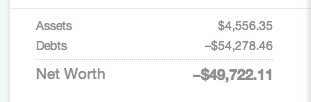

I use mint.com to keep track of my credit card accounts, IRAs, and student loans. My student loans are by far the bulk of my debt – about $50,000.

I currently have IRAs with two companies, Fidelity and USAA, and a brokerage account with Fidelity (the one my Fidelity Investment Rewards card plugs into). There’s about $4,000 among them.

My immediate goals are to pay down student loan debt, save up for a down payment on a house, and put the rest into an IRA until I max it out. This will definitely be a “slow and steady wins the race” kind of proposition.

My current salary is about $60,000 ($50,000 base + yearly bonus + reimbursements for healthcare).

My first Financial Snapshot. Really putting it all out there. Here goes nothin’…

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply