My Cash cards live on at CVS, but myself and a few others have hit snags at certain locations. But not at others. I had success this past week with loading up 2 cards for $500 each in 1 transaction.

No doubt it’s getting tougher, though. Best thing is to find what works for you, and rinse + repeat for as long as the gettin’ is good.

A few peeps report success buying and loading Vanilla Visa gift cards at Dollar General and Family Dollar stores, so that might be another avenue worth exploring, especially if you have access to several locations.

I’ve heard Rite Aid is 50/50 for loading Serve with gift cards, too.

So that’s the current state of PayPal My Cash cards.

Please report your experiences in the comments!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I have purchased paypal card with credit card from CVS at Atlanta area for the past three years and never have any issue.

Works fine with Paypal purchases at multiple Rite Aid and CVS, maxing out 4k each month for more than a year. Unloading to pay rent and the rest directly to my checking. Never any problems in store or online.

Only one Rite Aid store has the “scary” management instructions that other follow – to not even touch PaypalCash w/o cash in hands.

FD registers are hardcoded for VGC purchases with a CC.

looks like there is a $2000 limit a day for buying these cards. I bought 4 in one day with zero problem.

Yep, that’s the usual limit. Excellent news that you got 4 in 1 go!

So PayPal does not allow you to transfer the money in PayPal to your own bank account? Then how do you get cash? Thanks!

You don’t get cash – the best way to get money out is to use the PayPal Business Debit MasterCard for purchases. Transferring the balance to you bank account will surely result in getting suspended from PayPal.

So in other words “Paypal” is the one violating all sorts of banking laws. Because let’s face it. Money is money.

Now corporations can choose to either take or not take your money. And can choose their clients. But they can not issue or control the currency of a nation without it’s consent.

Please note… paypal is not a bank! If you forced them to follow your (lack of ) rules, they would surely not offer the service because it would be taken advantage of and lose more money.

Can I transfer the money to a friend on paypal? I would be taking advantage of using my credit card in order to send rent money to my roommates.

Oh and by the way. You’re paying interest on your own money. On top of the interest the CC issuer will charge you because you’re using “Their” money, not yours.

And these same folks are the ones that say that businesspeople are the source.

Hilarious. You basically are teaching the modern day equivalent of ANTI Money management skills.

It’s important to pay off the credit cards, churners by definition don’t usually run up balances and not pay them.

Is he correct? If you use your credit card, I thought you would not get any interest if you pay off your bill on time? Also with the 1-2% cash back you would be gaining money since the 3.95 would be less than 1%?