UPDATE: One or more of these offers are no longer available. Click here to see the latest deals!

0% APR intro offers are common, especially for purchases. And you can usually transfer a balance from another card – but you’ll pay fees in the form of a percentage of the amount you transfer. The more you transfer = higher fee.

So when I saw a deal for 15 months of 0% interest on purchases including NO fees on balance transfers, that caught my attention. Then I realized it was with an actually useful Amex card – with a decent welcome bonus. It’s the Amex EveryDay card – learn more here.

Offers like these aren’t as exciting as getting tens of thousands of bonus points. But they can give you a lot of breathing room – especially if you need to plan for a big purchase, or catch up to avoid paying hundreds in interest fees. In this case, for well over a year.

I’ve taken advantage of similar offers in the past. And this one would be a great way to consolidate some balances. Especially if you’re over 5/24.

Amex EveryDay balance transfer offer

- Key link: Amex EveryDay card – learn more here

- Link: 0% APR cards

When I think of “balance transfer card” I think of Chase Slate. (Their marketing for that card is genius.)

Thing is – it’s not a great card to actually spend with. Meaning once its usefulness has expired, you’re left with a blah card that earns no rewards – and you’ve taken up a Chase slot.

Also, if you’ve opened more than 5 cards from ANY bank in the past 24 months, you won’t be approved for it. And if you want to transfer the balance from an existing Chase card, you can’t make a transfer to another Chase card. So you need a card from a different bank.

The Amex EveryDay card earns:

- 2X Amex Membership Rewards points at US supermarkets (on up to $6,000 in purchases per year, then 1X)

- 1X Amex Membership Rewards point on all other purchases

There’s also a welcome bonus of 10,000 Amex Membership Rewards points after you make $1,000 in purchases in your first 3 months (that does NOT include balances you transfer – has to be new purchases).

There’s been some talk that Amex has dropped (or loosened) their 4-credit-card limit. Plus, Amex is spectacular about moving credit lines around.

If you have other Amex personal cards, you can add those credit lines to whatever you get with this card. I’ve personally done it many times – just call them to move things around.

And while the rewards structure isn’t the most exciting, it does earn rewards for spending – and keeps your other Amex Membership Rewards points alive and transferrable to travel partners. Plus, this card doesn’t have an annual fee – so you can keep it year after year to help age your overall credit and boost your score.

0% for 15 months and $0 transfers?!

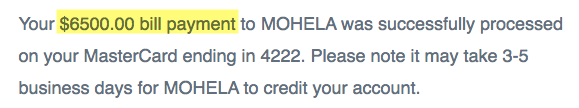

The other cool thing about this offer is there are no fees for balance transfers, as long as you initiate the transfer within 60 days of opening the card. Most cards charge 3% to 5% of the balance you want to move – which can add up fast if you have a large balance.

For example, you made a purchase or transfer in September 2018, you wouldn’t pay any interest as long as you pay off your balance within 15 months – or by November 2019.

That’s helpful if you need to plan for a big purchase like:

- Home repairs (I need a new HVAC system soon)

- Moving expenses

- Medical bills

- Car repair or down payment

- New appliances

- Payments on a student loan, car note, or other bill via Plastiq

The best part about this card offer isn’t the welcome bonus – instead, it’s the breathing room you give yourself to get caught up for a little while. So while it’s not luxury trips with free award seats in fancy planes, that certainly doesn’t make it any less valuable if it helps you get ahead.

Balance transfer offer terms

Amex says:

No transfer will be processed if: (1) any requested transfer is less than $100; (2) the total amount of all requested transfers exceeds the lesser of $7,500 or 75% of your credit limit; or (3) charging the requested transfers to your Card account would cause your total account balance to exceed your credit limit.

So the limit you can transfer to this card is $7,500 – and that’s if your credit line is at least $10,000 (but again, Amex is good about shifting credit lines between personal cards).

Credit cards are tools

Why? Because money is a tool. Nothing more or less. You exchange your time for money. And then exchange money for experiences or objects.

Like any tool, if you use it properly you can create something solid and beautiful. Or, you can totally mess everything up.

A hammer can nail boards together to build a home. Or you can destroy an entire structure with it.

The good or bad isn’t inside the hammer – it’s within the person using it. So it goes with credit cards.

I have 30 credit cards and see them as tools in a drawer. They have no energy on their own – it’s my job to supply a purpose

Used properly, credit cards can earn you rewards, help control your cash flow, and unlock travel you never thought possible.

On the flip side, credit card debt is a downward spiral, man. If you’re not careful, you’ll wind up owing much more than when you started.

What I’m saying is: don’t take a 0% APR offer as a license to spend like crazy. See it as an opportunity to give yourself time and space to plan your finances.

Bottom line

- Key link: Amex EveryDay card – learn more here

- Link: 0% APR cards

The 15 months with 0% APR and $0 balance transfer offer on the Amex EveryDay card is strong for many reasons – and improves upon researching. For one, it’s an Amex card (obviously) but that means it won’t take up a Chase slot and is NOT affected by your 5/24 status. The card earns rewards and even has a modest welcome bonus.

Finally, Amex is great about moving credit lines around.

You might move a balance to this card for any number of reasons: to avoid interest or annual fees, consolidate, or free up another card for spending. And having 15 months to repay without interest is a nice amount of time to catch up on a big purchase, like a home repair or move.

I haven’t seen offers like this with Amex cards before. It’s a good opportunity and a good deal. It’s not a license to spend money you don’t have – but used properly, can be a great way to improve your overall financial situation.

Have you used 0% balance transfer offers before? How’d it turn out for you?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Be aware the the MAXIMUM amount that can be used for a balance transfer is $7,500 – and that assumes that AmEx grants a credit limit of $10K+. The exact wording is that the transfer will be denied if:

“the total amount of all requested transfers exceeds the lesser of $7,500 or 75% of your credit limit”

Also, to get the bonus points AND use the balance transfer, you will have to make the initial $1,000 in purchases quickly (& potentially pay the AmEx bill to free-up available credit) so that the transfer can be completed within 60 days of card opening (not 60 days of card receipt…).

Just want to be sure anyone reading this is aware of all the rules so they can take full advantage of this offer.

Thank you for adding this, Nigel! I will put it in the post, too.