Contents

1. Starting Notes

2. Points Vs. Miles (And Their Value)

3. Envisioning a Goal

4. Checking Your Credit

5. Choosing an Airline

6. How to Pick a Card (Or Two)

7. Real Life Examples

8. Score!

9. How to Keep It Going

10. Keeping Track of It All

11. Wonderful Side Effects

12. Final Words

13. Resources

First things first. Don’t get overwhelmed. Don’t take on more than you can handle. And never make decisions that will hurt your credit. Remember that your credit is one of your most important assets. Used correctly, it can get you a lot of free miles and points. But don’t overdo it. Always remember that there are plenty of opportunities to earn points and miles. Sometimes so much so that you need to organize your approach.

![]() Never, ever let your miles expire. If you have Delta SkyMiles, you’re golden because they never expire. American and United miles absolutely have expiration dates. Don’t know what that date is? Download the app below and always have activity in the accounts from dining, shopping, or promotions (or signup bonuses). Even one mile deposited every year can keep all your earned miles from expiring.

Never, ever let your miles expire. If you have Delta SkyMiles, you’re golden because they never expire. American and United miles absolutely have expiration dates. Don’t know what that date is? Download the app below and always have activity in the accounts from dining, shopping, or promotions (or signup bonuses). Even one mile deposited every year can keep all your earned miles from expiring.

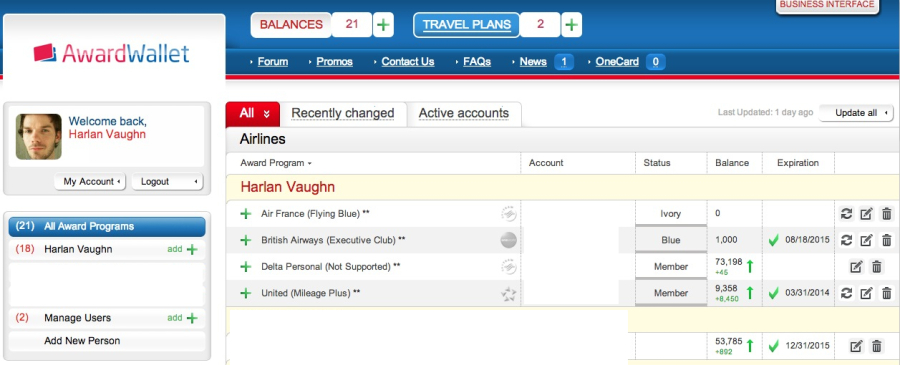

![]() Get AwardWallet. It’s a great way to keep all your login info and account numbers in one place. I’ve used many similar services, and think this one is the best. It’s blocked by a few airlines, but that doesn’t matter so much. What’s great is that it displays all your account numbers so you can access them easily and quickly.

Get AwardWallet. It’s a great way to keep all your login info and account numbers in one place. I’ve used many similar services, and think this one is the best. It’s blocked by a few airlines, but that doesn’t matter so much. What’s great is that it displays all your account numbers so you can access them easily and quickly.

![]() Keep a simple spreadsheet of what you signed up for, when you signed up, and how many miles you’re expecting. Don’t go too overboard, but keep it updated and in a folder that’s easy to get to. Check it every couple of months and make sure you got everything you were promised. Most merchants are good about giving bonuses, but stuff happens, and it’s worth keeping an eye on. Some people hate spreadsheets. If you’re one of those people, at least make a note somewhere of the big activity.

Keep a simple spreadsheet of what you signed up for, when you signed up, and how many miles you’re expecting. Don’t go too overboard, but keep it updated and in a folder that’s easy to get to. Check it every couple of months and make sure you got everything you were promised. Most merchants are good about giving bonuses, but stuff happens, and it’s worth keeping an eye on. Some people hate spreadsheets. If you’re one of those people, at least make a note somewhere of the big activity.

Between airline apps, AwardWallet, and a simple spreadsheet on my computer, I always know how many miles I have, when they’re going to expire, and how many are still on the way. This helps me monitor my progress and keep track of my goals. Most importantly, it doesn’t overwhelm me.

Next up: Wonderful Side Effects

- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply