Worth mentioning since I’ve posted about FoundersCard before.

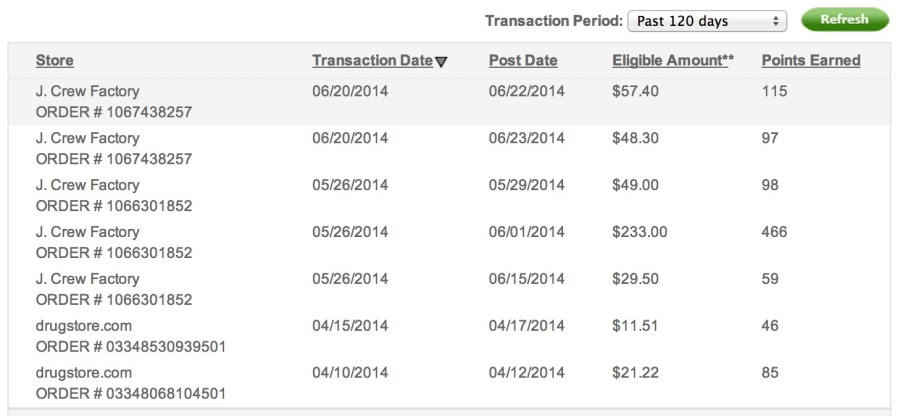

When you join FoundersCard, you get to enjoy the initial rate you paid… forever. I joined when the rate was $495, and have gotten that much value out of the card despite only being a member coming up on a year. Here’s a chance to do even better than the deal I got in on.

You now can join FoundersCard for $395 a year, and you’d get to keep paying that rate every year you keep the card.

Here is the link to the promo and the promo code to use is FCHARLAN818.

If you’ve been deliberating about whether to join or not, this $100 off the usual lowest rate ($495) might be the thing that makes this deal a little bit better.

Also, if you’re an AA flyer, their current AA promo is 5% off most fares on American. You will receive a discount code that is good for unlimited use. If you heavily fly on American/OW and are trying to meet some sort of status before the end of 2014, you’d get to take advantage of the fare discount and start earning your $395 back right away.

That, combined with the multiple other discounts and freebies offered by the card, as well as the fantastic global networking events, makes this card a great investment for entrepreneurs in major cities.

AA’s last quarter promo was a free Gold status challenge, and bonus Business Extra points. They’ve featured 5% off fares before, and that seems to be a hit with most members of FoundersCard.

Read my full review to learn about the other discounts offered and to decide whether this membership might be worth buying.

If you have any questions, email me at zynner@gmail.com or feel free to post a comment below.

Also see:

Also see: