I wrote about an increased offer for 30,000 Membership Rewards points for the AMEX EveryDay Preferred on CardMatch.

Nearly 3 weeks later, the offer is still alive and kicking. And so are other increased offers for AMEX cards.

Here’s a round-up.

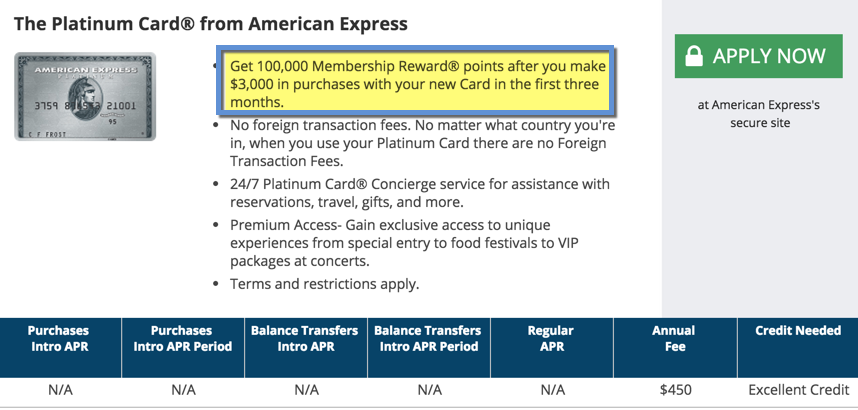

AMEX Platinum

Major draws:

- Centurion Lounge access

- Access to AMEX Fine Hotels & Resorts

- $200 annual airline credit

- Priority Pass Select membership

- Typical sign-up bonus: 40K Membership Rewards points

- CardMatch sign-up bonus: 100K Membership Rewards points

- Annual fee: $450, not waived

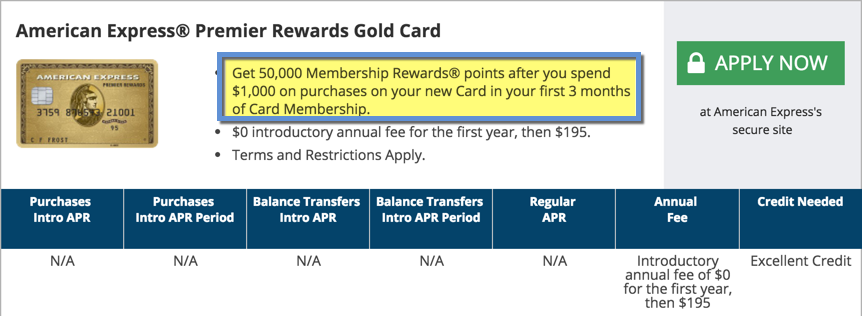

AMEX Premier Rewards Gold

Major draws:

- 3X Membership Rewards points on airfare booked directly with airlines

- 2X Membership Rewards points at US gas stations and supermarkets

- $100 annual airline credit

- Typical sign-up bonus: 25K Membership Rewards points

- CardMatch sign-up bonus: 50K Membership Rewards points

- Annual fee: $195, waived the 1st year

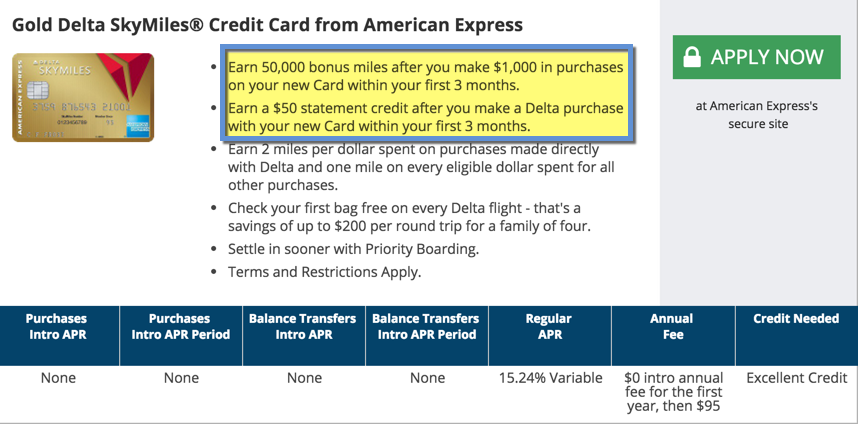

AMEX Gold Delta SkyMiles

Major draws:

- 2X Delta SkyMiles on Delta flights/purchases

- 1st checked bag free for yourself and up to 8 companions on the same itinerary

- Priority boarding on Delta flights

- Typical sign-up bonus: 30K Delta SkyMiles

- CardMatch sign-up bonus: 50K Delta SkyMiles and a $50 statement credit on a Delta flight

- Annual fee: $95, waived the 1st year

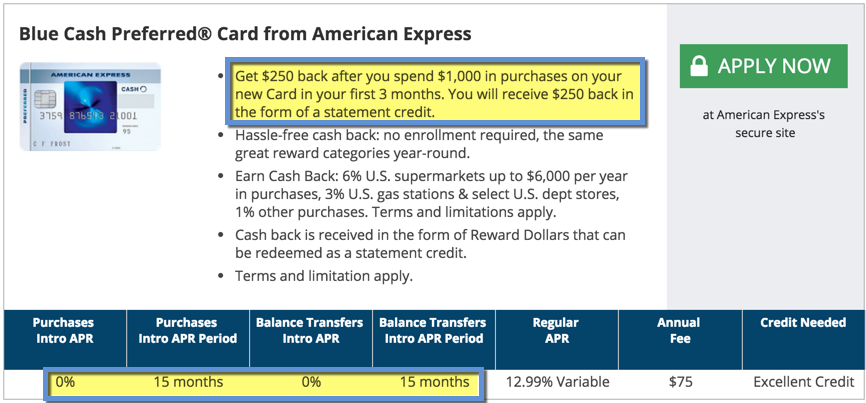

AMEX Blue Cash Preferred

Major draws:

- 6% cashback at US supermarkets, up to $6,000 a year

- 3% cashback at US gas stations and certain department stores

- Typical sign-up bonus: $150 statement credit

- CardMatch sign-up bonus: $250 statement credit

- Annual fee: $75, not waived

Interesting to note: 15 months with 0% APR. So you’ll pay no interest until November 2016 with this offer (if you sign up in August 2015).

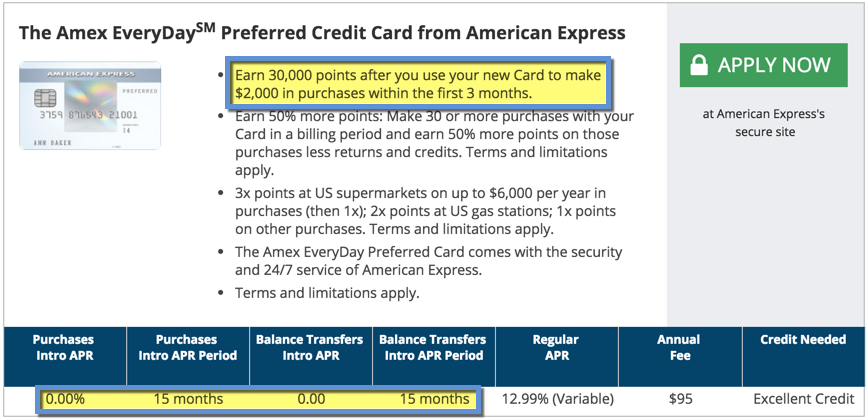

AMEX EveryDay Preferred

Major draws:

- 4.5X Membership Rewards points at US supermarkets (after 30 transactions in a billing period)

- 3X Membership Rewards points at US gas stations (after 30 transactions in a billing period)

- 1.5X Membership Rewards points everywhere else (after 30 transactions in a billing period)

- Typical sign-up bonus: 15,000 Membership Rewards points

- CardMatch sign-up bonus: 30,000 Membership Rewards points

- Annual fee: $95, not waived

Interesting to note: 15 months with 0% APR. So you’ll pay no interest until November 2016 with this offer (if you sign up in August 2015).

Read about my experience getting this card.

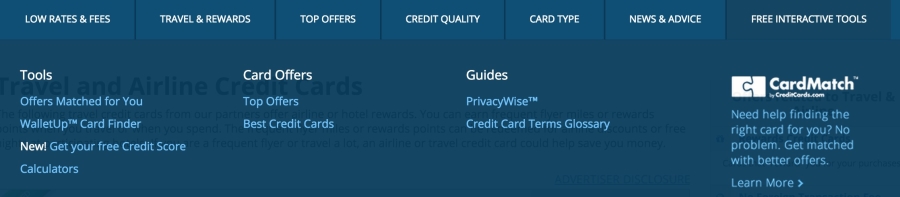

How to get these offers

Click through to CreditCards.com.

You’ll see lots of tabs at the top. Click the one on the right that says “Free Interactive Tools.”

Again, on the right, you’ll see the option for CardMatch.

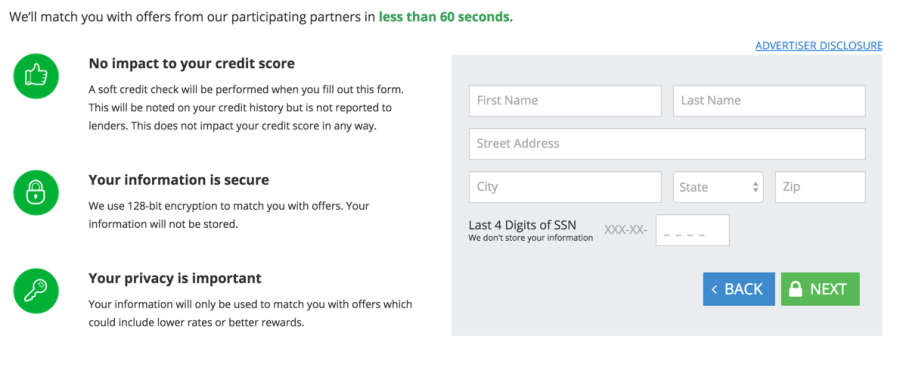

Enter in some basic info to generate your offers.

You won’t incur a hard pull by using CardMatch, but you will if you decide to apply for a card.

Bottom line

Just wanted to share.

I’m surprised the CardMatch offers have been around this long, and there’s no telling when they’ll be gone.

These cards are available as of this morning. So if you’ve had your eye on one of them, click through to CardMatch to pull up your offers!

Also would be curious to hear if anyone got other offers than the ones listed here. Please comment if you do!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

How do I even get Amex to come up as an option? I have an SPG Amex so it’s not like I have no history with them.

I’ve been checking the “match tool” for 9 months now and I get the exact same ####y cards EVERY SINGLE TIME. Is there some way to tell them I don’t want to be shown the Simmons card next time??

BTW yes I have excellent credit, a deep credit card history, and multiple cards but minimal churning.

Is there some way to get a good offer? Or just not the same bad offers every time?? Am I the only one frustrated by this sorry site that is hanging out big cards and big bonuses like candy to everybody else but keeps giving me the same old garbage?

You could always try a family member or spouse’s info instead. And then put your info into the card application. Just be sure to take screenshots and watch out for any language that says, “Not available to current cardmembers” or the like. Also remember that you can only get the bonus on AMEX cards once per lifetime.

As for getting CardMatch to show you different offers… mine change every month or so. No idea how to force an update.

You could always call AMEX and tell them you saw an offer – and ask them to give it to you.

Thanks Harlan, that’s helpful and good advice.

As far as using other family members, I tried my wife’s information and she got the exact same offers I got. E-X-A-C-T card-for-card, in order. She also has good credit but we have very different history. She’s had one card for every 10 I’ve had over the last 10 years. I’ve carried a mortgage 10+ years, she’s never had one. She’s paid an auto loan off, I’ve never had an auto loan, etc.

No joke 9 months ago I thought this was a fabricated bait-and-switch (Not this blog, the first one I read last year) until it got so much attention from the blogging community. Since then I’ve tried different computers, OS’s, browsers, even locations and it faithfully spits out the exact same pile of garbage organized in the exact same order every single time.

Not trying to go overboard on the rant but just as your response was super-helpful Harlan if I include the details maybe someone else who reads this will have similarly helpful additional insights (or at least some catharsis for people in a similar boat!). REALLY appreciate the ideas – I hadn’t even thought about just needing the offer to come up and then applying with my info. Thanks for taking the time and thoughtfulness in responding.

You’re very welcome!

Jeff – I couldn’t have said it better. I keep hearing about these great offers being handed out to numerous folks. I’ve used this “tool” 8-10 times now and the only offers I get are the Saphire Preferred, the crappy Simmons card, and ones from banks I’ve never even heard of. I’ve never seen an AMEX offer. So frustrating.

I’ve been thinking about getting the Sapphire anyway. I wonder if I go ahead and get it, if that would force the system to update. At minimum it should force one new “offer” right?

Ha ha I envision the system giving me a big electronic “I’ll show you” and making me the only person in the world who only gets 9 offers instead of 10 🙂

LOL, I’m still shown the CSP though I’ve had it for 3+ years by now. I don’t think their computer is that smart. :/

That being said, I do highly recommend the CSP. 🙂

FWIW, I plugged in my grandmother’s info and got a totally different set of offers – and none of the ones I posted earlier.

No idea what algorithm or info they are pulling, but man if I hadn’t already earned the bonus on most of them already I’d be so tempted. If only they’d show me the AMEX Platinum BUSINESS 100K offer… I’d bite in under a second!

I agree. Bloggers keep posting about AMEX offers on Cardmatch. Between me & my wife, not one AMEX offer has ever appeared. That’s checking at least 50 times. Not one blogger has ever been able to explain why they receive AMEX offers and Joe average does not. They just shrug there shoulders and say “I don’t know”. Overated marketing at its finest.

No idea how they determine who gets the offers and who doesn’t. When I enter in my info, they show up for me. There’s really no pattern to it, as far as I can tell.

Do you think it would be possible to contact the owner of that site and just point out “Hey, uh…so your site keeps showing me the exact same 10 cards and I don’t want any of them. Any chance there’s a glitch causing it to show me the same cards over and over again?” The reason I ask rather than just doing it is I generally like to stay off the radar when it comes to anything point-related and not draw attention to myself 🙂

I’ve heard of AMEX matching offers by calling. Remember they WANT to give you cards as much as you want the points. There’s a good chance they might go ahead and match the offers here!