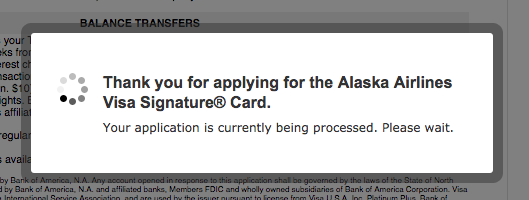

I recently picked up an personal Alaska Visa card, then tried to get another one soon after. It was automatically denied. Like, straight up the answer is no.

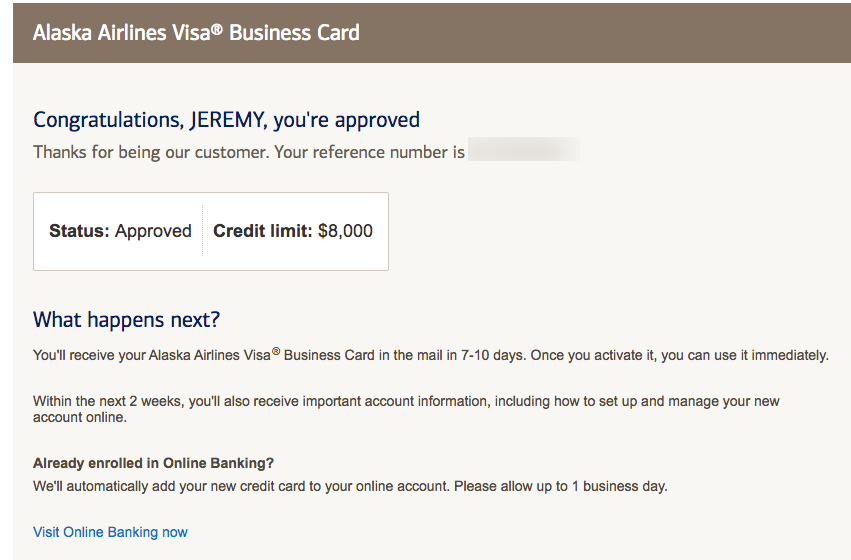

That’s unusual, so I thought it may have been because I didn’t lower the limits on my existing Alaska cards before applying. Not wanting to waste the hard pull on my credit (because multiple inquires on the same day are combined), I applied for the business version of the card and was instantly approved.

Deeee-nied!

But I didn’t want to let it go. I called the next day to speak to a credit analyst (they are open 8am to 7pm and I usually apply for new cards late at night while tipsy) for reconsideration.

I offered to lower my limits on one of the other cards, as they are pretty high (like $20,000 each), but she said the denial had nothing to do with my credit score or account history. And moving credit lines wouldn’t help me, either.

I was denied because I already opened a personal Alaska card within the last 90 days – which was the first time I’d heard that. But apparently it’s been enforced sporadically for a while.

So I figured how to play by the “new” rules and still get my doses of Alaska miles: rotate between the personal and business versions of the card every 90 days.

Get 30,000 Alaska miles every 45 days

- Link: Bank of America Alaska personal card with 30,000 miles

- Link: Bank of America Alaska business card

Even though I’ve been shut out from getting another personal Alaska card for 90 days, I had no trouble getting the business version of the card. I applied directly after the personal version was denied, and was instantly approved.

Yes!

I’m not sure if the same 90-day rule is enforced for business card applications. But I wouldn’t recommend applying for multiple business cards in a short time period as it might raise red flags.

I applied for the business card as a sole proprietor and used my SSN.

Here’s my plan moving forward. Since I just applied for both versions of the card, I’ll wait 90 days. Then:

- Pick up a new personal version of the card

- 45 days later, get another of the business version

- Another 45 days later, get another personal card (which will be 90 days since the last personal card)

- Then wait another 45 days for another business card (which will be 90 days since the last business card)

- Rinse and repeat

In this way, you can pick up 30,000 Alaska Airlines miles every ~45 days and still play by the rules. Be sure to track your application dates with a spreadsheet, screenshot with a timestamp, calendar alert, or whatever method you like to keep up with the timing.

Are there downsides?

Not really. If you’re denied at any step of the way, you can always try your luck with the other version of the card.

If you’re denied again, you can try for a different Bank of America card so the inquiries will combine. There’s really not much to lose besides a hard pull and a temporary dip in your credit score of 3 to 5 points.

Of course, there’s also a chance Bank of America could tighten their rules further. In that case, you’d have to play by them. But historically, they’ve been an easy bank to work with. And hopefully, that won’t stop as Chase is out of the game and it’s harder to get many Amex and Citi cards.

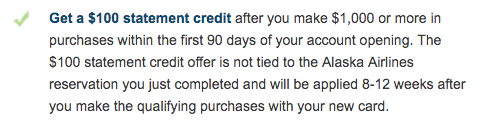

I’ve gotten this credit more than once

The only other thing I can think of is you may not get that $100 statement credit as the language says:

This one-time promotion is limited to new customers opening an account in response to this offer.

I’ve gotten the $100 statement credit more than once, as it seems to be for new cards and I’m certainly not a new customer. But they could apply that distinction at any time, as it’s included in the T&Cs.

And regarding the business card, you will have to say you have some sort of business. Bank of America didn’t ask me about revenue, and only asked for vague business categories (none of them really fit so I picked the closest approximation). However, it is helpful to actually have sort of side business. As always, do what you’re comfortable with.

Getting 30,000 Alaska miles every 90 days with only the personal version is still a good deal, too, if you don’t have a business.

Bottom line

- Link: Bank of America Alaska personal card with 30,000 miles

- Link: Bank of America Alaska business card

I’m switching my loyalty completely to Alaska and Southwest in 2017. I’m done with American, I’m like Delta who?, and United isn’t remotely ringing any bells for me.

I love how versatile Alaska miles are, and how many partnerships Alaska has for global travel. I already called it the last good loyalty program.

Hawk-eyed readers will notice this post is the first time I’ve mentioned Southwest. Yup, I’m going full hog, Companion Pass with Starwood points, and all that jazz. I’m ready! You’ll hear more about this soon.

And if you’re like me, you can’t earn more American miles through sign-up bonuses. And Chase cards are a thing of the past.

So earning Alaska miles is a good alternative. And now you can get your 30K hit every 45 days by simply switching up which version of the card you apply for.

If you have any of your own data points, please do share!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Hey Harlan, WIll the credit pull combine for if I apply for the personal and business on the same day/

Thanks!

Yes! Can confirm the inquiries DO combine. So it is actually possible to get both (60,000 Alaska miles) in one day if that’s all you want/need.

Thanks for the question! 🙂

What about the annual fees, do you cancel the previous cards or keep them open?

I haven’t had any of them for over a year, so haven’t paid a second annual fee yet. I imagine I’ll keep one or two for the annual companion certificate, though. And cancel the others.

Do you have to cancel previous cards every 45 days for applying ahain?

No, you can leave them open. Or cancel them. Your choice, really.

Have you ever gotten the card with only 5,000 miles? My husband was approved for that card on his 4th try. We stopped applying when that happened. We might try again. Thanks

No, never. I didn’t even know such a version existed. I’d definitely try again, especially if it’s been a while.

Yeah this seems to be the issue. My wife and I both didn’t not get the top card. You know this because the credit limit is below 5k. I have heard from a few different people that this has happened. 🙁

I wonder how many you can get before they start sending you the lesser version. I have a friend who has 5 and another who has 6 (I have 3 myself). Very interesting.

Is this method still working?

As far as I know, yes! Just be sure to close your other cards and reduce the credit limits to the absolute minimum before you get another.