Ugh, American Express just looooves to screw me out of bonuses. I recently got the Premier Rewards Gold card which comes now with a nice bonus of 50,000 Membership Rewards points after only $1,000 of spend in the first three months. BUT! It’s not available if you already have a Green, Gold, or Platinum card. And I have the Platinum Card. It was right there in the terms and conditions the entire time. I guess that’s what I get for doing an app-o-rama while half drunk – OK, really drunk – on tequila. This isn’t the first time I’ve been screwed out of a bonus. Here’s why: I never actually applied for the Platinum Card. That’s right. I called to upgrade my Gold Delta card to a Platinum Delta card. Guess what came in the mail? Yep. And there was no signup bonus attached to it.

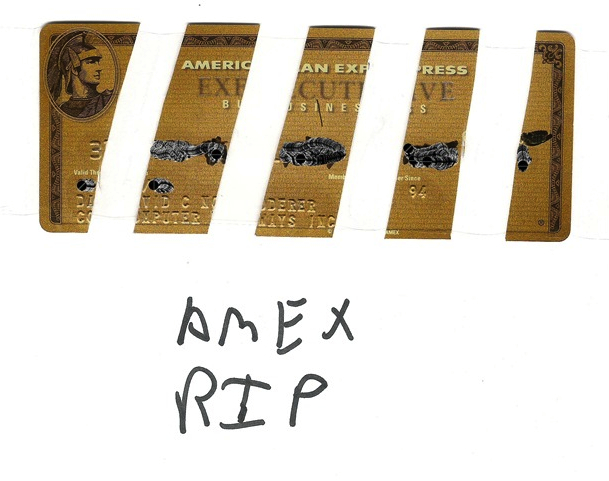

I bitched and bitched, called and emailed, and bitched some more to the point where I’m sure I’m on some sort of blacklist with Amex. I kept the card in the end because I had a big trip coming up with two friends and thought the free lounge access would be nice. Plus I wanted the airline credits and Global Entry… eventually. Basically, I wanted the card, but didn’t want it then. But I kept it as I’d already taken the ding on my credit report. I also still have the Gold Delta card. Go figure. You’d think that they’d offer MORE of a bonus for getting another card when you already have the Platinum Card, not less (or nothing!). I’m sorta hoping they give me the bonus for the Premier Rewards Gold card anyway. What’s the likelihood of that happening? Yes, I should’ve read the T&C more closely before I got all trigger-happy. But this is the second Amex bonus I’ve lost. It especially burns knowing that the Platinum Card recently had a 100,000 MR bonus. I’m sorta thinking of just canceling both cards for a year and starting all over from scratch. I don’t want a business version of either card, nor do I want to pay those hefty annual fees with no bonus to offset it. And of course Amex won’t match a public offer or award some goodwill points.

Good thing I’ve had MUCH better luck with Chase. Totally open to thoughts/opinions on this. Just burns me so bad to lose out on 150,000 MR points between these two cards. That’s R/T biz class to Australia! I’ll end this one the way it began: UGH.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] credit card. I actually put it on my Amex Platinum Card since I had a credit with them after bitching for a solid week in […]