When I pull cash out of an ATM, the receipt always says I have something like $100 in my account. Yeah, in my checking account.

The truth is I keep my checking account balance low on purpose. Because money in a checking account ain’t doing nothing but sittin’ like a bump on a pickle (#SouthernSayins).

I want my money to work for me. Every day, for years. Compound interest is a wonderful tool that can work for you – or against you. So make it work FOR you!

At the very least, keep your money in an interest-bearing savings account. Pay your bills from checking, then transfer the excess to a high-interest savings or investment account.

Compound interest is one of the most powerful forces in the universe

Whatever you do, stop using checking accounts to park your money!

Get an interest savings account and/or an investment account to earn free interest

My financial strategy:

- Keep monthly expense money in a checking account (here are the best with no fees)

- Pay bills from that account

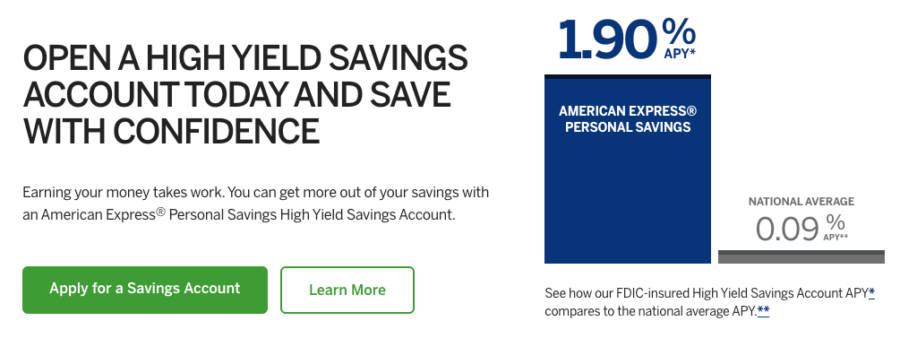

- Whatever’s left over, send half to a high-yield savings account (Amex Personal Savings has 1.9% APY!) and half to an IRA account (here are the best)

- Repeat monthly to pay bills, budget, and build short-term and long-term savings

1.9% is a fantastic return for long-term savings or an emergency fund

And all of this is free to have and keep. You should have a free checking account, a free savings account, and Fidelity has several funds with NO fees or minimums.

Your money can literally earn more FREE money just by parking it in the right place. Even saving $10 a week would give you $520 at the end of the year ($10 X 52)!

If you saved it in an account with 1.9% interest for 12 months, you’d get another $10 added to that. And that could be the beginning of a healthy emergency savings account.

If you have extra money, put it to work for you. Never keep large sums in a checking account for extended periods.

Plus, it’s a good idea to have something in a savings account or saved toward retirement.

But that’s a lot of effort!

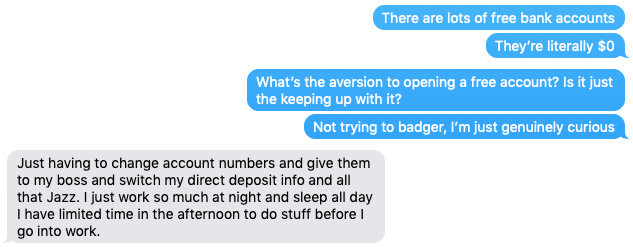

I’ve been trying to get my younger brother set up with a Fidelity Cash Management account – for months. I offered to set it up and let it sit there until he’s ready to use it. It’s free to get and there are no fees. But he doesn’t want one.

Finally, I asked him – why? Is it the psychological toll of having multiple accounts? Too much trouble to set up or switch auto-payments? Why keep a bank that charges fees when there are multiple free options?

Convo with my bro about switching his bank

He didn’t want to switch his account numbers and works a lot. I get it. But there’s no way I’m letting a bank charge me to access my own money.

I’d rather spend the few minutes it takes to switch account numbers one time than pay a monthly account fee for months and months.

Going back to that same $10 you could save – if you pay $10 per month in bank fees, that’s also $120 a year you’re giving to a bank to hold your money. Why on earth wouldn’t you rather have that earning interest in a savings account instead if you’re parting with it anyway?

Adding credit cards to the mix

To take it to the next level, an even better thing to do if you like to travel would be:

- Save money for a trip

- Get a travel rewards card and use points or miles for the trip instead

- Put the money you saved into savings or retirement account

Now that’s really saving money on travel!

Yes, credit cards are yet another piece of your overall financial puzzle (and everyone should have one). But it comes down to, more than anything, your mindset.

Your money mindset can make or break you. I LOVE MONEY and using credit card rewards to get free travel!

For those who think it’s too much trouble, I’d say… anything worth doing is gonna take work.

And when the end result is saving money or getting luxurious vacations for pennies on the dollar, the end definitely justifies the means.

Bottom line

I am all about:

- Saving time

- Saving money

- Traveling for free or really freaking cheap

Everything I write here boils down to one of those principles.

And yes, I use a lot of apps and stack deals and open new credit cards to earn bonuses because that’s fun for me. And I’ll admit: it’s a lot to keep track of. Mint.com is a literal godsend for seeing everything in one place, and I use FileThis to send all my statements to my Evernote account for easy review and storage (both excellent tools!).

I want all my money working for me. I never pay a dime of interest on my credit cards. And I’ll never pay junk fees to access my cash.

Get a a free checking account, park cash in a free interest-bearing savings account, and invest the rest in a retirement account. In this way, your cash always works to earn you more money with the power of compound interest. Never pay it – earn free interest instead!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You’re assuming that a checking account won’t pay interest. What if I told you checking can pay interest, and not any of those “$25,000 gets you 0.2% interest” accounts either.

/Morpheus voice

Bank or brokerage checking usually won’t except at high balances …. BUT.

Credit unions do.

I have a checking account paying 1.57% on a balance up to $10,000 (First Tech Federal). Another one with 4% on checking, 6% on savings for balances up to $500 (BECU).

Credit unions don’t hand out the miles and points bling like Chase does, but they do have their benefits…

Wow, That’s a great interest rate. I have my emergency fund at American Airlines Federal Credit Union for many years. Currently at 1.87% and I thought that was great. I have been able to utilize the Chase Banking Bonuses as well.

I’ve seen those! There are often a few hoops to get through to get the higher rates, but it’s definitely worth sharing. Thank you!

“Going back to that same $10 you could save – if you pay $10 per month in bank fees, that’s also $520 a year you’re giving to a bank to hold your money.”

Don’t take financial advice from someone who thinks $10 a month is $520.

It was a pretty simple typo – thanks for catching! I updated the post.

Also the advice to simply to earn interest, but feel free not to take it! 😉

Heritage bank is 3.33% up to $25k balance with easy hoops: 10 debits/month (Amazon gC reloads work well) and 1 ACH to/from the account. Super easy and it’s a checking account so the 6 monthly withdrawal limit won’t apply. Fee free too. I have 2 accounts and you can have even more if you have more funds sitting idle. I’m waiting for a big market drop so I can buy dividend stocks on sale to fund our travels.

And Vista is 3.5% up to $30k but requires 2 ACH and 30 debits. I’m looking into opening more Heritage accounts to lower my monthly debit burden. 60 debits from 2 accounts is a chore.

And if the market crashes I’ll just dump everything into stocks and live off the dividends. Lots of cheap places overseas. Looks like we’ll do a month in Chiang Mai as our first stop in January.