If you have a Citi Prestige card, there’s a promotion running through the end of August 2020. You can earn 5X points per $1 spent on “online purchases” – up to 7,500 Citi ThankYou points.

My friend Angie tipped me off that Plastiq payments are working to trigger the bonus points, so I took the opportunity to make a $1,500 auto loan payment. Plastiq is a bill payment service that allows you to pay most bills (and even individuals providing a service) with a credit card.

Details of the Citi Prestige 5X promotion

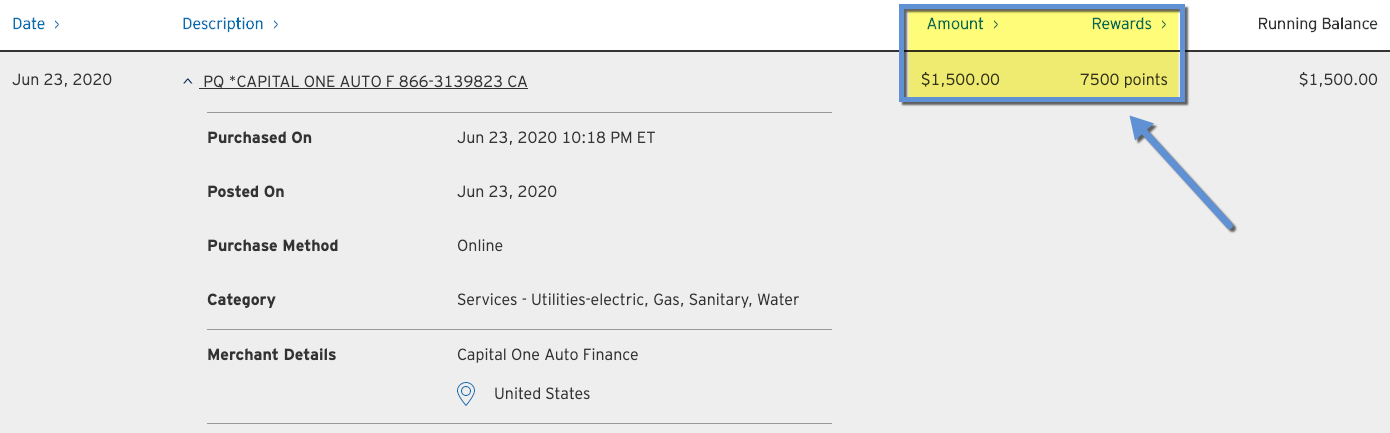

Sure enough, I earned 7,500 Citi ThankYou points for the payment. So while that’s great, a word of caution. Plastiq is increasing the payment fee from 2.5% to 2.85% on July 1, 2020.

If you wanna get in on this easy win, you only have a few more days!

Citi Prestige Plastiq 5X points

As mentioned, the fee is going up next week. That said, you can still lock in the lower 2.5% fee on payments scheduled through June 30, 2020. And the Citi Prestige 5X promotion runs through August 31, 2020. This is helpful if you don’t want to make a big payment all at once.

Keep in mind, Citi Prestige is a MasterCard, which means you can use it for auto, rent, mortgage, HOA dues, and pretty much any other payment. Other card types (Visa and Amex) don’t cover every category, but the advantage here is you can schedule, say, your mortgage or car payment through August. And as long as you schedule it before the end of June, you’ll get the lower fee AND 5X points on the purchase with Citi Prestige.

Yay-yiss hunty!

I had enough FFDs (fee-free dollars) to cover the payment, and the $1,500 charge earned me 7,500 points, which the max you can earn with this promotion.

The magic number

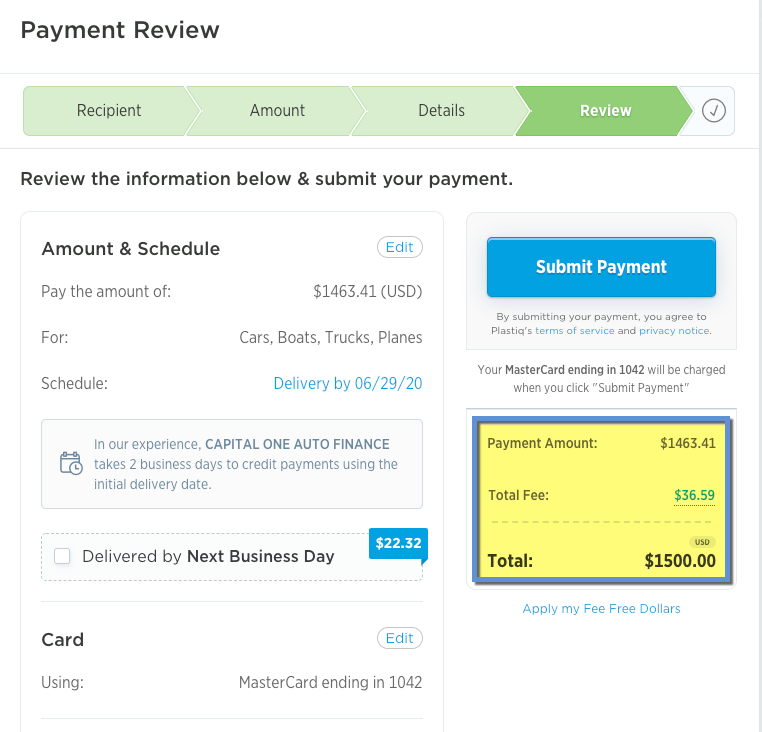

If you have to pay the 2.5% fee though, and want to hit exactly $1,500, you’ll want your payment amount to be:

- $1,463.41

- with a $36.59 fee

That’ll ensure you max out the promotion and get all your bonus points. Of course, you can always pay some other amount and finish maxing out the promotion with other online purchases. Citi is vague about what counts (other than groceries and drugstores), but if you want to be sure, Plastiq payments are a dead simple way to do it in seconds.

Is it worth it?

- Link: Sign up for Plastiq

7,500 Citi ThankYou points are worth $150 assuming you value them at 2 cents each (and you should – all flexible bank points should be worth at least that much otherwise don’t redeem them).

With this deal, you’re paying ~$37 to get $150 worth of points, which is pretty dang good.

Easy 5X? Yes plz (also: anyone read palms?)

If you’re new to Plastiq, you can sign up and get $50 FFDs after making $500 in payments. It’s not a lot, but you could easily max it out with the Citi Prestige deal and get a few bucks in free payments for later.

I don’t see any downside to this promotion tbh. If you already have a Citi Prestige card, this is an easy way to rack up extra points. And it’s worth it, even with Plastiq’s current 2.5% fee considered. It’s probably still worth it when the fee goes up to 2.85%, but obviously not as good as it is for the next few days. So get it while it’s hot! 🚨

Does AT&T Access More work for 3X for this “online purchase?”

My personal evidence says no, as Plastiq payments stopped working for the Citi AT&T Access More card a long time ago. And Middle Age Miles confirms this suspicion.

Thankfully, the definition of “online purchase” is broader with Citi Prestige for this promotion, and I can personally confirm Plastiq payments are working. And Middle Age Miles says Bravo app payments also work for 5X.

Citi Prestige Plastiq 5X bottom line

Wanted to share this quick, easy deal for folks who have a Citi Prestige card.

Mine renews in December and I’m not sure if I’ll keep it another year. In the age of Covid, I haven’t been dining out or purchasing any flights. If that continues to be the case, I don’t know why I’d keep it. And if things turn around and I can fly and dine out again, then great! I’d love to keep the card and use it that way, especially with a sweet retention offer.

I’m also sad about Plastiq raising their fee and cutting the intro offer. But as everything with this hobby, you gotta hop on the offers while they’re around because they all – without exception – can and will end.

Citi ThankYou continues to be a favored program for me because of my spending habits, even with Covid going on. Like everyone else, I can’t wait to redeem points for travel again. More soon. Hope everyone is safe out there. 💫

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

In sum. You just paid $0.25 per TY point, IMO not much of a deal.

Even if you redeem them for 1 cent each for travel booked through Citi, 7,500 points is worth $75. Paying $38 and getting $75 toward travel isn’t a terrible deal, especially if you usually pay bills through a checking account. Plus you get to float the cash for a little while. Not the best deal I’ve seen in my life, but certainly not bad.

And you had to deal with Plastiq. That’s not really a plus. But, on the good sign, you did find a way to plug your Plastiq referral right before the rate increase, and to share something a friend alerted you to. Welp, there is that, I guess.

I’ve had nothing but great experiences with Plastiq. My car payment is made electronically through them. The referral link doesn’t really earn me all that much. I really did just want to share what I thought was a good deal.

Where is your monthly update?!!?!

Where is yourJune FIRE update??

Jon! It’s coming this week and it’s full of great news. I had to let the dust settle. Can’t wait to share. I’m back. xoxo and thank you for checking in!!!

Hey Jon! It’s here: https://outandout.boardingarea.com/condo-sold-net-worth-return-to-form-up-35k-july-2020-freedom-update/

Thank you for the kick in the pants – I needed it. Hope you are doing well!