I’m a HUGE Tori Amos fan, and have been looking forward to seeing the musical she’s been working on, The Light Princess, for a while now. Well, tickets went on sale this past week and I was able to snag some good seats to both her talk beforehand and the show itself – in London. Which meant I had to get myself to London.

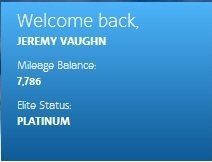

Luckily, ol’ Deltoid just entered into a partnership with Virgin Atlantic – and award space (in economy) is great. I had the pick of about 5 different flights each day, all at the low-level cost. There was nothing in business or Upper Class as it’s called, but that’s fine because I’d like to hoard my Skymiles to go down to Patagonia on Aerolineas Argentina in the near future anyway.

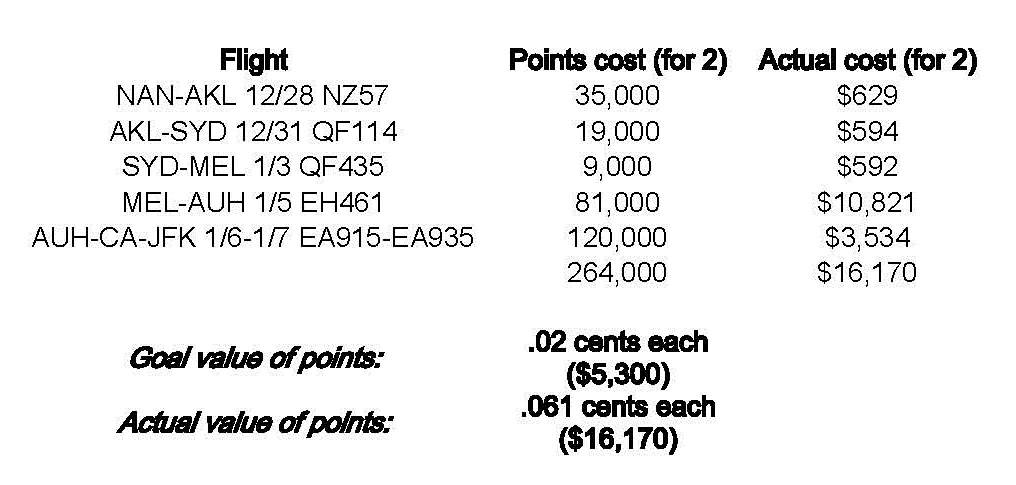

And the point – to get to London – was quickly addressed. I booked some great flights on Virgin Atlantic and cannot WAIT to see the musical. My out-of-pocket cost was 120,00 miles and $369 for two flights. Not bad for crossing the Atlantic.

This, for me, is the true value of points and miles. Being able to pop over to London for the weekend to see this show is something I’ve been looking forward to for a few years now. The day came, I bought my tickets, and I’m able to go without paying very much at all. Now we just need to find a place to stay for two nights, which should be pretty easy. Then head to JFK, enjoy the flights – and the show!

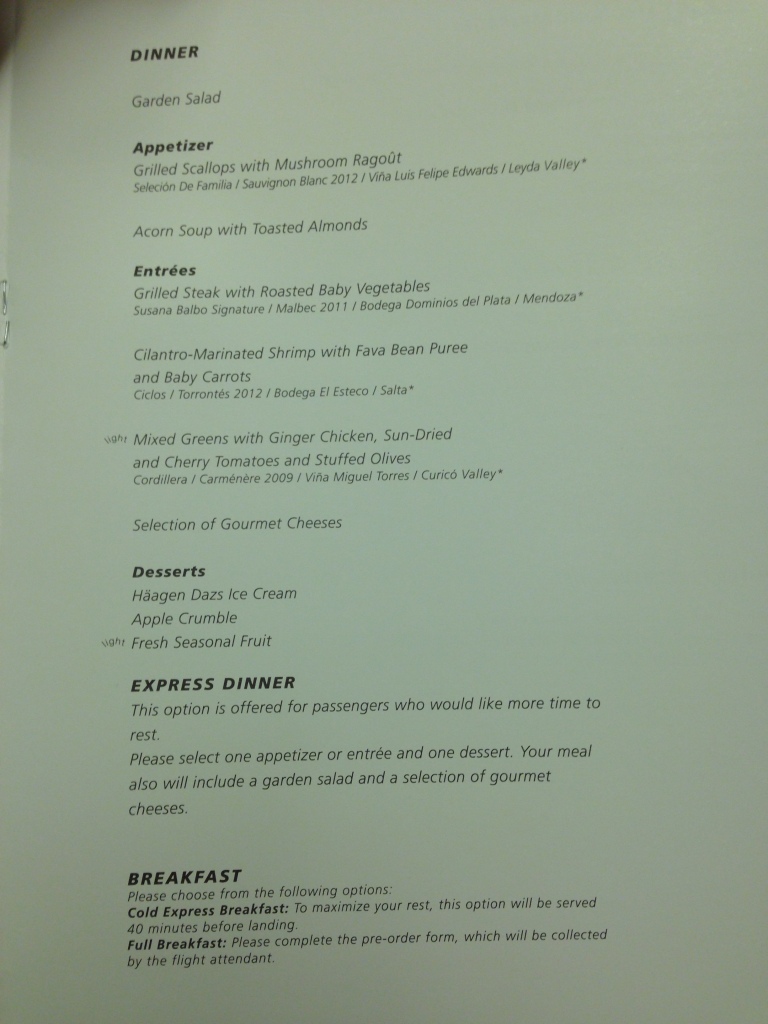

Looking forward to flying on VA metal. It’ll be my first time. Trip report and show report to follow! October 18th!