Also see:

If you’re paying fees to access your own money, it’s time to dump your stupid bank.

Do it now do it now DO IT NOW. If you pay $10 a month for not carrying a minimum balance, $2 to request a balance, or ATM fees when you need to withdraw money, vote with your feet. Get. Out. NOW.

I’ll share bank accounts that are completely FREE to have and use with NO minimum. Oh, and you don’t need a physical branch.

Get a FREE bank account (don’t pay to access your own money!)

Personally, I don’t think a large checking account balance is a badge of honor. So you have $100,000 sitting in a checking account? I mean, that’s cool but… your money should be working for you while you sleep at night. And it ain’t doin’ anything in your checking account. Especially if you pay fees to have said account.

And if you receive the bulk of your money through direct deposit, you do NOT need a physical branch.

Something that irritates me more than watching someone pay at a restaurant with a debit card is hearing they still pay fees for using their checking account.

To those people, I’d say… there is a way out. And yep, you’ll have to switch your direct deposits. No excuses.

Here are some totally free bank accounts to consider. Dump your bank!

1. Fidelity Cash Management account

This is what I personally use as my checking account. I’ve had it for years. And used the debit card to withdraw funds all over the world, including Japan, Chile, England, and Spain.

I’ve never paid a single cent for the account. And I think nothing of walking up to ANY ATM in the world and pulling out MY money. If there’s a fee, it doesn’t matter – it’s reimbursed as soon as the withdrawal clears. I’ve never had an issue with the card not working or with the conversion rates.

I recently recommended this to a friend who was paying $8 per month to have a checking account – $96 a year just to access his own money! Criminal. Why do that when options like this exist for free?

Would you switch your direct deposit just once to save $96 in a single year?

2. Schwab Bank High Yield Investor Checking Account

Essentially the same except…

- You’ll get a hard pull on your credit file

- ATM fees are reimbursed once per statement cycle instead of as you go

- You must open a Schwab brokerage account (thought you don’t have to use it, and it’s free)

Lots of travelers like this account for some reason. I prefer the Fidelity version, but that’s just me. If you like the setup of this account better, go for it! Both are free, so I approve whole-heartedly of either choice.

3. Aspiration Summit

This one is awesome because their checking account has a savings account built-in, like a hybrid.

Once you hit $2,500 in the account, you’ll earn 1% interest on the balance, which compounds monthly.

If you like the simplicity of a singular account for checking and savings, and plan to save over $2,500, this is a solid option. Every ATM in the world is free to use. If there are any fees, you’ll get them back. And you’ll only pay a fee on this account if you choose.

Aspiration is also committed to helping non-profits around the world. So they’re free to have, and help worthy causes. Win-win all around.

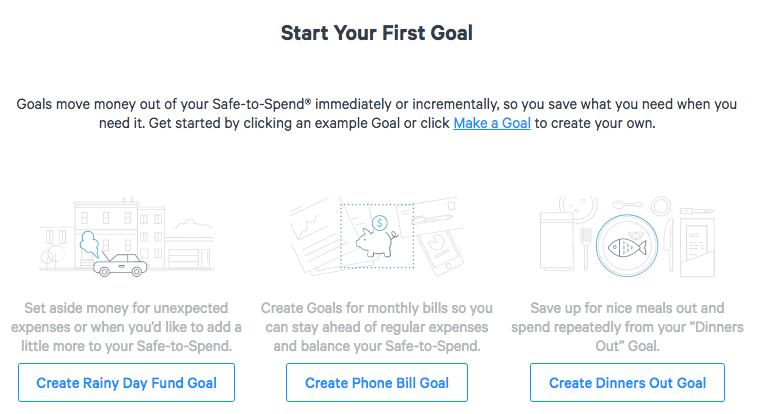

4. Simple

Link: Open a Simple checking account

Simple is cool because they analyze your spending and give you a “safe to spend” number. That’s helpful if you rely on your checking account to reflect your finances.

In addition, you can add savings goals – as many as you want – and fill them up like little buckets, right inside your account. (This is known as the envelope system.)

You can also set up a shared account with a partner or spouse. That’s useful if you’re saving up to take a trip together, for example. Or for a house down payment.

Biggest drawback? You have to use their network of fee-free ATMs to make transactions. So you can’t stroll up to any ATM like you can with the previous 3 options.

However, if you have a convenient ATM near you, or if you don’t use them often enough to really matter, the other cool features might win you over.

The goal-setting and partner account-sharing are excellent features – this should appeal to lots of peeps. And the account is free to keep and have. The app is also super cool and easy to use.

5. Capital One 360

Here’s another free account with no minimums or requirements. Just free to use.

Their app is clean and easy to navigate, customer service is great, and branches are plentiful should you need them. If you have a Capital One credit card, even better – it’s easy to move money across your accounts.

I have Capital One for my auto loan and they’re all over Dallas. I’d consider them if I didn’t already have the Fidelity account.

Bonus: Your local credit union

If you really want a physical branch, consider supporting a credit union near you. Their rates are often competitive and generous. And you’ll have a branch nearby should you need it.

It’s also good to support local businesses. Even better, you’ll be privy to preferred rates on auto loans and mortgages, should you ever need them. And having a checking account is a stepping stone toward that bigger overall relationship. Plus, supporting your community is awesome. 👍

Most credit unions have websites. Commit to finding one near you. Or even better, walk in and ask what they can do for you.

What to look for in a checking account

This is nowhere near an exhaustive list, but a resource to give you ideas. There are great checking accounts available through:

- Ally

- BBVA

- Chime

- Discover

- EverBank

- FNBO

- …And so many others. (Anyone know a good option with a bank that starts with “G”? I was on a roll with this list! A, B, C, D, E, F…)

What you want to keep an eye out for is:

- Fee schedule

- No minimum balances

- No ATM fees (or a list of free ATMs)

- Free bill pay

- Mobile deposits

- A great mobile app

You might also ask about any type of APYs for letting your money sit. Although a money market account, CD, bond, or IRA is even better (which is why I don’t really care about APYs for checking). But first things first, dump your bank if you’re paying fees. You can work on the other stuff when you’re ready. 😉

Bottom line

My mom was paying a monthly checking account fee, with another fee to have paper statements (she’s with Regions). I get that old habits die hard and it’s an effort to switch, but would you fill out one piece of paper to save $96 a year for perpetuity? I know I would.

There are so many no-fee options out there. If you’re banking with Chase, Bank of America, Regions, Wells Fargo, or any other bank that charges you a monthly fee – however small it is – dump them immediately!

This list should be enough to get you started. But if you know of another nationally-available option, please let us know!

Have you dumped your bank? Which account did you settle on?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

which bank account do you use for business

I actually use the Fidelity Cash Management account for my business direct deposits and as a “business” checking account. Love love love it.

Thanks for this very useful info about free checking accounts. I’ll be getting this one from Fidelity.

Thank you so much for reading and commenting! I think any of the ones listed here are better than the big banks. I love the Fidelity account because it’s easy to fund my IRA and sweep the rewards from the Fidelity Visa into it, too. Hope you like it. Thanks again!

There is a charge when withdrawing money abroad from a Fidelity Cash Management Account. Per their website:

“Please note, there is a foreign transaction fee of one percent that is not waived, which will be included in the amount charged to your account.”

There is no foreign transaction fee with the Schwab Bank High Yield Investor Checking Account. I use it when I need cash while traveling abroad. I have compared the exchange rates used in withdrawals from dozens of countries over the years to publicly available rates and have found them in range.

Sorry if this is bad news to anyone, but I hate to see people throw away even 1% of their money.

Aspiration has that as well. I at most withdraw $100 USD equivalent and put most spending on a rewards-earning credit card with no foreign exchange fees. So I pay $1 a trip @ 1% rate, which is a small price to pay. But that’s worth noting if you’re overseas for an extended time or pulling out large sums – thanks for adding the info!

uh yeah, you think Harlan? esp as considering the whole basis for your article is fee-FREE & Fidelity is who YOU use?

The best ATM card to use for foreign travel is Capital One – they charge NO fees or foreign xactionfees, same as using an ATM here.

Look for a sign on the ATM that is “no service fee” on the OTHER bank’s

end, though, or they might still hit you with a foreign fee.

The fees I avoid are: minimum account balances, statement fees, and fees for simply having/not using the account enough.

I use no FX credit cards for 99% of my spending in other countries, so foreign ATM fees don’t bug me as much as it does other people, apparently. And yup, I love my Fidelity account!

Thanks for adding that about Capital One – sounds like they have a good thing going! Now, if they’d only approve me for one of their credit cards…

When opening a new checking account, the banker will often assume that you want to purchase some of their over-priced paper checks. If you need paper checks, you can find them online a much-reduced prices.

I haven’t used a paper check in yeeeears. But some still do – this is an excellent tip to save. Thank you!

Costco and Sams Club (for members) have extremely low cheque printing prices – think less than $10 for around 500 of them. If you’re not a member, Walmart also offers low prices and smaller quantities, though not as good of a value as the first two. They all use Harland Clarke to print, which is what most banks use as well.

I use Schwab for the same reason – no FX fees. Fidelity, Aspiration and Simple all charge FX fees and thus are NOT fee-free. CapitalOne doesn’t charge FX fees, but their fraud process is so bad, I stopped using their cards abroad.

Depending how much you travel abroad and where, FX and DCC charges can add up! Some countries have fees for credit card use that are even higher, so having no-fee cash access can safe you money!

Awesome, another vote for the Schwab account. Thanks for the tip about CapOne and their fraud process – I did not know that.

Excellent info, thanks again for adding! 🙂

Credit Union.

Mine, Digital Federal Credit Union, is making so money they keep offering new, free services.

As a nerd and as a member for 40+ years, I can highly recommend DCU.

1. No ATM fees. Even though I only use an ATM about 5 times a year and usually in Europe, this is nice.

2. “No bounce checking” up to $2K.

3. Sub accounts. Easy to track specific savings.

4. Linked accounts to family members and our small business.

5. People in the USA at the other end of the phone line.

6. Free FICO 5 score.

7. Reasonably-priced loans. Not the best, but good rates.

8. Financial management tool (web-based, links to outside accounts).

This is such a great tip. Thank you so much for reading and commenting!