Somehow I’m back at 61% of my $500,000 savings goal and up nearly $19,000 this month. Not gonna lie, last month was devastating being down so much.

So while I love restoring growth, I know better than to get attached or assign mental possession to it. It could just as easily slide down again (and it has). In my case, it will.

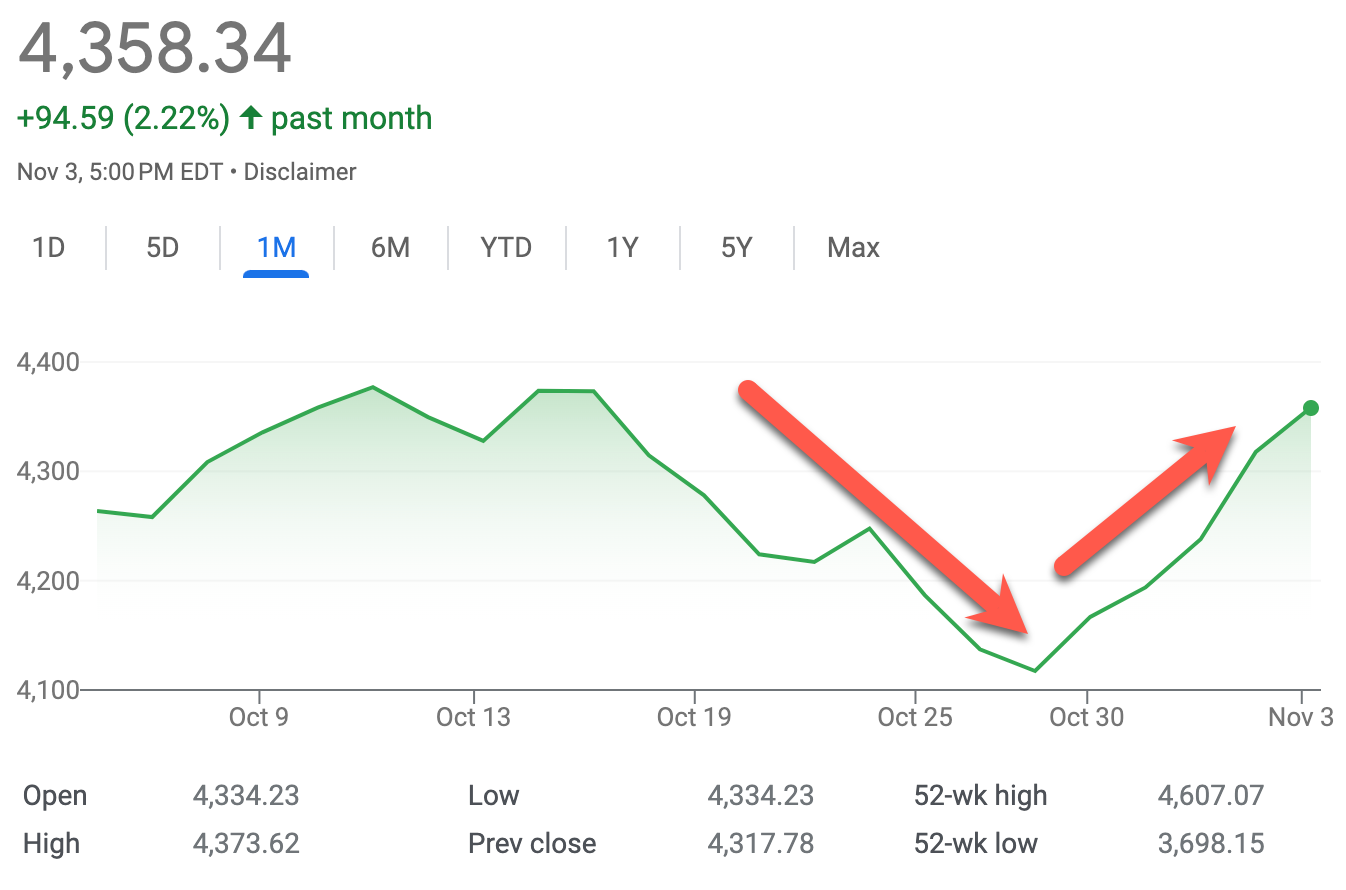

Because we have a lot of expenses coming up in the next few months. The only thing that could provide levity is for the stock market to keep going in this upward trend, which… is it?

With my upgraded Hilton Aspire card

There’s been a lot of positive economic news lately (in the world at large), and my 401k has nearly recovered all the losses from earlier in the year. This month, my other investment accounts rose back to their October 2023 levels. If the market continues to improve, it could seriously make up for (and exceed?) my upcoming expenses.

And if the housing market improves, I could add to my home equity. Again, trying to stay level, but there it is: that hope that things will start to turn around.

Either way, I’m staying on track, adding cash to accounts when I can, cutting expenses wherever possible, and steadily paying down debt—all at the same time. As I have someone managed to do for years.

November 2023 Freedom update

This month’s numbers gave me back some optimism. I hovered around the $300K mark for so long—it’s good to be back. I’d love to keep that moving up.

Despite contributing $1,000-ish per month to my 401k, my overall investments are at minus $58 this month. There were several days where I added cash and the next day, it was all worth less than the day before. But this past week has been positive, almost resetting all the loss. I’m to the point where I have enough saved that the investments can carry themselves in a strong market.

And I want them to. You always hear about “when it starts to snowball…” Well please, feel free to snowball. I’d love for the investments to tend to themselves while I go into heavy spend mode in the next few months.

Mentally, I’m here

I’m going to try my best to not only NOT rely on a credit card for extra expenses, but also hoping I can knock out the remaining $5,461 balance on my 0% APR credit card before the rate expires on December 26, 2023. (How’s that for a Christmas gift?)

Every extra dollar is going to knocking that out over the next couple of months. And you know what? I’m feeling confident that I can actually do it.

This month’s progress

I was on a hustle in the last month. And not only are my Travis Scott tickets selling, they’re selling better than expected. I’ve sold everything I had for a few shows, and the others are picking up as the tour progresses. I might even make enough to pour it all into the credit card.

Plus, I finally filed my 2022 tax return and am getting back $1,100. That’ll all go toward the card, too.

This BABY

My homeowner’s insurance went up $500 last year and another $700 this year. I was with USAA for the last 15 years, but as of three days ago, I’m now with Allstate.

They beat my old rate by nearly $1,000 and gave me a great deal on auto coverage. So I’m waiting for the refund check to come in from that, which will also go—you guessed it—toward the 0% APR card.

With all my efforts combined, I might just get it done. And then I can work to max out my Roth IRA (knowing that I have until April 2024 to do that). But yeah, there’s always more to work on.

To recap this month, I:

- Saved $1,000 by switching insurance companies. I saw my new premium, gasped, and got on the phone. Bye, USAA

- Kept investing in my 401k and HSA accounts. And this month, I bought at low valuations

- Now own four parcels of land worth over $27,000. I wanna get one more then I’m done (for now)

- Set up at UTMA account for Beck and started it with $100. It’s not much, but the account is established, and he’s already gained $5

- Paid ~$1,500 toward my credit card and more on the way. I refuse to pay interest on that balance

- Lost some home value because of a soft market, but thinking that’ll turn around if the Fed is done tampering with interest rates

- Saved a couple hundred in my savings accounts. Again, not much, but Yotta inspires me

- Filed my 2022 taxes! Finally—I’d been waiting to get Beck’s SSN. His passport is also on the way! Getting back $1,100 as a refund

Childhood. “I’ll just leave this here.”

By the numbers

My increases for the month were mostly investments recovering losses. And despite socking away $1,000 into my 401k, it’s still negative for the year.

Last month’s ride

The real estate market stayed low, but now that my homeowner’s insurance is cheaper, my monthly mortgage payment will be, too. And that’s definitely a win in this economy.

| Current | Last Month | Change | 2023 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $227,539 | $227,597 | -$58 | As much as possible | |

| Roth IRA | $55,281 | $55,453 | -$172 | $6,500 (in new contributions) | $4,000 so far! |

| Taxable brokerage + UTMA | $3,067 | $2,838 | +$229 | $25,000 (total invested) | |

| Savings | $2,138 | $1,944 | +$194 | $30,000 | |

| Primary home equity + appreciation | $53,557 | $57,343 | -$3,786 | $70,000 | |

| Raw land | $27,400 | $27,400 | $0 | No goal, just including for completeness 🙂 | |

| LIABILITY | |||||

| Credit card/HVAC upgrade | $5,461 | -$6,930 | -$1,469 | $12,708 (starting balance) | |

| Net worth in Empower Personal Dashboard | $304,594 | $285,843 | +$18,751 | $500,000 (overall goal) | Track your net worth with Personal Capital |

Long-term goals include:

- Put more money into Beck’s UTMA

- Finish maxing out my Roth IRA

- Build my savings account

- Invest as much as possible

- Switch to a regular 401k in January (it’s currently a Roth 401K). I’m thinking I’ll use the tax break next year

Also: Stay above $300K—and keep it moving past 61%!

November 2023 Freedom update bottom line

- Link: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)

- Link: Join Yotta (a lottery-enhanced savings account) and get FREE lottery tickets! Do it do it do it!!!!

In a macro sense, I suppose it’s a win that I’ve been investing throughout all this and snagged more stock at low valuations. It’s been a rough couple of years with interest rates rising and general panic and paranoia (real or manufactured) about the state of the economy, inflation, etc. At times, I’ve thought it would be impossible to have this goal in such a rough financial environment.

I will say inflation is real. We feel it. Stuff that used to cost $6.99 is now $13.99. I can’t believe my eyes at the cost of routine grocery runs. It’s been hard to continue investing without that nice “pop”—which I’m hoping is on the way. It is sort of dystopian that we depend on Wall Street for our financial future.

Even if I don’t get to $500,000 by August 2024, I’d settle for $400,000. Or ya know, something above the low-$300 mark. Lol, I’m trying not to focus on it except for these monthly updates, which are helpful to process out what’s happening. I do still feel like the goal I originally set is both quantifiable and challenging. We’ll see what happens!

Thank you for reading! I hope this chronicle inspires someone to begin a journey of their own.

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply