Also see:

- How to pay bills with PayPal My Cash + Business Debit Card + RadPad + Evolve Money

- Confirmed: CVS accepts credit cards for PayPal My Cash reloads in NYC

- Get Instant Access to Aspiration Summit, the Best Checking Account in America

I have to thank Out and Out reader Greg for pointing this out. He says:

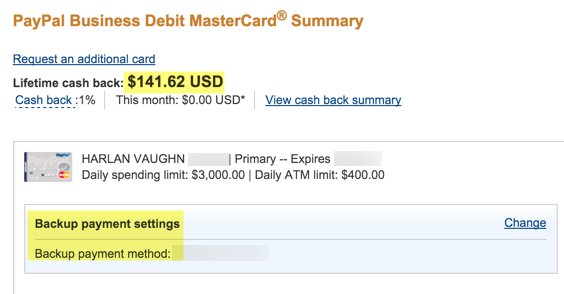

I have a Paypal Business Debit MasterCard that earns me 1% cash back on “credit” purchases. I don’t fund it, I just use it to pay almost all of my bills and have it linked to my bank account.

I get my 1% cash back on everything, don’t have to worry about my Paypal balance (as long as my bank balance is good), it makes me feel like I’ve added a layer of protection to my bank account, and it buys me some float time from when I make a purchase until it clears my bank account.

I don’t do “debit” transactions with it BC I don’t get 1% cash back and and money is immediately withdrawn from my bank account… Unless of course my Paypal account still has a balance left from my monthly cash back reward, then that is deducted before anything hits my bank account.

After doing a little digging, Greg is absolutely right!

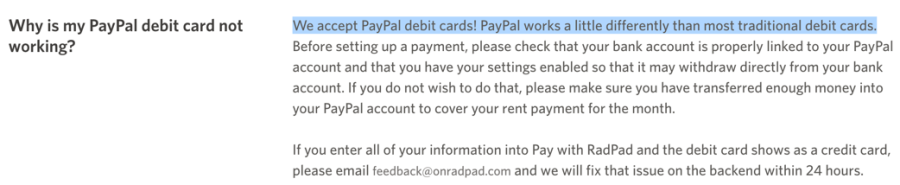

I wrote about how to pay rent with RadPad and the PayPal Business Debit MasterCard.

You can add in PayPal My Cash cards purchased from CVS to earn points and miles, too. As long as you load up your account and ONLY take the money out through a purchase made from the PayPal Business Debit MasterCard.

And yes, RadPad specifically codes as a purchase and earns 1% cash back.

In application

Link: RadPad for rent payments

RadPad is free to use with debit cards. And the PayPal Business Debit MasterCard is free to get, too.

Here’s how to get 1% cash back:

- Sign up for RadPad

- Get the PayPal Business Debit MasterCard

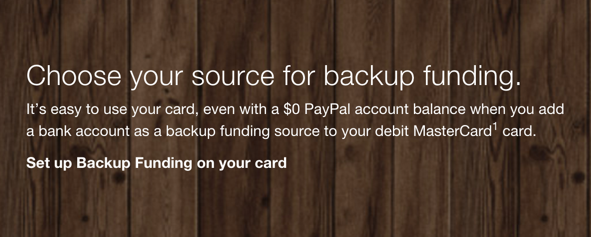

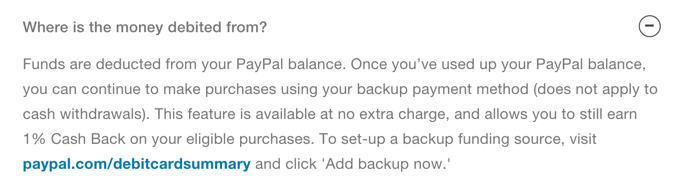

- Add your bank account as a backup funding source and keep your PayPal balance at $0

- Pay your rent on RadPad with the PayPal Business Debit MasterCard

- PayPal will pull the funds from your bank account because your balance will be $0

- At the end of the month, you’ll earn 1% cash back from running the purchase through your PayPal Business Debit MasterCard

I have gotten the 1% cash back from paying my rent through RadPad many times, but only used RadPad when I had enough in my PayPal account.

Now I know you don’t have to have a balance at all in your PayPal account. Which leads me to…

Try a combination of PayPal MyCash cards and your bank account

So I thought, OK, what if I bought $1,000 in PayPal MyCash cards and loaded them up, but my rent is, say $1,500?

- You’d still earn 1% cash back ($15)

- $1,000 would come out of your PayPal balance

- $500 would come out of your bank account

When you load up PayPal MyCash cards to the $500 maximum, you’ll pay a ~$4 activation fee. Considering you’ll earn 1% cash back from the PayPal Business Debit MasterCard, you’ll get $5 back. And the points and miles are yours to keep.

I think I’ll try to stock up on PayPal MyCash cards this weekend and give this a go.

It’s a good way to meet minimum spending requirements, earn points and miles, and pay bills that only accept debit cards – and you get 1% cash back on purchases you run through as a credit purchase.

If your rent is $1,500 per month, you’d earn $15 x 12 = $180 over the course of a year. RadPad is free, the debit card is free… it’s literally free money.

But before you do this, please read Frequent Miler’s cautionary tips. Never, never load the MyCash cards and move the money to your bank account. Only use the balance for purchases!

Pay other bills this way

I’ve been paying rent directly out of my bank account like a chump recently, and it kills me to think I could’ve earned cash back on all of it.

If there are any other bills that must be paid with a bank account or debit card, maybe a utility company, you can use the PayPal Business Debit Card to get 1% cash back. While not a lot, it’s certainly better than nothing!

Bottom line

Maybe you already knew this, and I’ve been slow on the uptake, but this is an easy way to score some cash back for paying your bills, especially rent.

I love RadPad and the PayPal Business Debit MasterCard, and it seems possible to throw PayPal MyCash cards into the mix to earn some points and miles, too.

At the very least, if you’ve been paying rent out of your bank account, pay it with RadPad instead.

Be careful if you add in PayPal MyCash cards. Make sure you only withdraw the funds through debit card purchases. DO NOT withdraw it to your bank account after you load them to PayPal because you WILL get caught.

I’ve never had a problem with PayPal or the MyCash cards, so exercise caution here.

If you don’t want to mess with the MyCash cards, no problem, stick to RadPad and the debit card and earn some free money when you pay rent.

What do you guys think of this?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Dude, you are seriously going to kill this one…and the MS who are not experienced with paypal are going to get their accounts frozen.

It’s been around for a few years by now, so I don’t think it’s in any danger of going away. Folks should definitely be careful like you said, as PayPal is NOT to be messed with. But if you’re careful, you shouldn’t have any issues.

He’s not killing anything since this has been long dead already. Anyone who cares about their relationship with Paypal has stopped doing this a long time ago.

I would rather ride a Greyhound Bus coast-to-coast then deal with the clowns at Radpad.

Radpad’s customer service is beyond incompetent— they’re unable to process payments to a landlord in another state, if one is leasing a property in a different state.

Avoid Radpad at ALL costs!

Wow, shocked to hear this.

One of my landlords is between New York and Florida and I’ve had no issues sending checks to him while he’s out-of-state. Or even switching back and forth from New York to Florida.

And the customer service I’ve gotten has been lightning fast. Sorry to hear you’ve had a bad go of it with RadPad.

I used this for a year already. No problems with RadPad or Paypal. Loading full 4k monthly via MyCash from CVS/RiteAid. Part goes to pay rent. The rest I TAKE OUR DIRECTLY TO MY BANK ACCOUNT. Never a glitch.

Good to hear. Thanks for sharing your experience!

I see that there’s a daily spending limit of $3000. Can this still work if your rent is over 3k?

Yes. But you have to call the day your rent is charged, which is kind of annoying. But worth it for the 1% back, IMO.

And RadPad’s limit for free debit transactions is $5,000. Above that, there’s a ~$10 fee.

Hope that helps!

Do you mean to call paypal to request a limit increase on the day that I selected for radpad to pay my rent?

Yes sir! The number on the back of your card.

You are seriously promoting deals that have been around for years and are just about to die? Everybody knows that Paypal Mycash cards is the surefire way of getting your PP account wiped from existence. And it’s not true that taking out money only via the PP debit card will prevent that. Hundreds or thousands of people have been doing that and got fried just during the last 12 months. A word of advice: don’t read/write this crap. Check other forums and blogs for the truth… What we don’t need is just another blogger who has no clue what he’s writing about and make things worse than they already are.

A little confused when you talk about using the PayPal card as a “credit” card. Does it still code as Debit? Basically, if PayPal card only gets the 1% cash back on “credit” purchases and RadPad is only no fee if you pay with a debit card how are you getting the 1% without getting hit by the RadPad credit card fee?

Ah, they run it as a “signature” AKA credit purchase. So even though it’s a debit card, the charge is treated as if it’s a credit card. And you’ll earn the 1% cash back when they run it that way.