[This post is meant as an broad overview, not an in-depth look into each individual program.]

When it comes to traveling to Europe, which points program has better offerings: Ultimate Rewards or Membership Rewards?

Let’s compare redemptions popular European destinations to see which one comes out on top.

Before we begin though, let’s assume we want the best value for our money overall (points or miles + surcharges) and we want to fly in economy. Here are each program’s airline transfer partners that fly to Europe.

Ultimate Rewards:

British Airways and United are the front runners here.

Membership Rewards:

Now to the good stuff!

Paris

I picked Paris because it’s a pretty common European destination. What’s availability like with Ultimate Rewards and Membership Rewards partners?

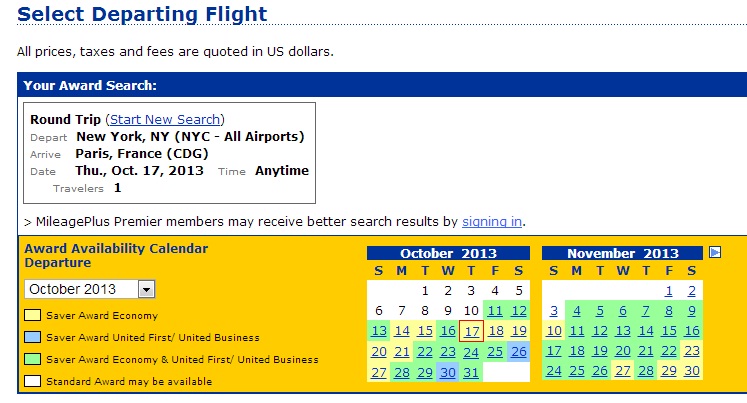

With Ultimate Rewards:

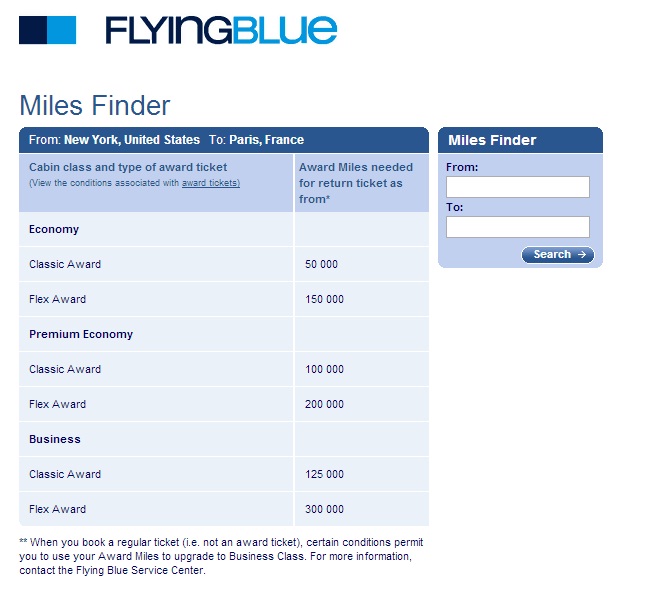

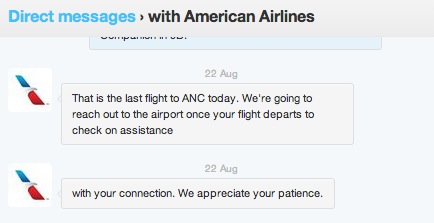

Go ahead and throw out Virgin Atlantic since they don’t fly to Paris (they’d be great if we wanted to go to London). Throw out British Airways unless you want to pay the fuel surcharges they impose. The best option in this program for this redemption is United, by far.

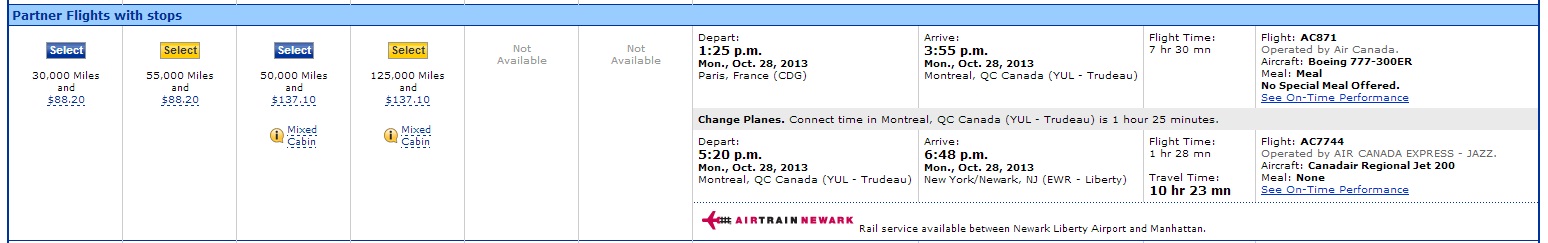

I like how United always shows how much an itinerary would have cost if purchased. I like to always make sure I’m getting at least 2 cents of value out of each points. This redemption meets that criteria at 2.5 cents/point. Not much over, but if I really wanted to take this trip, I’d feel good about redeeming at the given rate.

With Membership Rewards:

So many choices: Delta, Aeroplan, ANA, Iberia… this could go a number of different ways.

We can go ahead and throw out Delta. Their new award chart recently devalued and would now costs 60,000 miles. Not bad, same as United, but we can do better.

Aeroplan offers flights in economy for 60,000 miles round-trip, too, but their fuel surcharges can be prohibitive. Throw them out, too.

Aeroplan award chart (the OLD one – US-Europe is still current, though)

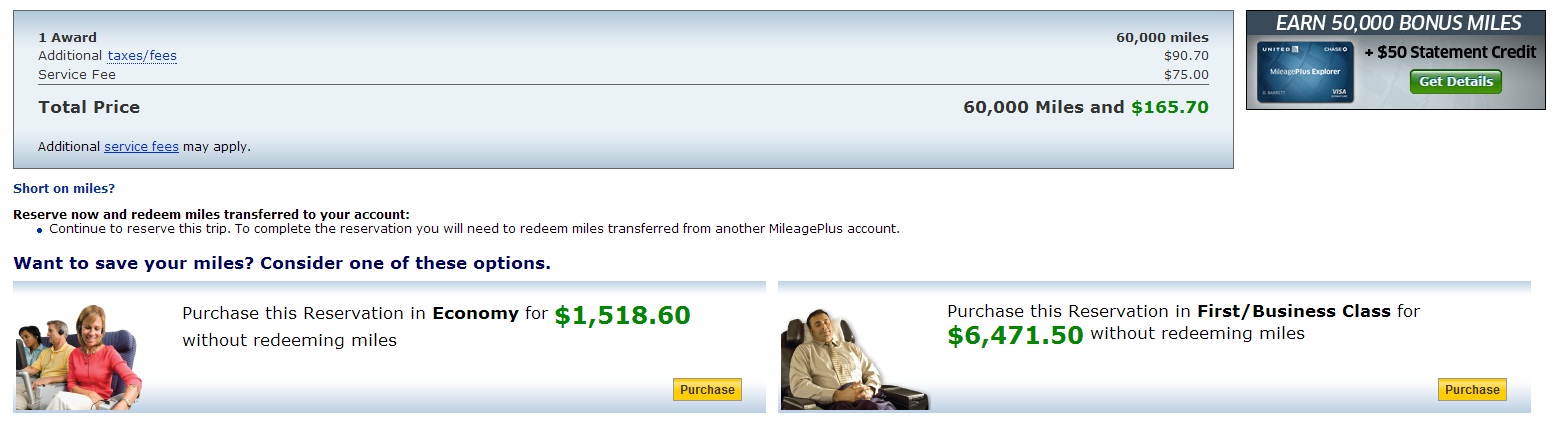

That leaves ANA and Flying Blue, the program of… Air France. Logic would lead you to believe that Air France would be the best way to get to Paris, right? Let’s narrow this down a bit more.

Sounds pretty reasonable!

Alright, 50,000 miles + $257 isn’t terrible. At this point, it’s between Air France and United, with its price of 60,000 miles + $166. Is it worth it to pay $91 to keep 10,000 Ultimate Rewards points? Since 10,000 Ultimate Rewards points are worth .02 each, or $200, the answer is YES. Air France (Membership Rewards) is winning!

Can ANA have a come-from-behind victory? Even if not, Membership Rewards is the way to go here.

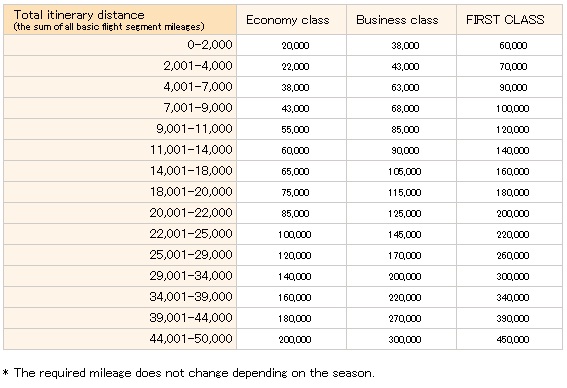

ANA has a distance-based reward award. JFK-CDG is 3,635 miles.

We can see JFK-CDG would be just 22,000 miles each way, or 44,000 round-trip, already saving 6,000 Membership Rewards points over Air France’s 50,000 miles. ANA does NOT charge fuel surcharges on US Airways flights, so for 44,000 miles and a small copay, you could be on your way to Paris!

WINNER: Membership Rewards

Bottom line:

With Ultimate Rewards, the best award redemption we could find was on United for 60,000 UR points. With Membership Rewards, the best award we could find was on ANA for 44,000 MR points. By flying on Star Alliance partners through ANA, we save ourselves 16,000 points, which is pretty nice!

This is only ONE example of potentially hundreds. It all depends on availability, surcharges, and your own personal preferences. This example goes to show that it’s good to have a few different points currencies for all the various award tickets that are out there. As always, do what makes me most sense for you and be sure to really dig into the details of your preferred program as there are always little tricks and tips that can get you even MORE value out of them, and, to quote Million Miles Secrets (one of my favorite blogs)- travel BIG with SMALL money! 🙂