Also see:

- Explosions! The earth is moving! (I got an Amex signup bonus.)

- “Secret” Benefit of Amex Premier Rewards Gold Card is Gone

- Now you can see Amex bonus transactions online

I just reviewed my latest post and I’ve written about Amex a LOT recently. This is neither a good thing nor a bad thing. Chase’s products are functioning smoothly and as they should; I still love the Arrival card; still jammin’ on my Club Carlson Visa. The only anomaly recently has been with Amex.

Smell ya later, PRG

When Amex unveiled the ability to see category bonuses online, I immediately checked the unpublished benefit of getting 3 points per dollar on online transactions. It was there at one point. And, at another point, they took it away.

That hidden benny was the only thing tethering me to the PRG card since I make a lot of online transactions. And I really don’t spend that much on airfare. Furthermore, when I do, I use the loyalty card for the airline I’m flying more often than not. The PRG was reductive in that way. Also, spending $30,000 in a year gets a 15,000 point bonus, bringing the points per dollar total to 1.5… just like the new EveryDay Preferred card (when you make 30 transactions in a month).

I’m better off using loyalty credit cards for airfare purchases and the EveryDay Preferred card for gas, grocery, and miscellaneous purchases (travel and dining still go on the Sapphire Preferred).

With this thought, I called up Amex to cancel the PRG card once and for all, and to recoup the $175 annual fee I’d just paid.

I asked if there were any product conversions or retention offers for the card. When you call to genuinely cancel the card, btw, it gives you a strange sort of confidence, because your mind’s already made up. The agent offered me the Green Card. Nope, don’t want it. No retention offers for little old me. Bye bye, PRG.

Wiggle room

And then, a funny thing happened. I asked, once more, post PRG-cancelation, if I could move some credit from my Delta Platinum SkyMiles card over to my new EveryDay Preferred, which had a really low credit limit. They’d rejected this idea before, saying I had to wait 60 days. But I guess the cancelation gave me some wiggle room. The agent moved over my credit line with no problem.

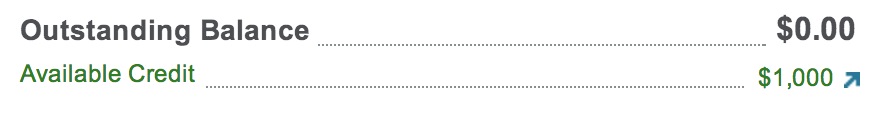

I left a measly $1,000 on the Delta card that I never plan to touch (and, actually, this one’s next on the chopping block). Now I can use my EveryDay card… every day… and still have some credit left over. Was it the canceling that gave me some leverage? I didn’t ask too many questions.

But, I can confirm, Amex finally let me switch credit allocations. This was the first time in a loooong time that I hung up happy after an Amex call.

Bottom line

The credit switch showed up in my account instantly. So did the death of the PRG card. In my opinion, Amex is cannibalizing the PRG with the EveryDay Preferred. Read my analysis of the two if you’d like. But you can probably guess, especially after reading this, which one I recommend. 🙂

Has anyone else had a similar experience with Amex recently? Would be curious to hear your stories.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Announcing Points Hub—points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply