Also see:

- Earning Points with Serve Reloads After April 16th

- Cut the Crap: The Fidelity Investment Rewards Credit Card is THE BEST cash back card!

Since I’m without REDbird and just have Serve as an option here in NYC, I’ve been thinking a lot about how to best use Serve following its move to Amex-only cards after April 16th.

They’re really not leaving consumers with a whole lot of options, but there are a few ways to get some great value and/or handy uses out of Serve using just American Express cards.

But don’t get them from American Express

In this post, I produced a list of all the Amex cards that are not issued by American Express.

Why?

Credit cards issued by American Express will not earn points and will not count toward minimum spend when used to load Serve. Which is so lame. I’d love to be able to use the Amex EveryDay Preferred to load this puppy up.

But alas, we take what we can get.

The FIA Fidelity Amex (!!!)

Why don’t other bloggers talk about this card more? This is my number one use of this card following April 16th. I’ve written about this card in detail many times before.

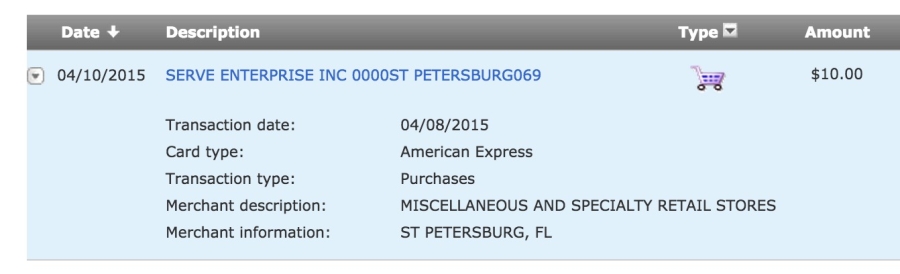

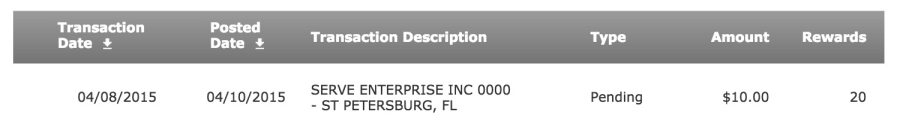

The transactions post flawlessly and are coded as purchases and earn free money.

I loaded up my Serve this month with my Barclays AAdvantage Aviator Red MasterCard for $990 to take AAdvantage of the 50% bonus that I was targeted for a few weeks ago to earn some extra free miles.

But then I loaded up the remaining $10 to my FIA Fidelity Amex to see how it would post.

What does this mean?

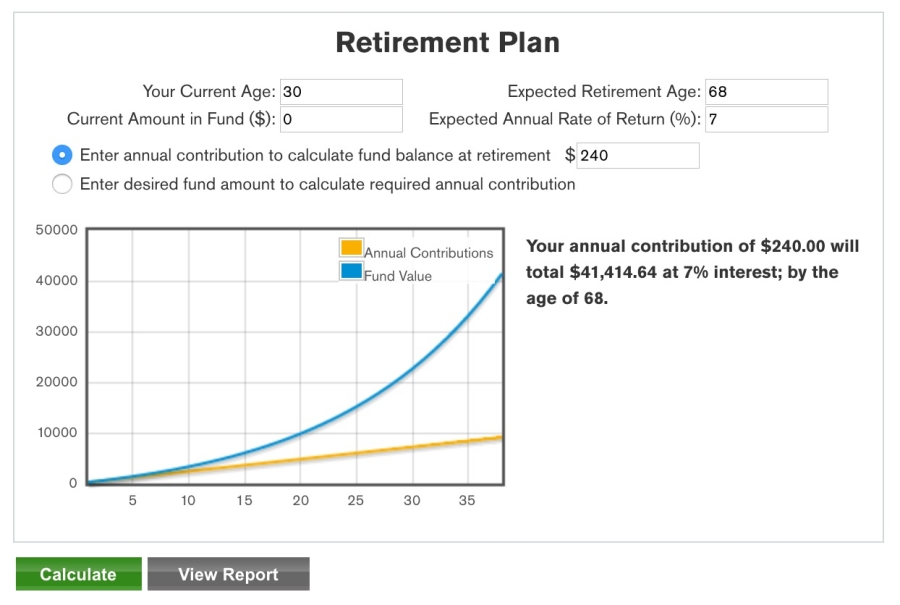

You can earn an extra completely, totally 100% free $240 to credit toward an IRA, brokerage account, or checking account for 1 minute of “work” each month. I use the Serve iPhone app to blearily load up my Serve account from bed the first 5 days of each month. It takes me literally seconds. This is the easiest money I’ve ever earned in my life, I think. I consider this, by far, the best use of the Serve card after April 16th.

Why?

The FIA Fidelity Amex has no annual fee and earns an unlimited 2% cash back on every purchase… including Serve reloads.

Say you get the FIA Fidelity Amex, which is free, and the Serve card, which is also free, and load up $1,000 each month and then pay it off.

You’d be stashing away a free $240 annually into a retirement account with very little effort.

I plugged in my own numbers into Bloomberg’s retirement calculator, and, assuming I contribute nothing but the $240 each year (and it grows at 7% annually) between now and when I’m 68, I’d have a totally free $40,000+ waiting for me on the other side.

This whole Serve reload thing probably won’t last for the next 38 years, but take the free money while you can. I like to stash away at least $200-$400 per month into my IRA, and the extra $20 isn’t much but with compound interest on your side, a little truly goes a long way. And this is completely free money. Which is awesome, and there is no reason not to take advantage of this if you can.

Get some free miles

To the same end, you could get 12,000 free American, Virgin Atlantic, or Asiana miles per year.

Obviously, I’d go for the American AAdvantage miles. 12,000 of them is nearly enough for a free domestic one-way. Depending on the route, you could score a $400+ ticket for nothing. Not a huge haul, but still pretty good considering the minimal effort needed. Can’t overstate the “earning miles from bed” factor enough.

You’d also get 10% of those redeemed miles back right away just for holding the Citi AAdvantage Platinum Select Amex, which brings the total redeemed miles to 11,250 miles needed for that free one-way. Really, not bad.

I don’t know much about Virgin Atlantic or Asiana miles, but they both have co-branded Amex cards available that are not issued by American Express, so if you’re into either of those mileage programs, this is an option for you.

Explore a funky new program

There is a world out there beyond Ultimate Rewards and Membership Rewards. Really.

- Try out USAA’s Rewards program with their Amex credit card.

- Or Travelocity.

- Or US Bank’s FlexPerks program.

Wells Fargo, PenFed, and Bank of American also have their own rewards programs that are accessible via American Express cards that they issue. No guarantees that they’ll code Serve reloads as purchases as opposed to cash advances, but if you have a pre-existing relationship with any of those banks or programs, it might be worth it to snag one of their rewards cards.

For one, it deepens your relationship with the bank. I have an old, old Icelandair MasterCard from Barclays that I use for one charge per month. I got it in 2007, so it’s 8+ years old by now, and I feel has helped me to get both the Arrival Plus and the AAdvantage Aviator Red after that – Barclays saw that my relationship with them was good and that I had a flawless payment history for over 8 years. And they gave me more credit.

Banks really like good relationships with customers. It’s why I use Chase as my primary checking account. They have the best rewards credit cards and have deigned to give me 6 of them, which is awesome. But I am also using them for 2 checking accounts (business and personal) as well as personal savings.

Also, just throwing this out there… if you got the US Bank FlexPerks Travel Rewards American Express, it would mean you could get a free Gold checking account with them – they waive all monthly fees if you have one of their credit cards – and it has a modest $100 bonus right now for opening a new checking and savings account with their START program and saving $1,000. Just in case you’d like to fall down the rabbit hole.

Pay bills that don’t accept credit cards

This is how I use the money loaded to my Serve account. Consolidated Edison, the utility monopoly company here in NYC doesn’t accept credit cards… but they take Serve bill pay all day and night.

Ditto for my student loan provider. No credit cards accepted, but the Serve bill pay has been a boon for helping me pay down my student loans while saving for my retirement simultaneously – which is pretty awesome.

I’ve also issued rent checks through my Serve account. They allow you the ability to send a check to anyone – including smaller landlords – for free.

What other bills do you have that don’t accept credit cards? Mortgages, condo common charges, car payments, insurance payments, utility bills, rent, student loans?

They’ll all take a check, though – and Serve could be your ticket for paying them via credit card. If nothing else, I really value that ability to use Serve to pay my utility bill and student loan bill each month. I’m sure there are dozens of other payments that you could easily plug into Serve’s bill pay and earn some easy miles or cash each month.

Which by the way… getting paid for paying bills? That’s pretty awesome, too.

Use Serve as a savings account

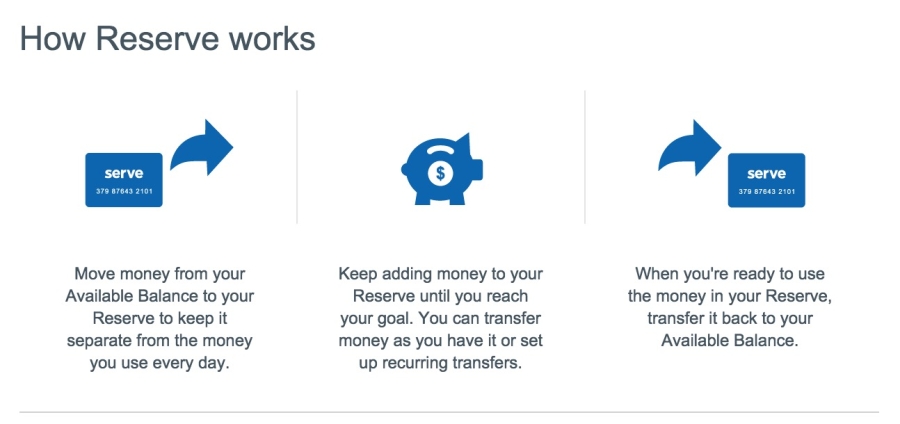

Serve has a savings account-type capability built into it called… Reserve. (I can just imagine that marketing meeting. God.)

Anyway, you could use it to save up some money – funded for free with a credit card – and rack up some miles or cash for doing so. Getting $240 annually to save $12,000 is 2% back (duh, and assuming you’re using the Fidelity Amex) – which is a better APR than most savings accounts offer anyway. And if you transfer that money into an IRA, you are effectively saving money for both short-term and long-term.

This is a wonderful use of Serve as a financial tool. If used correctly (AKA you pay off your credit card each month in full), this could be a great way to sock away money and to earn some rewards for doing so. Building a reward for yourself is one of the best ways to establish a habit loop – and if maxing our your IRA is your goal, the savings account can be the reward. Or rather, whatever you’re saving for would be the reward. Maybe both?

Bottom line

It takes me literally 10 seconds to load $200 at a time to my Serve account. Let’s round up and call that 60 seconds to do 5 reloads a month. 1 minute of work earns me $20 a month (with my FIA Fidelity Amex). It’s the equivalent of finding a $20 bill on the ground and picking it up. Serve is free and the Fidelity Amex has no annual fee.

There are still a few good uses for Serve after April 16th if you can’t access REDbird for whatever reason. While I wish I had REDbird instead, I’ll take what I can get.

American Express just set up a huge limitation, but with a little effort, you can still milk Serve for all it’s worth. Which is… not a lot but also not nothin’.

Are there any other good uses for Serve still out there? Would love to here from those who are still using Serve!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

This is a good post – thank you! It’s great that you covered potential uses of Serve and potential benefits. Surprised others haven’t yet either – if nothing else, it’s a way to advertise a few cards and inform readers as this is kind of a big deal. Big deal especially for me since I’m an expat and MS opportunities are rare.

Thank you for reading!

I suppose a couple of these things could be replicated with REDbird… and I didn’t even consider the expat angle. That’s really interesting! Glad you found this useful.

Hi Harlan,

Great post. I was wondering if you had any info on whether or not travelocity’s amex codes as a purchase? I’m looking to apply for a replacement card for my chase freedom i was previously using for serve loads. If not, what other card is not too picky? I want to go for FIA amex but from what i’ve read on myfico its incredibly difficult to get.

Thanks Harlan – I’ve been missing the WorldPoints Mall and was looking for other ways to boost my points on my Fidelity Investment Rewards card. I hadn’t heard of the Serve Prepaid Card. I may be a little slow on the uptake (or maybe it’s just my Friday thinking) but can Serve be used to pay the balance on the Fidelity card, meaning can you load Serve from Fidelity to gain the points … and then turn around and use Serve to pay down the amount you just loaded? Essentially no money out of pocket, no balance on your card but still points are earned. I’m sure I’m missing something. As I say, fuzzy Friday thinking. 😉 Thanks, D.

Hey D!

In theory… yes, you could love up Serve with the Fidelity Amex and then use the bill pay function to pay off the Amex bill. I’d recommend using the bill pay to pay bills that don’t accept credit cards (like utilities, loans, etc.) and THEN use the balance to pay off the Amex just so it isn’t quite so obvious.

I believe that Serve uses a third party bill pay platform, so they probably can’t trace it back to your Fidelity Amex, but you can never be too careful!

Thank you for reading!

What is the simplest way of doing a a direct deposit in avoiding the monthly fee on the Serve card?

Hey Ron! If you load at least $500 per month, there is no monthly fee. https://www.serve.com/help/ and click “Fees and Limits”.

I have heard online linking of Amex CC to serve account can get your serve account flagged and shut down. So how can you use to earn $240 per year?

Can anyone confirm that you receive miles for Asiana Amex?