Howdy from Knoxville! I’ve been in Tennessee for a couple of months, but later this week I’m heading to Asheville, North Carolina – and very much looking forward to it!

Tennessee’s been great. I reconnected with hiking and made an effort to get moving and active again. Now I’m unstoppable, especially after climbing mountains in the Smokies this weekend.

It’s been a fun month in Tennessee

On the money front, things held steady. I’m up ~$4,000 despite wild market gyrations. I was able to throw $1,000 into savings and pay off every cent I put on my credit cards. And I didn’t hold back this month with the eating (and drinking) out .

I had a friend in town and woof, Nashville is an expensive city. I’m caught somewhere between living in the now and saving for the future… but let’s say “the now” took over a little more this month.

Oh and I’m newly a Hyatt Globalist member! All it took was a 29-night stay, but it worked out almost exactly as planned. Actually, I came out ahead of my calculations by a bit.

It feels so good to be transient (and I don’t use italics a lot).

June 2021 Freedom update

I’m getting into the swing of living on the road and also beginning the journey of my third $100K. At this point, I’d love to hit $250K by the end of the year – six more months to go! I think I can do it. (Can you believe the year is half over already?)

My biggest cost with all of this is housing. It’d be cheaper if I were splitting this adventure with someone but alas, I am alone in this. I’m trying to stay around $1,500 per month and so far have come in under budget every month. I’ll have a couple of expensive months coming up followed by a break, so it will balance out.

I spend a lot of time in my area, within town, or at home. It’s become paramount that I locate myself as close as possible to where I want to be. After work, I’m drained – and need attractions to be nearby if I intend to find them tempting.

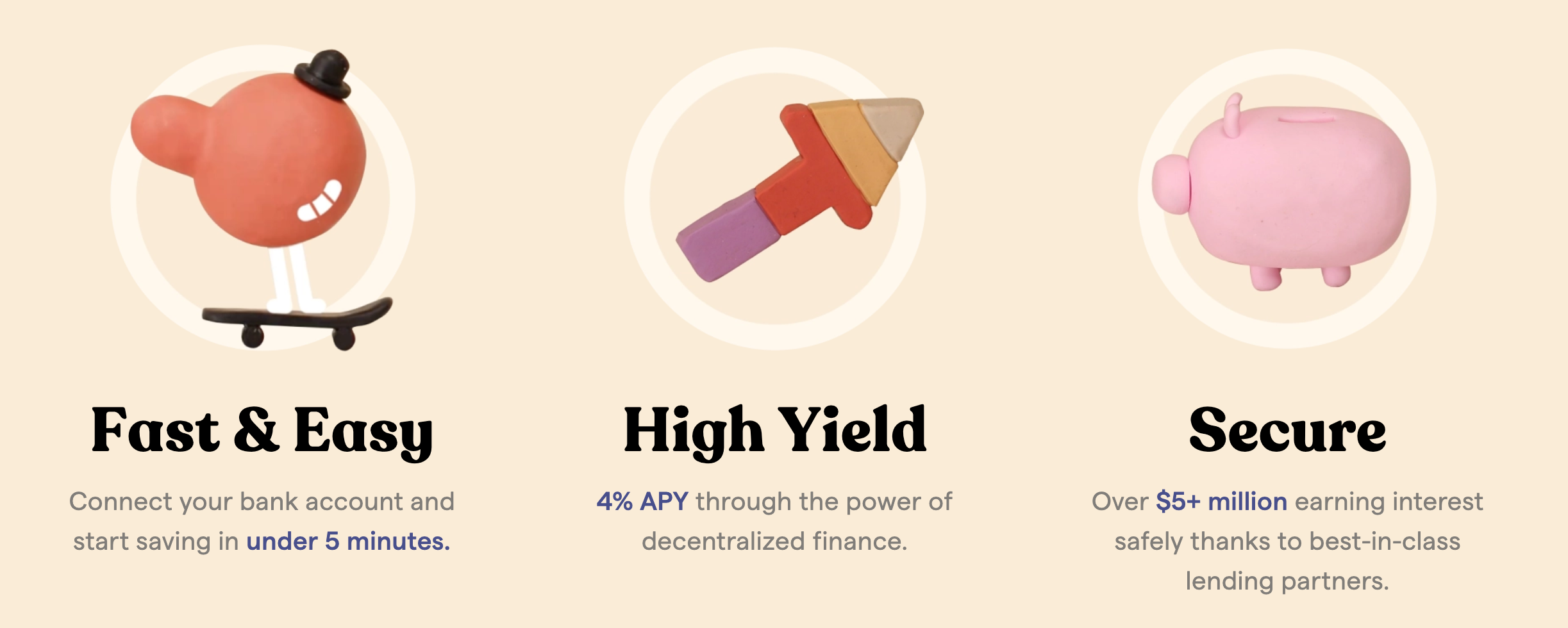

What is DeFi?

Decentralized finance. I’ve been learning about new ways to use crypto as a savings vehicle that’s also a hybrid investment. Nothing crazy, but I threw $50 into Donut just to try it out.

Apparently you can earn up to 15% APY if you’re willing to put in $5,000. I’m not there yet, but I’ve been comparing it to BlockFi and a couple other crypto-based accounts.

Donut has a slick iOS app and interface

Donut is currently only available on iOS, but I look forward to exploring it more. Once I reach my $30K savings goal, I’ll feel more comfortable with riskier assets. Almost there. More on this soon, but feel free to explore ahead of me!

More social

- Link: Follow me on Instagram

I’ve been trying to be more active on Instagram and adding more personal finance, travel, and miles content on there. My account has never really had a focus – just me and my journey – but I’ve been posting more often. It’s still scattershot, but these topics mean a lot to me and I’d love it if you’d follow me there.

View this post on Instagram

I also use Instagram as a photo album and mini travel diary when I’m not posting here and as I’ve moved along this path, I’ve fallen further in love with my life and have wanted to share it more. So I humbly invite you to join me there. The thing that makes this adventure truly worthwhile is the amazing people I’ve met – thank you! ✨

By the numbers

My favorite part!

| Current | Last month | Change | 2021 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| 401k (contributions only) | $7,500 | $5,833 | +$1,667 | $19,500 | |

| Overall investments | $168,373 | $165,306 | +$3,067 | As much as possible | |

| Savings | $26,125 | $25,125 | +$1,000 | $30,000 | |

| Net worth in Personal Capital | $202,508 | $198,676 | +$3,832 | $500,000 | Track your net worth with Personal Capital |

I used to think this section was getting boring – now I think it’s the most thrilling part.

Inching ever closer

Right now I’m throwing every spare cent into my savings account. It may take me a couple more months. Once that’s done, I can focus on purchasing riskier assets like crypto, DeFi, meme stocks (I’ve been missing out on that whole trend) and simply just loading up my taxable brokerage account with index funds.

View this post on Instagram

The market was sluggish in May 2021, but I still realized positive gains. I try not to watch the market, but it’s fun to participate in the drama of it all. I’ve done well at tuning out and staying the course though. Some days I forget to even check at all, which is ideal.

June 2021 Freedom update bottom line

I promised myself I’d make this update less than 1,000 words and I just might do that! This month finds me chugging along in good spirits. Of course I love reaching ever-higher heights with my net worth and moving toward my goal, but daily life has me in the most beautiful trance.

I’m still interested in crypto, like the Donut app I joined and put $50 into. I need to sit down and give myself a crash course because I don’t see crypto going away any time soon. The riskier the asset, the high potential for gains. Or something like that.

I’ve also been trying to post more on Instagram – follow me there! ⚡️

I’m starting to explore the terrain between personal finance and miles/points. How can one love travel and still save toward financial independence? Especially me, as a digital nomad and switching homes every few weeks.

Next up, I’ve got Asheville, West Virginia, Pittsburgh, and upstate New York. I try not to plan too far beyond six weeks because anything can happen.

Speaking of which, I’m about to hit 1,000 words! Thank you for reading them if you’re still here. Now I want to know – are you planning your summer travels? Is crypto alluring to you, too? Or are you staying put and hanging tight for a little while more?

Stay safe and scrappy out there! ✨ If you’re thinking about opening new credit cards, please consider applying through my CardRatings links!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Boring can be exciting too. That’s how I prefer my slow march to FIRE. But don’t be surprised if there are a few small corrections in the market coming up, and possibly a big one 6+ months out. I’ve been thinking about taking some profits on my positions I’m over 100% up on. Maybe sell half and play with remaining house money.

Boring is definitely exciting. And yes, I’m always ready for a correction. It’s been talked about so much that I almost wonder if it’s all hype. But yeah, something is definitely brewing. I’m just going to continue my strategy and keep to my plan.

I’m looking forward to having some “play” money though. No risk, no reward as they say. 🙂 Your plan sounds solid – and fun!

Pretty sure I’ve beat the correction drum here before too and things have kept going up up up. If you remove Covid we’re in the longest up streak in history, but if you look at fundamentals the market should be half what it is now, yet here we are. So things can continue to go up for months or years, or covid 2.0 can roll in and we’re back at DOW 20k. I’ve been having some serious FOMO from the March lows. I started buying on the way down but stopped at 25k and didn’t get back in at all. I’m still up, but not up like others. You’re in a great spot. Nomad travel while working remotely is what I wanted before we hit the road, but we didn’t have jobs which made things super stressful.

Sounds like you’re in a good place, Harlan. I’m glad to hear it! So far at least, this lifestyle really seems to be working well for you.

It’s working out great so far! When it no longer becomes fun, I can also get another place somewhere. Until then, I see no reason to stop. I’d love to spend some time internationally, too. Maybe keep this up until the housing market cools off a little.

Thank you as always for your continued support! Hope you’re doing great, Audrey! <3