I’ve written at length about the Fidelity Investment Rewards American Express card.

Two choice quotes (yes, I am quoting myself):

“The unsung hero of cashback cards.”

“The best cashback card on the market.”

This card is good for:

- Unbonused spending categories since it offers a flat 2% back on every single purchase

- Keeping forever to boost credit history since it has no annual fee

- Everyday spenders that don’t need/want to meet exorbitant spend requirements

- Those who want to invest in the long-term instead of short term travel ventures

I have this card and find myself using it quite a lot. I keep it in my wallet and use it when I’m somewhere that is not in a bonus spend category (hardware stores, big box stores, random services) which happens more than I thought it would. It’s a nice way to “give myself” a bonus since I like to earn 2 points on every dollar I spend.

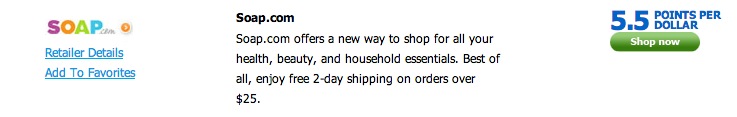

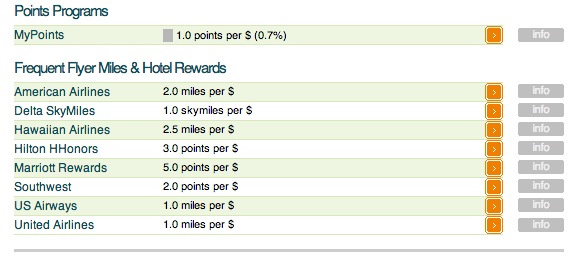

I also LOVE their shopping portal. It regularly offers larger payouts than other portals, including the already generous Chase Ultimate Rewards shopping portal. Except these points go right into your brokerage/IRA/college savings account for you to invest however you want, which is pretty cool. I always check this portal and am sometimes blown away by how large their payouts are. They also have more online stores than the other portals.

This card is quite the anomaly in the points and miles world: it’s an American Express card issued by a Bank of America subsidy that plugs directly into your account at Fidelity… what? How did those partnerships produce this card?