Update: This offer is no longer available. Check here for the best current credit card offers!

Today is the last day to get the newly-launched Capital One Venture X card’s incredible early spend bonus! After many rejections from Capital One, I finally got approved for this one – here’s my tip on how to check your approval odds.

For most people wanting a premium travel rewards card, it doesn’t get much better than this one.

The welcome offer is incredibly strong, the rewards earning rates are excellent, and the card’s ongoing benefits justify the $395 annual fee year after year.

Capital One is building their own network of airport lounges and doing great things with their transfer partners. And their version of the Priority Pass includes restaurants in airports (something the Amex version of Priority Pass does NOT).

The Capital One Venture X 100K offer is one of the best in recent memory

I love earning a flat 2x miles on all purchases without having to think about category bonuses. But the Capital One Venture X does earn 10x miles on hotels and rental cars and 5x miles on flights booked through Capital One.

If you’ve had your eye on this one, this is the last call. We don’t know what the new offer will be, but it’ll likely be inferior.

Capital One Venture X 100K details

Every year, you’ll get an annual $300 travel credit plus 10,000 anniversary bonus miles (worth $100 toward travel) that easily cover the card’s annual fee. Then there’s:

- Huge 100,000-mile welcome offer – worth $1,000 toward travel

- $200 to use toward vacation rentals (like Airbnb or VRBO) the first year

- 10x miles on hotels and rental cars booked through Capital One

- 5x miles on flights booked through Capital One

- 2x miles on all other purchases

- Lounge access to Capital One and Priority Pass lounges

I used the $300 travel credit to book flights through Capital One

The card also comes with primary rental car insurance, travel interruption, trip delay, and lost baggage insurance, cell phone protection, no foreign transaction fees, and so much more. I suppose it’s worth mentioning that you also get a $100 credit toward Global Entry or TSA PreCheck every four years, too (it seems like every premium card has that these days).

You have six months to meet the $10,000 minimum spending requirement, which should be attainable for most households (that’s ~$1,666 per month). This is also *the* card I use at Costco, since they only accept Visa cards now. I will happily earn 2x transferable miles on purchases there – and consider this the best card for Costco spending.

A note about the $200 vacation rental credit

If you don’t like Airbnbs, consider using the $200 credit to book a room in Ukraine to help hosts there. You won’t check in, but the money will go to support someone trying to evacuate. It’s a fantastic way to help for no additional cost to you.

Capital One transfer partners

You can use the miles you earn toward travel purchases, where they’re worth 1 cent each – making the Capital One Venture X is an elevated 2% cashback card.

Or…

you can transfer them to airline and hotel transfer partners, including:

- Aeromexico (1:1)

- Air Canada Aeroplan (1:1)

- Air France/KLM Flying Blue (1:1)

- Accor Live Limitless (2:1)

- Asia Miles (1:1)

- Avianca LifeMiles (1:1)

- British Airways (1:1)

- Choice Privileges (1:1)

- Emirates Skywards (1:1)

- EVA Air (1:1)

- Finnair Plus (1:1)

- Qantas (1:1)

- Singapore Airlines (1:1)

- TAP Miles&Go (1:1)

- Turkish Airlines Miles&Smiles (1:1)

- Wyndham Rewards (1:1)

Capital One has been rapidly improving their mileage transfer partners, including both the offerings and transfer ratios (most are now 1:1 except for Accor, which – no loss there). There are also transfer bonuses! I’m excited to see what else they add in the future.

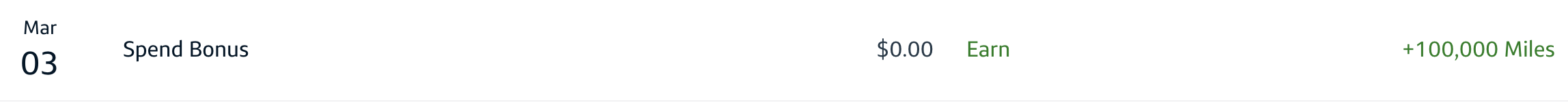

When the early spend bonus hits

With minimum spending included, you’ll have at least 120,000 miles after you earn the welcome offer.

Plenty to play with

That’s enough to get some seriously fun travel with Capital One’s transfer partners. It’s also worth at least $1,200 toward travel – but can easily be worth much, much more when you transfer your points for flights instead.

My faves and where I’ll likely send my points are in bold in the list above.

Capital One Venture X 100K bottom line

I’m loving my new Capital One Venture X card! I already earned the welcome bonus and spent the $300 travel credit. As of now, I still have my $200 vacation rental credit and am strongly considering booking an Airbnb in Ukraine to help a host there.

Next month, I’m flying through DFW and scheduled an extra long layover to properly explore the new Capital One lounge. Sure beats the socks off the crowded Centurion lounges.

I plan to keep this card long-term because of the annual $300 travel credit an annual 10,000-mile bonus that cover the card’s annual fee, and also to access Capital One lounges when I fly and for Costco shopping.

One more note: you can add authorized users for no additional cost – and they get their own Priority Pass membership! I added a user and her credit score has already gone up ~60 points, which is also pretty rad.

Today is the last day to hop on this fantastic offer and potentially open yourself up to a new points ecosystem with a great welcome package. If you’ve been holding out, give it a spin even if you’ve been denied before. Again, here’s how I figured out I was likely to get approved after many previous denials.

Thank you for using my links to apply! You’ll definitely be supporting an independent blogger and it’s very much noticed and appreciated.

Stay safe and scrappy out there! ⚡️

Will you be taking advantage of the Capital One Venture X 100K + $200 welcome offer?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Is there a way to use the card virtually before it’s arrival? This is my first C1 card

No, not that I’m aware of. That would’ve been so useful but I had to wait to receive the card in the mail.

I’ve read that you can get a virtual number in the app. Also, I got my card pretty quickly, in about 3 days I think.

I think you need to activate the card before you can get a virtual card number. I wasn’t able to access that part of the app until I activated the card (which requires entering in the card’s CVV code). Maybe I’m wrong, but I got my card really fast too! They ship them out ASAP and it came via FedEx if I’m remembering correctly.

One interesting thing after applying for the card – you can go to the link below and see your credit score that was used to determine your approval.

https://applicationcenter.capitalone.com/login

Very cool! It’s included in the welcome packet they’ll send you, too – but this is a neat thing to know. Thank you for sharing, Richard!