This past month has been nonstop in the best way possible! It’s been one good thing after another. I’m so grateful – I really needed some things to work out.

We went to my partner’s brother’s graduation, spent a week exploring Dallas (so different with kids), and had a weekend visit with family.

This weekend, I lost my mind and bought a minivan (used, of course). We got a great deal on an 8-passenger minivan and the finance terms and monthly payment were agreeable. So we drove it home. And so far, we love it. We quickly outgrew my little Nissan Versa Note, lol.

Dad reporting for dad duty

I start a new job on Monday and am very much looking forward to it! This infusion of new energy is seriously good.

I also found a new barber and have been doing yoga when I can (because self-care is so important, especially when you’re parenting). It’s been pretty nonstop, but all in the service of moving forward and making progress.

With all of that, let’s see how it impacted me financially.

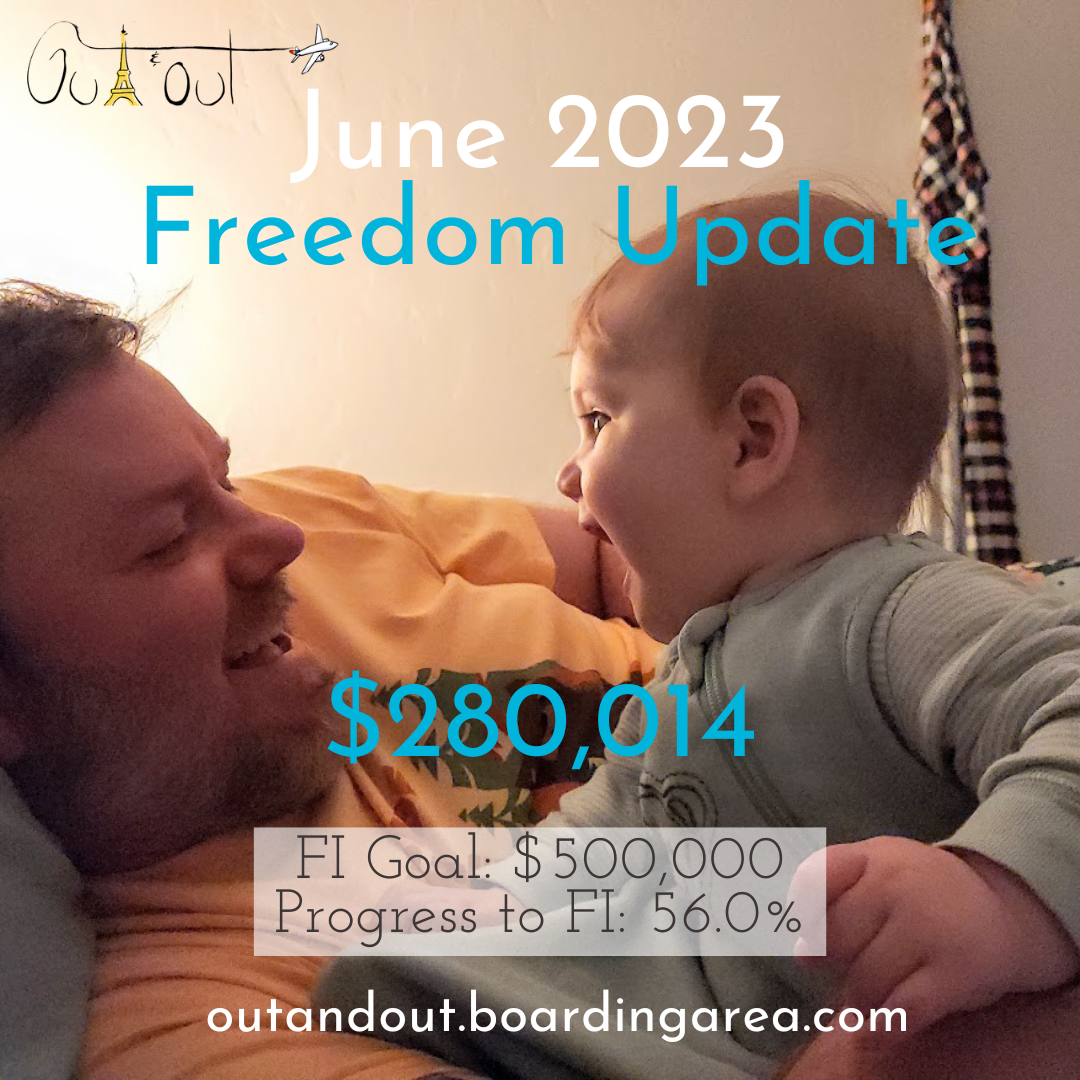

June 2023 Freedom update

I put $6,000 down on the van. $5,000 on my Amex Blue Business Plus card for 2x Amex Membership Rewards points and $1,000 pulled from savings and ran through a debit card ($5,000 was the dealership’s credit card limit).

We also had some cash outlay for the Dallas trip. We used CityPass to get discounts on the Dallas Zoo, Perot Museum of Nature and Science, and Reunion Tower – those were all excellent activities for the littles.

Overlooking Dallas at Reunion Tower

We stayed at the Hyatt Place Dallas/Park Central to take advantage of the Bilt/Hyatt Globalist promo (and Dallas was a bonus points city for Hyatt’s Bonus Journeys promo, which is now over). I need 11 more nights in the next month and half to get Globalist through February 2025.

I used “Pay My Way” for a cash & points combo

We’re gonna try to get out of town again to complete the rest, although Oklahoma City has a couple of great “mattress run” properties if it comes to that. The room in Dallas was 5,000 points per night, but I got back 3,500 points for every second night. It divided to 3,250 points per night. Not bad.

I wish we could’ve stayed longer. It’s hard to get someone to look after the dogs, although now that we have the van, it’ll be much, much easier to just take them with.

Warren at Klyde Warren Park in Dallas

It was also fun to chase a promo. Felt like old times again there for a bit. 💫

This month’s progress

Financially, this month was kinda of a mess. Here’s how it played out:

- I switched to Fidelity for all my banking and transitioned all my deposits and autopayments over a few weeks. Really excited about this. #DumpYourBank

- Spent ~$1,000 all told for the Dallas trip, including activities, meals, gas, lodging, etc. We needed to get out of here for a sec.

- Put the aforementioned $6,000 down on the van purchase. This was the sweet spot to get my payments where I wanted them.

- Did NOT contribute to my Roth IRA this month. $2,500 left to go.

- Paid only the minimums on my 0% APR credit cards. Those are first on my hit list. So grateful to have them.

Like last month, the progress wasn’t huge on paper (or screen) either. But the money I spent this month went a long way to provide us with more options, more comfort, and peace of mind. Also we needed a little vacation and that was really beneficial to get away and make new memories.

All-in-all, I’m pleased with how things are going and also looking forward to pushing some of these goals forward next month. 🙂

Future goals (or maybe the rest of this year)

Yesss, now we’re talking.

For the rest of 2023 (the next six months-ish), I want to:

- Start contributing to a 401k again (I think I’m gonna do the Roth option this time)

- Max out my Roth IRA ($2,500 left)

- Open and fund an HSA account

- Pay down the credit card by December (that’s when the 0% APR expires)

- Rebuild savings and add funds into taxable brokerage and Warren’s (my son’s) UTMA

- Break $300K net worth finally!

I saw this at a playground and felt it so much

I have until August 2024 to reach my $500,000 goal and am still a ways off. Without the stock market and economy putting wind in the sails, I’m pretty much on my own. At this point, I’m gonna get as close as I can and keep it going. But wow, I’d love for the market to pick up steam and make a huge leap forward (who wouldn’t though, right?).

By the numbers

My home appreciation went up a lot this month! OKC is growing and I think the house will continue to appreciate. It’s nice to know I can always sell and come out with a net profit – but I want to keep the house for as long as I can. Who knows, maybe pick up another one at some point. It’s a great market and there are gems out there.

The sweetest BABY

Investments picked up a fair amount, too. That’s encouraging, and hopefully the overall market will start to bounce back. It’s been a brutal year for stocks, which are most of my net worth at this point.

| Current | Last Month | Change | 2023 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $229,940 | $220,968 | +$8,972 | As much as possible | |

| Roth IRA | $54,322 | $52,137 | +$2,185 | $6,500 (in new contributions) | $4,000 so far! |

| Taxable brokerage + UTMA | $12,746 | $12,244 | +$502 | $25,000 (total invested) | |

| Savings | $5,390 | $6,997 | -$1,607 | $30,000 | |

| Primary home equity + appreciation | $60,197 | $51,188 | +$9,009 | $70,000 | |

| LIABILITY | |||||

| Credit card/HVAC upgrade | -$10,381 | $10,485 | -$104 | $12,708 (starting balance) | |

| Net worth in Personal Capital | $280,014 | $273,218 | +$6,796 | $500,000 (overall goal) | Track your net worth with Personal Capital |

I want to get back to putting a bit into Warren’s UTMA (and open one for Beck). I’ll likely need a couple of months to get some breathing room, then can resume doing that.

Life’s good and I’m doing what I can. For now, that’s more than enough.

This

June 2023 Freedom update bottom line

That’s all I got for this month. It was a busy one – this one will be, too!

What a market environment within which to chronicle this journey. It feels like life is baby steps when I was hoping for giant leaps. Expectations are definitely getting adjusted, but things are most decidedly moving forward. This was so fun to write. I want to get back to more travel content. Hope everyone is doing well!

Thank you to everyone who reads these updates. It means the world to me.

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

When I was 16, my parents got a minivan and I was SOOO embarrassed. I hated being seen in that clunker.

Fast-forward 11 years later, and I am married with 2 kids. My parents ask if I’d be interested in buying their old minivan, and I end up buying it.

All of my friends who had been schlepping their young kids and car seats in the back of a Honda Civic are all SOOOO jealous of me and my “cool” minivan and all the room we had.

Yes, literally the exact same van. A little perspective changes things 😉

Just curious if you landed a remote job now after Covid employers want people in-office? I’m back 4 days and not liking it:(

Hey Boonie! Yes, it’s completely 100% remote, thankfully. I don’t think I could do the in-office thing again… ever. So far it’s amazing!