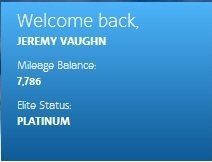

I got these passes as part of the signup bonus for the Citibank AAdvantage Select American Express card, and I’d like to give them to a reader.

To enter:

01. Leave a comment on this post telling me when you’d use the passes.

02. Follow me on Twitter, then retweet THIS status: https://twitter.com/harlanvaughn/status/352995490054406144

I’ll randomly pick a winner on Thursday, July 11th at 11:59pm. Residents of US and Canada only. You must be over 18 and have same-day ticketed travel on American Airlines to use the passes.

A big thanks to all my readers and supporters so far! This blog is a bit new, so I want you to know I truly appreciate all of you!