November is here, and in a couple of short weeks, it’ll be Black Friday. Peeps tend to naturally spend more during the holiday season for presents, travel, and organizing parties.

While there’s a moment of calm, consider you can turn all your holiday spending into 1,000s of points & miles by opening a new credit card and using it to meet minimum spending requirements over the next month or so. If you apply now, it’ll arrive in time for the biggest shopping season of the year.

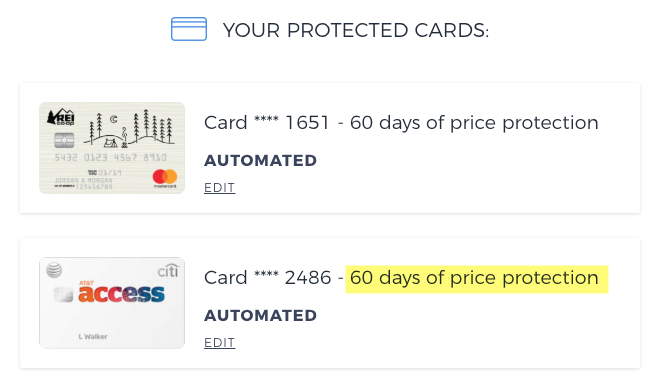

Plus, with all the sales and deals going on, consider a card with 60- or 90-day price protection – and automate it – to save even more money.

Turn those Amazon purchases into award travel! Now’s the time to jump on a new card offer

Here are a few worthwhile sign-up offers, and how to set alerts for price drops.

Holiday time now = an award trip in 2019

Yeah, November and December are expensive months. If you’re buying gifts, making last-minute trips to earn elite status, or attending/hosting holiday events, it all adds up. So make it work in your favor.

If you’re planning to spend anyway, earn a sign-up bonus for your efforts. And use the points or miles you earn now to go somewhere fabulous next year.

Of course, you should only get a new card if you can pay it all back after each billing cycle. Because paying interest negates any rewards you earn.

With all this in mind, here are some awesome offers going on now.

1. Chase Sapphire Preferred® Card

| Chase Sapphire Preferred® Card | bonus_miles_full |

|---|---|

| • 5X Chase Ultimate Rewards points per $1 spent on travel booked through Chase • 3X Chase Ultimate Rewards points per $1 spent on dining |

| • $95 annual fee • $50 annual hotel credit • 10% anniversary points bonus • Free DoorDash DashPass subscription | • $4,000 on purchases in the first 3 months from account opening |

| • The best card for beginners | • Compare it here |

If you’ve never had this card, and haven’t opened 5+ cards in the last 2 years, this is *the* best place to start.

Stay at the Hyatt Ziva Puerto Vallarta for 20,000 Chase Ultimate Rewards points per night (transferred to Hyatt)

If you transfer the points you earn to travel partners, the sky is the figurative and literal limit!

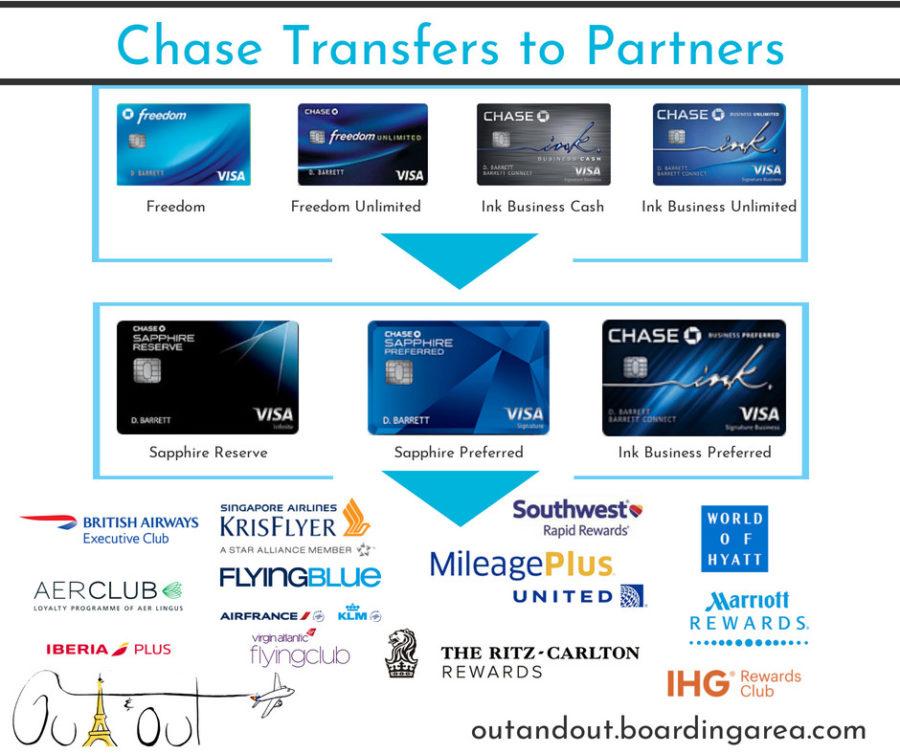

Access 14 transfer partners with Chase Ultimate Rewards points

Here’s how to earn and redeem Chase Ultimate Rewards points. And here are 7 easy ways to use the sign-up bonus you’ll earn.

I still recommend this card to peeps because of the strong sign-up offer, ease to earn ongoing points, and excellent ancillary benefits, like primary rental car insurance (which has saved my butt before).

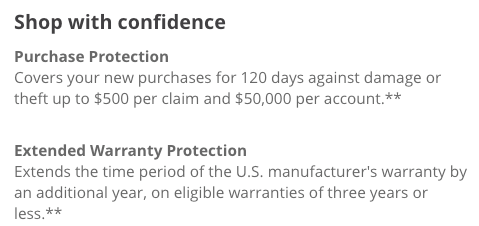

You won’t get price protection, but rather purchase and warranty protection

This card does NOT have price protection, so it’s up to the merchant to refund you the difference. But you will get purchase protection, and an extra year of warranty protection on warranties of 3 years or less.

That can be helpful if you’re buying a big-ticket electronic item, or something with lots of moving parts that might need repair down the road.

These, coupled with the excellent sign-up bonus, are perfect for holiday shopping. 👌

2. Any Citi personal card

Link: Citi Price Rewind

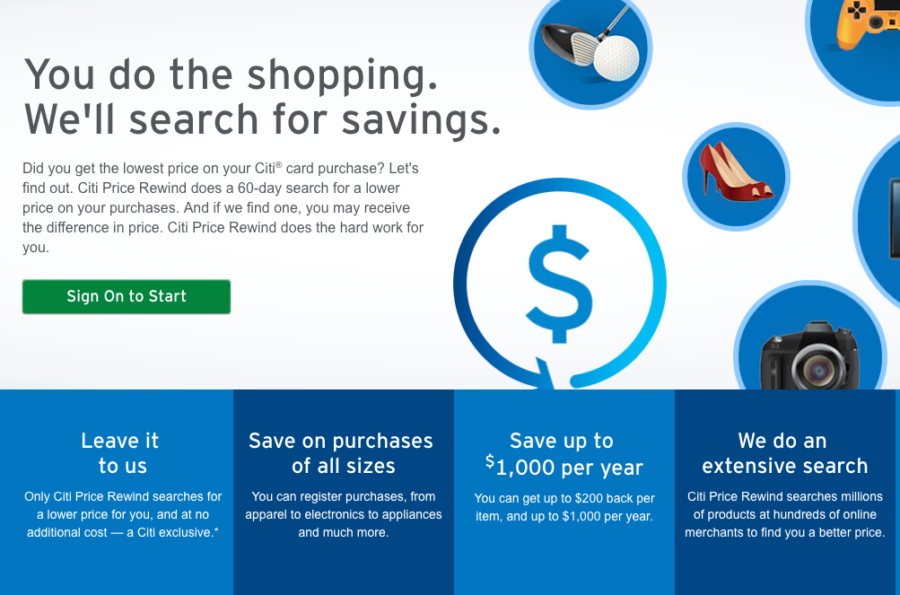

If there’s a price drop within 60 days, you can get the difference refunded back to your card.

I LOVE Citi Price Rewind

Citi wants you to register each purchase manually. But there’s a way to automate it, which I’ll get to in a sec.

3. Capital One cards

| Capital One Savor | $300 Cash |

|---|---|

| • 4% cashback on dining and entertainment • 2% cashback at grocery stores • No limit to how much you can earn |

| • $95 annual fee | • $3,000 on purchases within 3 months from account opening |

| • Learn more here |

All Capital One personal cards come with 60 or 120 days of price protection, depending on the card.

In particular, I’d recommend the Capital One Savor card for 4% cashback on dining and entertainment. Plus, there’s a $500 cash bonus after spending $3,000 on purchases within 3 months from account opening.

And if you dine or go out a lot, it’s a worthwhile card to add to your collection.

The Capital One Savor card comes with 120 days of price protection

Even better, this card has 120 days of price protection – nearly 4 MONTHS to find a lower price.

But you can automate that, easily. Let’s get to that now.

Automate retailer and credit card price protection with Earny

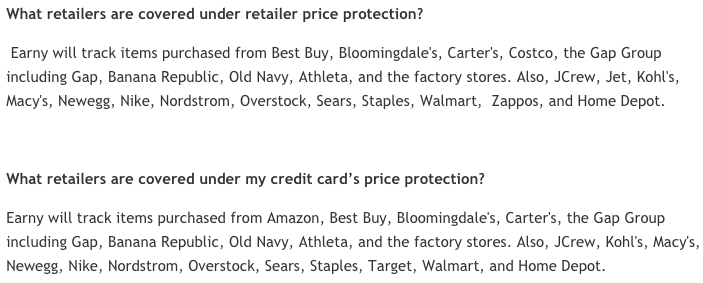

Enter Earny, a service that files price protection claims on your behalf – with zero effort on your part, after you link your cards. As of now, it only works with Visas and MasterCards.

If you have an eligible card, you should sign up immediately!

I use my Citi AT&T Access More card for online shopping

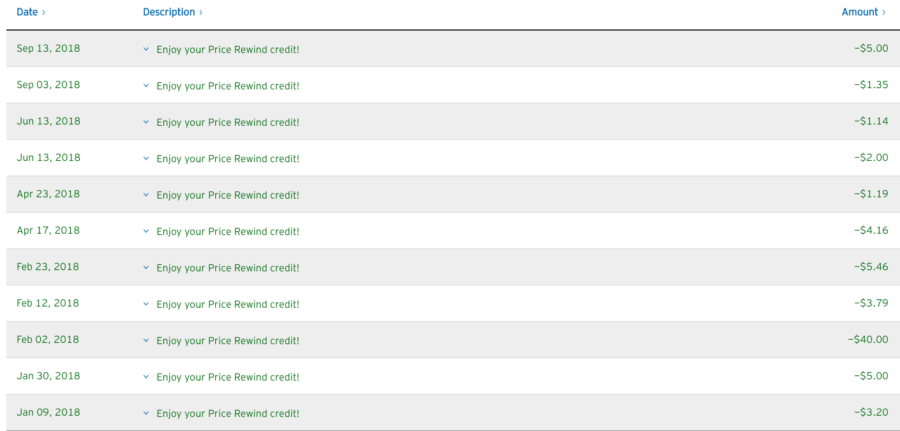

In return, you’ll pay 25% of whatever Earny gets you back. But truth be told, I get so many random credits to my Citi cards, that it’s so, so worth it. Amazon in particular has price drops all the time.

I get Citi Price Rewind credits all the dang time thanks to Earny

With so many sales coming up, there’s a strong chance of a price drop.

Earny works at lots of merchants

It also tracks price protection from individual retailers, and with your eligible credit cards. Amazon no longer offers price protection, but many credit cards do. Either way, Earny will keep track of it all for you.

Set it and forget it – my kind of service!

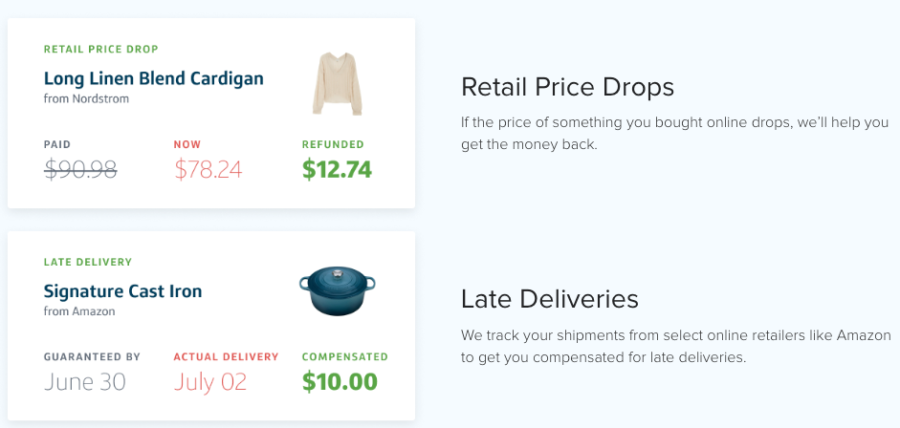

Add Paribus for even more support

- Link: Signup for Paribus

Way I see it, Earny and Paribus are two sides of the same coin. There’s some overlap in what they track, and some difference. It’s a good idea to cover all your bases.

Paribus is slightly same, slightly different. I recommend getting both – they’re free, so why not?

Paribus also tracks late deliveries, and it’s a completely free service. You have nothing to lose, and lots of price drops to gain. During the holiday season, that can be valuable.

I’d say to sign up for both services and let them work their magic. Paribus is especially great for late Amazon deliveries. You know at least one Amazon package is gonna arrive late over the next couple of months.

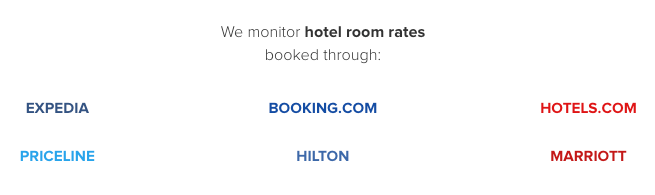

They also monitor hotel price drops, which is a nice extra.

Paribus also tracks hotel price drops, great for Hilton and Marriott loyalists

I’ve personally saved hundreds since I joined in 2015. And again, it’s a free service, so there’s no reason not to join.

Bottom line

Right now is also a great time to open a new credit card, and I’m thankful if you consider using my links for that purpose. Because by the time the card arrives in 7 to 10 business days, it’ll be… Black Friday! I recommend:

- Chase Sapphire Preferred® Card if you’ve never had it (no price protection, but purchase and warranty protection)

Any Citi personal card for Citi Price Rewind (60 days of price protection)- Capital One Savor – learn more here (120 days of price protection)

Credit card price protection is at the top of my holiday shopping list. I know everything I buy over the next couple of months is gonna go on sale at some point. Especially on Amazon.

I use Earny and Paribus to track the bulk of the price drops, and automate to my savings.

In addition to that, it’s important to use a credit card that has price protection, in case the merchant doesn’t. Or at least one that has purchase and warranty protection for those big ticket items, like electronics and furniture.

Go forth, plan your purchases, stay scrappy, and earn a ton of points & miles from your natural spending this season!

Love and light to all.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Discover does not offer price protection.

You’re right, I updated the post. They still haven’t removed it from their website, so that misled me.

Nice article for holiday shopping to refer quickly.Thank you.Even though lot of people know about price protection, warranty your article helps to refresh those quickly.