I have three real estate projects going on simultaneously:

- Building a cabin in the woods of Arkansas

- Rehab for an 105-year-old house in Memphis

- New home purchase pending for an August closing

I expressed to my real estate group that I might be taking on too much at once, but they chuckled and said something to the effect of: Do as much as you can.

My new kingdom lol

And it DOES sound like a lot, but between the three projects, there’s quite a lot of waiting. Waiting for permits to get approved, contractors to be ready, the loan to close. So I do everything in pieces, a little here and a little there. So far, it kinda works?

I’m spending a lot of cash lately. The cash outlay for these projects is big. Even so, the equity, appreciation, and monthly income will ultimately be even greater — and I don’t think I’ll lose money on any of it. But I am leaving “save” mode and well into “spend” mode. Sometimes you gotta put it all out there so it can come back later.

Plus, these projects are what’s going to take me to the next level.

I’ve been busy building my team, making connections, and getting everything in motion.

This month, I’ll talk about where I stand in the current moment. Next month will be my final Freedom update, and I’ll include my projections for these projects and where I plan to be within the next year or so, say.

July 2025 Freedom update

- Link: Track your net worth with Empower Personal Dashboard

- Link: Join Points Hub — the ultimate points, miles, and travel rewards community — on Circle!

I’ve also been helping to get my grandmother’s house redone on the side (lol). It’s getting fresh exterior paint, a deck glow up, and some pesky limbs removed from overhead.

A comp with the same floor plan sold in under a week for $180,000, so I’m going to mark that house as a $180K gain as it’s fully paid off. That alone puts me well over $500K with my current net worth of $382K.

Balmy day, sweet sangria

But the major highlight of this month is being under contract for a new house. The deal has a lot of moving pieces, but I got an incredible price and will hopefully close in early August. Because of that, I’ll release my final Freedom update closer to the middle of next month.

I’m also going to my first-ever IN-PERSON tax sale and can’t wait to see what happens with that. I’ll either pick up another new property or learn a lot in a short amount of time (or both slash everything). I’m excited and took two days off work to do it: one day for the tax sale and another day to potentially secure my new property? Or just putter around, tbh.

This junk is all gone now

Earlier today, I was at the house in Memphis with a junk removal service. There was an incredible amount of utter CRAP, and every contractor that’s looked at it so far said they couldn’t give a rehab estimate until the place was empty.

As of this week, it will be. It’s starting to look like a house and not a big trash heap. I’ll get that remodel going after I close on the other deal. (Don’t want to apply for a new loan until it’s done.)

The house that’s closing needs a fair bit of work, too. I opened a new LLC to hold any other new properties. I’m officially in the real estate business. My focus is shifting to getting these places cash flowing ASAP. But I’m having fun scooping them up, too.

Financial ponderings

It all sounds like gobbledygook, but I have it all plotted on spreadsheets and kanban boards (not just in my mind).

A lovely sundowner with mom

I expect my net worth to temporarily DROP, which will be kind of alarming. It’s already starting to. I’ll be spending cash as soon as it hits my account and carrying a balance on my business credit cards. But on the other side of this work is equity and cash flow — especially for the cabin and upcoming rental house.

For a while, I anticipate rolling cash right back into the projects, making upgrades as I can. At some point, I won’t be able to mentally hold another project, but until I reach that level, I’ll keep plugging away.

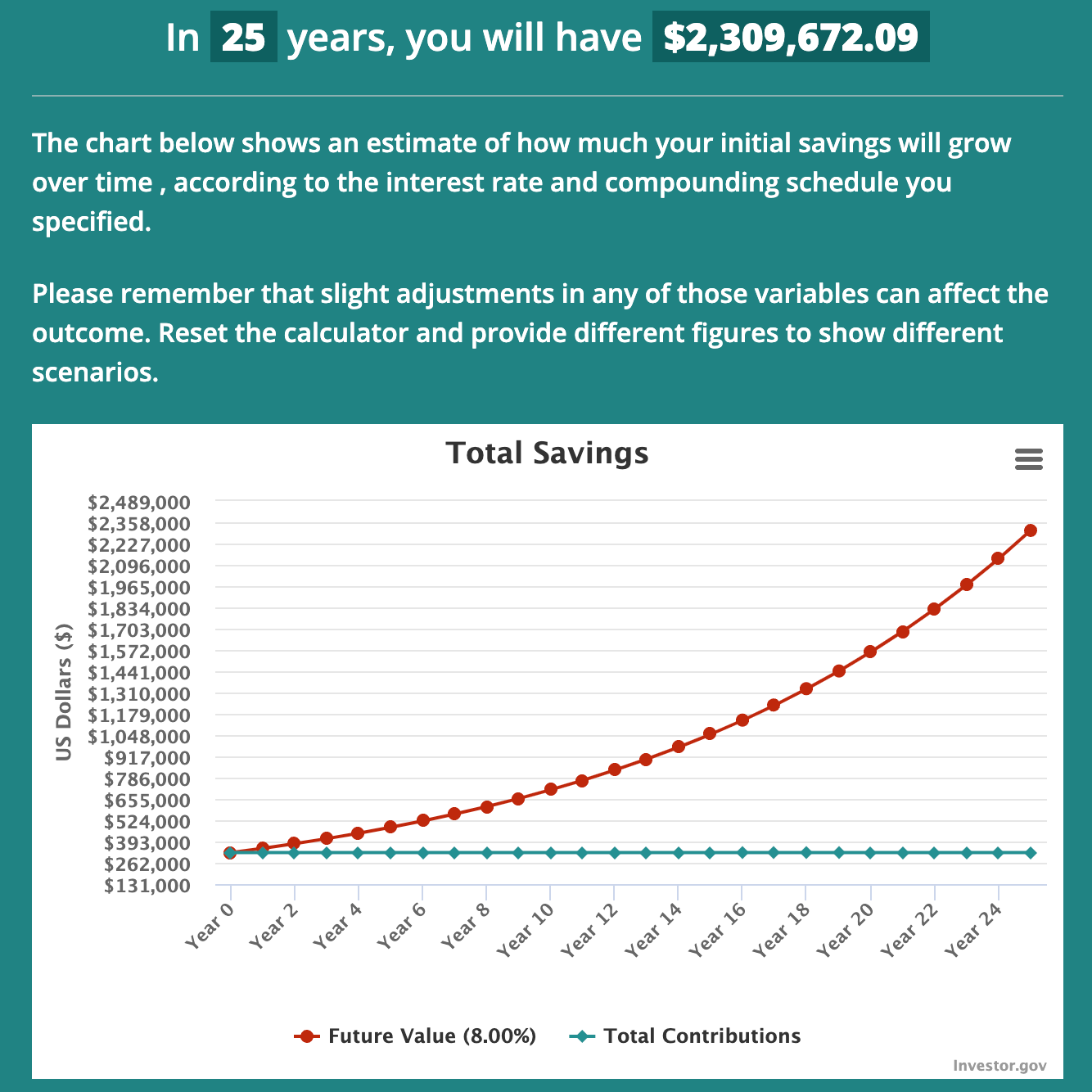

I feel assured anyway, because I don’t intend to touch my current investments, which are now up to $325K.

Pretty good

Even if I never add a single cent (wait pennies aren’t a thing any more) nickel, I’ll have $2.3M in 25 years with an 8% return. But I’m adding $1,000 a month, so that’ll be closer to $3.2M. Plus whatever the real estate stuff does.

I’m thinking long term while I can, although I’m starting to acknowledge that, wow, I’m in my 40s. Somehow I feel more urgent and daring in ways that I never did in my 20s — with a bigger dose of “eff it,” if that’s possible. The timeline is getting shorter. I gotta enjoy what I have right NOW instead of just thinking about some future self. I’m becoming the future self!

This month’s progress

During the last month I:

- Got a house under contract.

- Cleaned up my tax sale property.

- Contributed $1,000 to my 401k via bi-weekly contributions.

- Continued building a cabin in Arkansas… will it work? We’ll see.

- Held the line with my credit cards and other monthly payments.

- Did more cabin research than I’ll ever admit. (Y’all should see my Pinterest boards!)

By the numbers

Here’s how it all looks in rows and columns.

| Current | Last Month | Change | 2025 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $324,840 | $311,632 | +$13,208 | As much as possible | |

| Roth IRA total | $52,539 | $50,458 | +$2,081 | ||

| Roth IRA 2025 | $207 | $207 | xx | $7,000 (in new contributions) | |

| Taxable brokerage + UTMAs | $4,527 | $4,368 | +$159 | $25,000 (total invested) | |

| Savings | $91 | $42 | +$49 | $30,000 | |

| Investment property #1 | $21,500 | $21,500 | xx | $20,000 in equity | |

| Raw land | $40,400 | $40,400 | xx | No goal, just including for completeness 🙂 | Haven't gotten 2025 assessments yet |

| LIABILITIES | |||||

| Car loan | $19,770 | $20,059 | -$289 | As much as possible | |

| Credit card #1 | $0 | $0 | xx | $0 | COMPLETE! |

| Credit card #2 (.99% APR) | $9,006 | $8,998 | +$8 | As much as possible | |

| Net worth in Empower Personal Dashboard | $382,213 | $375,713 | +$6,500 | $500,000 (overall goal) | Track your net worth with Personal Capital |

Houses n stuff

Short- and long-term goals still include:

- Pay off credit cards.

- Save $7,000 this year in my Roth IRA.

- Build up cash reserves for savings and to buy more real estate.

- Acquire more real estate.

- Develop my land for more opportunities.

July 2025 Freedom update bottom line

You know that meme or saying or whatever: “You can just do things“? Man, I took that to heart.

The more I take action, the more things start to swim along and take me with it. It’s like the world is conspiring to make my ideas actually happen, and I’m just the originator or designer or planner. My ultimate goal is to spend all my time working on my own projects, which, working on these, has felt closer to the flow state than I’ve consistently experienced in a WHILE. And to spend time delighting in the company of my loved ones.

With all that said, I’m preparing a big final update with all my projections and numbers… but it’s feeling like I might leap frog over $500K and land right into $1M. That would be stellar, and I contribute much of it to “just doing things.”

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Where’s the travel info?

“WhErE’s tHe TrAvEl InFo?”

I gotta say that I’ll miss the updates.