Also see:

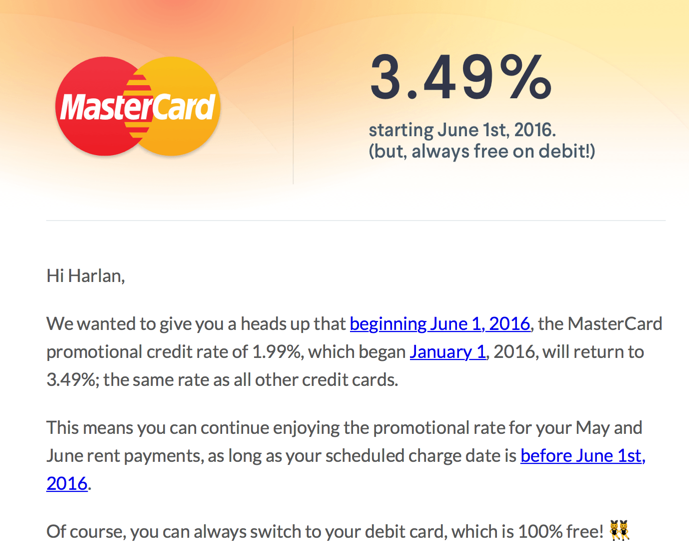

RadPad has been a sweet deal these past few months thanks to their 1.99% fee for paying with a MasterCard.

You could earn 3X Citi ThankYou points by paying with the Citi AT&T Access More card (and still can until June 1st, 2016). Because I have 3 Airbnbs, it’s been a points-generating machine for me.

Even better, when you pair it with Citi Prestige, the 3X points are worth nearly 5% back when you redeem for American Airlines flights. Even with the fee considered, you still come out ahead.

RadPad increases to 3.49%

So many deals are dying these days. When I got the email about the increase to a 3.49% fee, I didn’t feel anything. Just another one gone. Add it to the list (as of June 1st, 2016).

Their consolation seems to be “always free on debit!” (which still gets you 1% cash back). But with the Citi AT&T Access More/Citi Prestige combo, I was doing better than 1%. I was getting nearly 3% back.

Obvi, the rate increase eats into that margin.

I tweeted my displeasure, and got fed the line about debit being free as a reply.

@harlanvaughn Bummed to see you go! Don’t forget, debit’s always free!

— RadPad (@radpad) April 13, 2016

Hoookay. And also like, byeeee.

Enter Plastiq

- Link: Plastiq

- Link: Citi AT&T Access More card

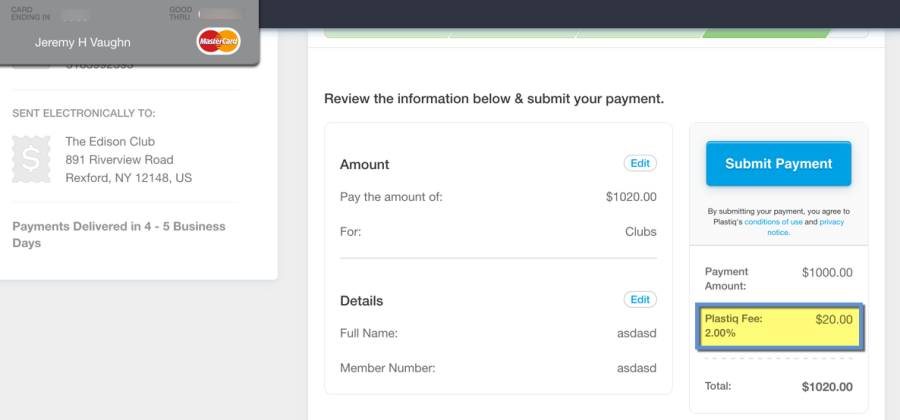

I’ve always been trepidatious about Plastiq. But via Reddit, they’re now charging 2% fees for MasterCard bill payments, clearly in response to the RadPad move.

I’m ready to jump ship. And even better, you can pay not only rent, but also your mortgage, utility bills, and student loans.

According to FlyerTalk, you’ll get 3X Citi ThankYou points on mortgage payments with the Citi AT&T Access More card. I just joined the ranks of mortgage-payers, so this is excellent news!

When combined with Citi Prestige, that’s like 2.8% back when redeeming for American Airlines flights even after Plastiq’s fee (3X Citi ThankYou points X 1.6 cents with Citi Prestige – 2% Plastiq fee).

By the same logic, it should also work for rent payments, as they’re coded the same way.

But before you jump ship…

I was ready to be like RadPad who? until I plugged in my mortgage into. I was able to get the 2% rate to show with certain merchants, but not others. Here’s what I mean.

I found a completely random merchant and set up a test payment. The 2% rate shows up with a MasterCard set for payment.

Great!, I thought. It works!

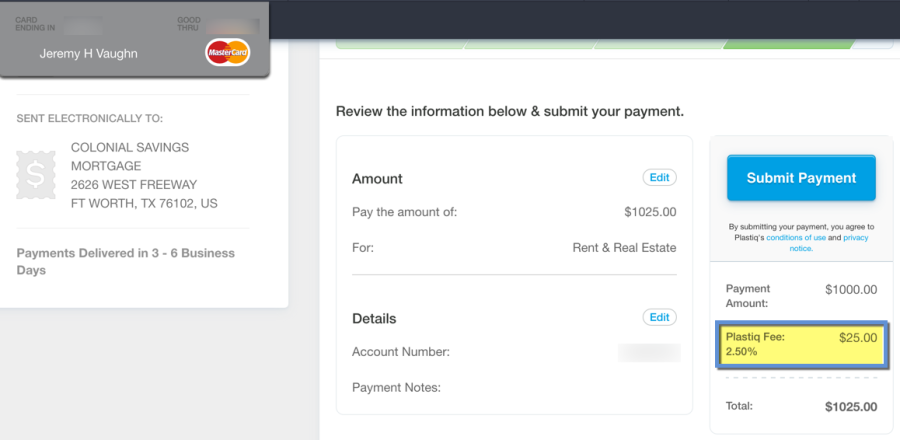

I was easily able to find my mortgage company, Colonial Savings, via the search tool. They’re available for ACH payments. But the fee was 2.5%, which isn’t as good as 2%. I have no idea why.

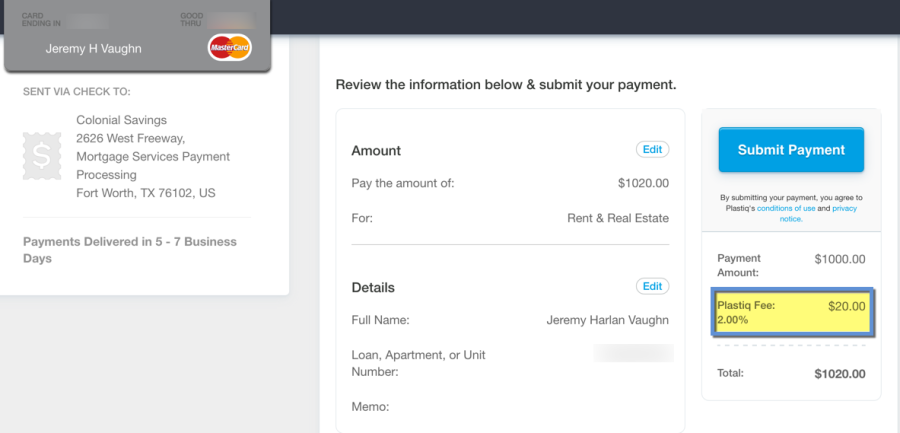

But, a manual add yielded a 2% fee with a MasterCard.

As you can see, the difference for a $1,000 payment is $5, which isn’t a lot of points OR cash.

But the crucial difference in this case is the ACH payment has a 2.5% fee and it’s delivered in 3 to 6 business days. And the mailed check payment has a 2% fee and is delivered in 5 to 7 business days.

For $5 more, I’d rather spring for the ACH payment because I don’t want a late fee assessed to my mortgage.

And, even still, I’m coming out ahead with the Citi AT&T Access More/Citi Prestige combo.

All this to say, YMMV and do what’s best for you.

I have a mortgage payment due May 1st, and I’m gonna try this out and watch it like a hawk to see how fast Plastiq pays and how it codes with the Citi AT&T Access More card. I expect it to go smoothly.

By the numbers

Per $1,000 you’ll:

- Pay $1,020 with a 2% fee and earn 3,060 Citi ThankYou points worth ~$31 at 1 cent each or ~$49 on American Airlines with Citi Prestige

- Pay $1,025 with a 2.5% fee and earn 3,075 Citi ThankYou points worth ~$31 at 1 cent each or ~$49 on American Airlines with Citi Prestige

The difference is marginal. And either way, you’re basically doubling your return on the fee payment. Even with the 2.5% example, you pay $25 but get back $49. That’s an extra $288 per year and your mortgage gets paid with a credit card.

Not to mention you can also use this for rent, utilities, student loans, etc. So with the Citi AT&T Access More and Citi Prestige card, you can pair them and score a nice haul – again, assuming they code correctly. Start small and see how it codes and what posts.

Of course, you could also transfer your Citi ThankYou points to travel partners and get outsized value, too. That’s an extra ~37,000 Citi ThankYou points per year per $1,000 in Plastiq payments at the 2% rate.

Bottom line

Interesting stuff. I’m glad I found a way to effectively replace RadPad AND pay my mortgage and still come out ahead.

I’m not sure if the 2% fee on MasterCard payments with Plastiq is being rolled out slowly or is just glitchy at the moment. Either way, it seems you’ll come out ahead when you use the Citi AT&T Access More card for 3X Citi ThankYou points. And then pair it with Citi Prestige (or even Citi ThankYou Premier) for more redemption options. Here’s my link if you decide to apply for either one.

My utility company charges 3% for credit card payments, so payments via Plastiq are actually cheaper anyway. And in most scenarios, you’re more than recovering the fee thanks to the 3X category of online purchases on the Citi AT&T Access More card.

I love geeky stuff like this, so I’m gonna try it for my next mortgage payment and see how it goes.

Also, I love how the same day RadPad announced an increase, Plastiq matches their old rate. If anything, it’s made me want to try it and see how it goes.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I’ve been considering this card but don’t need the ATT phone, I’m all Verizon in Portland since ATT doesn’t have great coverage here. I do like the thought of using the card for Plastiq payments of my car loan and some other bills. The 3% online is very tempting! Not sure if it pans out over the annual fee though. I guess it’s time to break out the spreadsheet. I’m currently meeting min spends for Ink and SPG business so using those on Plastiq now as 10K in 3 months is a lot more than my normal spend.

What’s your next trip Harlan? I’m headed to Puerto Vallarta in April and Colorado in June on my SW companion pass.

It definitely more than makes up the annual fee on the Access More card since the card gives you a 10k TYP bonus every year that you spend at least $10k. Paying rent/mortgage should more than cover that.

Absolutely agreed.

Whoa there’s a lot here to unpack – lots of great ideas! 🙂

You could always resell the phone after the credit posts. I don’t think Citi knows whether or not you actually got AT&T phone service. And you could unlock it and use with any network – even Verizon. Or pocket the cash from the sale.

Another commenter mentioned this, but you get 10,000 TY points after spending $10K in a year – that more than offsets the annual fee. IMO, it’s not even a consideration.

Curious to hear your experience with Plastiq – easy payments? Any issues? I think I’m going to schedule my first one next week, too! And yup, the 3X is definitely a plus.

Next trip? Nothing planned at the moment! I feel naked without a trip in the future. Next thing is just to wind up NYC and get to Dallas finally. I’d love to visit Cancun for a beach vaycay. Or Alaska again. Or Iceland. I’m thinking my next trip will be a “return trip” instead of a brand new place.

PVR sounds fab, too. Never been there. You’ll be there soon – hope it’s nice and sunny for you! 🙂

Thanks Aaron for the 10K TYP bonus info, I wasn’t aware of this. That could sway me.

Harlan, my experience with Plastiq is that it has been effortless and on time, every time. I’ve used it to make my car payment and student loan for a few months now. I have made the transaction 2 weeks prior to the due date just in case. It takes about 2 days for them to mail the check, they notify you by email when it goes out. Then about 5 days snail mail time. Plastiq also sends an email when the recipient cashes the check.

I am using to meet min spend on both Ink and SPG business so I don’t mind paying the 2.5% for right now on a few items.

Can’t wait for PVR and good luck wrapping up NYC in prep for your move.

Anybody know if Citi AT&T gets 3x on rent payments via Plastiq as well?

Lots of reports say it DOES, but depends on how the charge is coded. Mortgage payments are coded as “real estate” which is eligible for the 3X category. Utilities, I believe, do NOT earn 3X. Hope that helps.

Some people said Yes but some said No. After Radpad’s 1.99% rate expires in June, I want to test it in person to see if it counts for 3x. If not, it is not worthy to pay rent through it anymore.

I’m pretty sure rent and mortgage payments will earn 3X because of how they’re coded. Utilities probably will NOT because the card doesn’t earn 3X on utility bills. I’ll keep you posted!

Any update on how the mortgage payment went? Did it qualify for 3x?

Hi Fred! I can confirm I earned 3X with the Citi AT&T Access More card – all the points from the payments made with Plastiq posted perfectly!

I still like plastiq and can’t apply for any more credit cards.

hi Harlan, I just paid my rent using plastiq for the first time last week and it’s coded as “Miscellaneous Real Estate Agents and Manage RS Rentals”. When i called to find out if it would be coded as 3x, i was told only purchases at retail and travel websites would be counted as 3x. Is it true? did they just changed the rules? or the rep didn’t know what he was talking about? he did put me on hold and went look for the info.

Rep had no clue. It still counts for 3X and has always coded that way for me.

Same here. Paid the mortgage via Plastiq and checked out with the CSR to see how many TYPs are due. It turned out to be 1X. Pretty disappointing.. 🙁 Will need to wait for the monthly cycle before they actually post the TYPs accumulated on my account. Hoping it ll turn out to be 3x

I’ve never had it NOT code as 3X. My statement closes on the 9th next month – let us know if yours closes before then if you think of it. Thank you!

Confirmed.. that works !!! 🙂

Can you please tell us if you got 3x?

I did! (And still do.)