I’m currently at 67.2% of my $500,000 goal. My previous net worth peak was $363,002, and this month I’m at $335,872. I’m tired of being at this level, though I’ve been mostly at the mercy of the stock market. I’m to the point where I’ll do whatever it takes to get over the $400,000 hump and into the home stretch to $500,000.

I’ve been working nights and weekends to freelance, pay down credit cards, and get my savings built up.

I had the sweetest 40th birthday party, y’all

Something about turning 40 last week lit a fire under my butt. I’m over the halfway mark and ready to push through this last 30% or so that’s left.

I love this sweet drawing!

You think I can do it by August 2025? That would divide to about $14,000 a month for the next 12 months. That sounds like a lot, but then again, I’m up nearly $17,000 this month alone. But a lot of it is the stock market, which I can’t control. So now I’m working on producing as much as I can—which I can control—to clear this hurdle that’s been in the works for a few years now.

I’m proud of my goal and progress so far, and now I’m beyond ready for the final phase.

September 2024 Freedom update

- Link: Track your net worth with Empower Personal Dashboard

- Link: Join Points Hub, the ultimate points, miles, and travel rewards community on Circle!

It’s been a month of transitions.

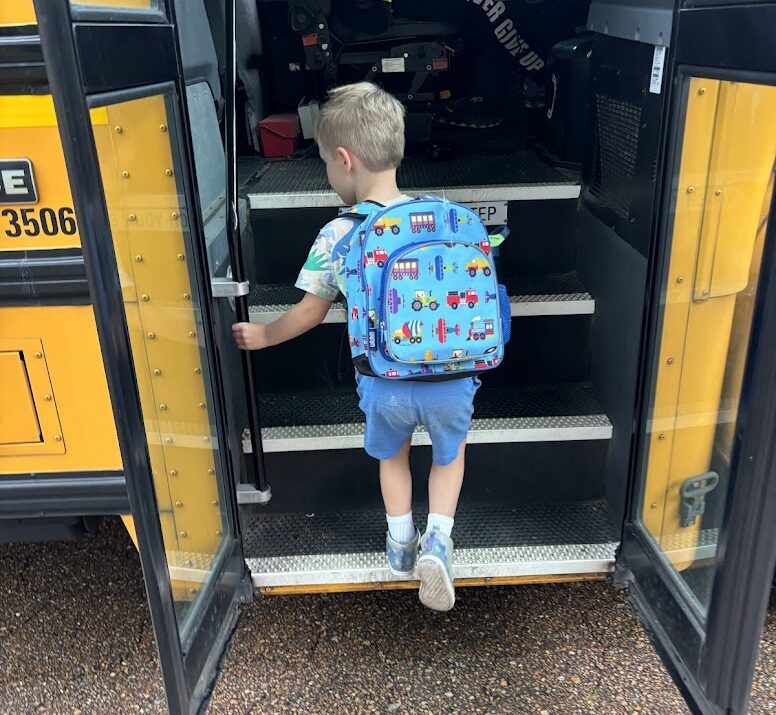

Warren turned five and started kindergarten, I turned 40 started new work projects, and we’re all adjusting to new schedules.

This absolute sweetheart rides the bus every ay

I have to decide what to do about my outstanding credit card debt, as my 0% APR rates expire this month and next. Can I ramp up payments enough to pay them off with an interest charge or two, or should I pay the 3% fee to roll over the balances to another card?

On one hand, I’d love to have more time but on the other, I’m sick of carrying balances. It’s been a constant stream of expenses and being laid off in the middle of everything set me back quite a bit—although I’m grateful I was able to pick up work right away. I feel like I’ve been in catch-up mode for so long (can you feel my “over it-ness”?).

Anyway, I’m confident I can knock it all out with a few months of solid work and then be on the path to saving and investing, which is what I’ve been wanting.

This month’s progress

The stock market had a strong month in August 2024, and I saw my overall investments go up over $18,000. However, I dipped into my savings to pay bills as I didn’t get my first paycheck from my new job until the end of the month, and didn’t want to incur more interest.

I set up a new 401k, which will get going in October 2024, and didn’t add anything to my Roth IRA or any UTMAs for the kiddos. I made a couple of car payments and the minimums on my existing credit cards with said savings.

This crystal cave blew my mind

This month will be the turning point for getting the credit cards under control as checks get predictable and freelance work continues to roll in.

Then, I can start on my savings goal and other investments. It feels like it’s far off, but I’m determined.

Every dollar that rolls in will be given a job toward these things. We cut our grocery bill as much as we can and have basically no “excess” spending. We eat out once or twice a month and use the local parks and libraries for entertainment, as well as playing in the back yard. It’s an austere life, but we get out nearly every day and spend lots of time outdoors.

To recap the last month or so, I:

- Got health insurance again!

- Paid down my car loan by about $700

- Set up the new 401k with 10% contributions to start in October 2024

- Turned in a few freelance assignments to keep the funds flowing

- Adjusted our spending to focus on the basics and tried to stay as frugal as possible

By the numbers

The overall net worth went up nearly $17,000 this month alone. It’s wild how much a good month on the stock market can affect this number. I grapple with this a lot—how dependent I am on the market doing well. After I get the credit cards paid off, I’ll focus on having pure cash for a while—although I’ll continue investing via my 401k and employer match (can’t say no to free funds!).

At this point, I’m ready to catapult over the $400,000 mark and will do whatever I have to do. I’m picking up assignments and working every day, while taking care to eat nutritious foods, take breaks, sleep at least eight hours, and move often—and interact with the kids. It’s a project to balance.

I can’t miss these sweet little fingers

I feel stretched thin, but sticking to a strict schedule helps. We get the kids down for bed between 8 and 8:30 pm, I work until 10 pm or so, and I shut my laptop at 10:30pm no matter what so I can be up at 7am and get plenty of rest.

I don’t look at social media as much and can’t read a lot of junk or mess around, so it’s all business all the time. But that’s what I want right now, so it’s good, especially with the election coming up and all the crap that goes along with it. I don’t miss social media and would rather be working.

| Current | Last Month | Change | 2024 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $319,164 | $300,435 | +$18,729 | As much as possible | |

| Roth IRA total | $84,050 | $78,906 | +$25,144 | ||

| Roth IRA 2024 | $2,700 | $2,700 | xx | $7,000 (in new contributions) | |

| Taxable brokerage + UTMAs | $4,082 | $3,739 | +$343 | $25,000 (total invested) | |

| Savings | $258 | $2,162 | -$1,904 | $30,000 | |

| Raw land | $40,400 | $40,400 | xx | No goal, just including for completeness 🙂 | |

| LIABILITIES | |||||

| Car loan | $23,578 | $24,332 | -$754 | ? | |

| Credit card #1 (0% APR) | $8,492 | $8,577 | -$85 | $0 | |

| Credit card #2 (0% APR) | $11,581 | $11,696 | -$115 | As much as possible | |

| Net worth in Empower Personal Dashboard | $335,872 | $318,903 | +$16,969 | $500,000 (overall goal) | Track your net worth with Personal Capital |

LFG

Short- and long-term goals include:

- Pay off credit cards

- Build my savings account again in 2024

- Work up to 15% in 401k contributions at the new job

- Put more money into Beck’s UTMA (tabled for now)

- Contribute to new baby’s UTMA (ditto)

- Max out my Roth IRA for 2024

September 2024 Freedom update bottom line

- Link: Join Points Hub

Life’s good! I’m getting into work mode and want to knock out this lingering stuff. I’m tired of the $300K mark, the credit card debt, and not having savings. It’s time to work and catch up.

The kids are healthy, Warren loves school (and the bus), and the new gigs keep me busy. Travel is probably off the table for the rest of the year, but I’m newly 40 and ready to ascend to the next level, so that feels almost as enriching.

If you’re keen, check out Points Hub—the points, miles, and travel rewards community I built. It’s two months old and finding a groove. We have some amazing members, lively conversations, and incredible partnerships so far—and we’re just getting started. Join us! It’s how I’m contributing to the travel world right now and it’s a total blast.

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Always love reading these reports. I think you should focus on getting those credit card balances down. 0% APR is a trick that the credit card companies play on us to get us to pay interest when the intro period ends. So I’d put everything possible into those cards, even to the expense of investing in an IRA, 401(k) or anything else. I’d even consider withdrawing some of your investment money to make sure those are paid off before the 0% period expires.

As for your goal, you’re right of course that you can’t predict the stock market. What I think I would do would be to take your balance right now, figure out about what you can expect from the stock market (and any other investments) by August 2025 (estimate conservatively). Then that will tell you how much YOU need to contribute by August to hit your $400K number. Then, hopefully the market beats your prediction and you make it with a few months to spare.

Keep on keepin on!

Happy Birthday – 40 is the new 20! I’d put every dollar possible me to get that credit card paid off even pausing investing and contributing to 401k and kids college funds. You need that gone and can tell your anxious. The sooner it’s paid off than you can go back to saving !

Happy birthday Harlan!