Plastiq is an online service that allows you to pay nearly any bill using a credit card. And now for the “gotchas:”

- There’s a 2.5% fee to send a bill payment

- You can’t make loan payments (rent, car note, etc.) with a Visa or Amex card, but residential rent and HOA fees are OK

- You CAN make loan payments with a Mastercard or Discover card

- Capital One cards currently don’t work in their system right now

- Most cards only earn 1 point or mile per $1 spent, which doesn’t make the fee worth it

That said, there are a lots of situations you’d want to use Plastiq despite the fee:

- To complete minimum spending requirements in literally seconds and earn a sign-up bonus

- When they run a promotion for free or discounted payments

- When paying the fee gives you wiggle room for unexpected expenses

- To reach a big spend bonus for a free hotel night/airline elite status credit, depending which card you have

- If your card issuer is running a promotion for bonus miles/points/cash

And there are two cards with a 2X earning rate that work with Plastiq. The first is the Amex Blue Business Plus, which earns 2X Amex Membership Rewards points on all purchases, up to $50,000 spent per calendar year. That’s cool, but many peeps don’t qualify for small business cards, or don’t want to pay personal bills with a business card.

I value bank points at 2 cents each, so earning 2X points per $1 spent is a 4% return.

If you maximize your per-point value, it can easily offset Plastiq’s fee. Like when you get an international long-haul flight in a premium class. For that reason, I’ve been using my Amex Blue Business Plus on Plastiq a lot – but as noted above, I can’t pay my mortgage or car payment.

Enter the second option…

Citi Double Cash Plastiq payments

The Citi Double Cash card earns 2% cashback on all purchases – 1% cashback when you make the purchase, and another 1% cashback as you make payments.

This is a regular ol’ consumer card with no annual fee. Plus, you can product change nearly any existing Citi card to this one.

For example, I called Citi and asked them to turn my American Airlines card to a Double Cash card. Within minutes, it was done.

Of course, you can also apply directly. There’s no sign-up bonus, but it’s one of the most straightforward cashback cards around. Although, that 2% return still doesn’t cover Plastiq’s 2.5% fee.

The power is in pairing with other Citi cards because you can transfer the cashback you earn directly to Citi ThankYou points when you have other Citi ThankYou cards – and that can get you outsized returns.

Double Cash + Premier

ThankYou points redeemed for flights are worth 1.25 cents each if you have the Citi ThankYou Premier card. If you transfer the 2X points you earn with Double Cash to ThankYou Premier, that’s a 2.5% return (1.25 x 2) – which covers the entire Plastiq fee.

Or, you can access Citi’s travel partners (here are the 5 best), including:

- Avianca

- Asia Miles (Cathay Pacific)

- EVA Air

- Etihad Guest

- Flying Blue (Air France / KLM)

- Jet Airways

- JetBlue

- Malaysia Airlines

- Qantas

- Qatar Airways

- Singapore Airlines

- Thai Airways

- Turkish Airlines

- Virgin Atlantic

Assuming your points are worth 2+ cents each when you transfer them, this equates to a 4+% return. And yeah, it sucks that you have to pay a $95 annual fee on the Citi ThankYou Premier card, but consider it earns:

- 3X Citi ThankYou points on travel, including gas

- 2X Citi ThankYou points on dining and entertainment

- 1X Citi ThankYou point everywhere else (make that 2X Citi ThankYou points when you use your Double Cash card everywhere else and send the points over!)

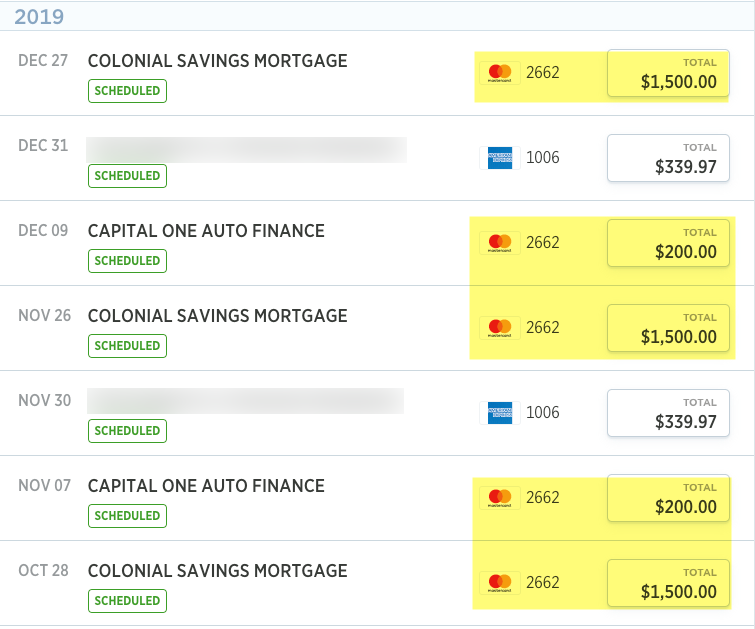

It’s also a Mastercard, which means you can use it for loan payments, including mortgage and car payments. That’s sweet, because you come out at least 1.5% ahead of Plastiq’s fee (4% – 2.5%) and can essentially turn your biggest expenses (housing and auto) into award flights when you send your Double Cash rewards to the Premier (or Prestige) card. I’ve got my mortgage and car payments set to Double Cash through the end of the year for this reason.

Better believe I’m sending the 2% cashback to my other ThankYou cards

There’s no other card that lets you earn 2% cashback on mortgage or car payments – the Citi Double Cash is the only Mastercard with that earning rate.

You can still use a Visa or Amex card to pay rent and HOA dues, so if you have say, the Fidelity Visa or Blue Business Plus, you can access a 2X earning rate for your living expenses (I’m still using my Blue Business Plus to pay HOA fees, as seen in the pic above).

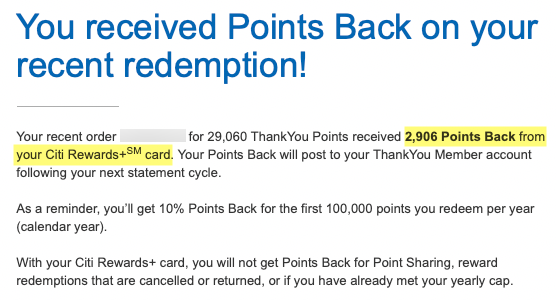

Citi Double Cash Plastiq + Premier + Rewards+

Even better, when you throw the Citi Rewards+ card into the mix, you can get 10% of your redeemed points back per year, up to 10,000 points per year.

So you could:

- Earn 2% cashback with Double Cash

- Transfer to ThankYou Premier to book airfare at 1.25 cents each (2.5% return) or transfer to travel partners (4+% return)

- Get 10% of your points back up to the yearly 10,000-point limit

In fact, I just did this to fly home for Thanksgiving.

Mama gonna be so happy

If you book airfare, your return would be 2.75% with the 10% points rebate factored in (2.5 x 1.1). Or if you transfer to partners and assume a base of 2 cents each, that’s a 4.4% return (2 x 2 x 1.1) – a great deal for bills you’d pay anyway.

By the numbers

Let’s say your mortgage is $1,500 per month, car note is $300 per month, and some other bill is $200 per month. That’s $2,000 in recurring bills.

You’d pay $50 to pay those bills with a credit card ($2,000 X 2.5%) with Plastiq. Over the course of a year, you’d pay:

- $24,000 for mortgage, car, and the other bill

- $600 in fees

And with Double Cash, you’d earn $492 in cashback or 49,200 Citi ThankYou points.

With ThankYou Premier, that’s worth $615 in flights. And you’d get back 4,920 points if you also have Citi Rewards+, which is worth another $61.50 in flights, or ~$677 back in total. So you end up ~$77 ahead of your fees, which are $600 for the year.

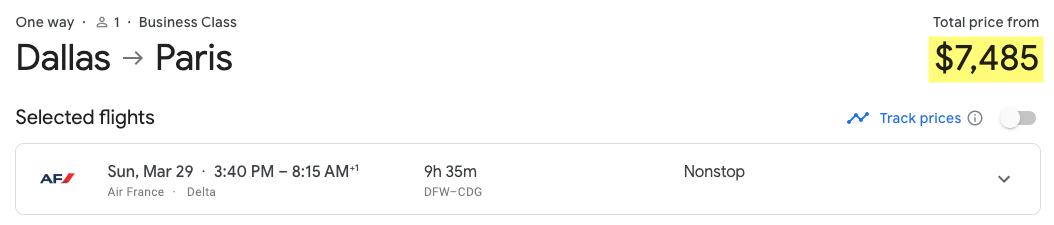

Or, you could send your roughly 50,000 Citi ThankYou points to a partner, and get a flight worth $1,000s.

Paris in the springtime, anyone?

For example, I found a nonstop Business Class flight from Dallas to Paris for only 56,000 Flying Blue miles + $210.

Wowza

That’s a steal considering this flight is currently selling for over $7,000. I’d also get 5,600 points back for this redemption thanks to my Rewards+ card.

And while you come out a bit ahead with Double Cash –> Premier transfers to book flights through Citi, the real value shines when you can find deals like this. Either way, you don’t lose money – just move it around – but you’ll get the best deal when you transfer to partners.

This is gonna be my plan moving forward: pay with Citi Double Cash, move rewards to another ThankYou card, get 10% back up to the yearly limit with Rewards+ – and use the points to fly fancy and/or save when flights are expensive. So glad this is a thing now!

Bottom line

On its own, the Citi Double Cash card isn’t worth it for Plastiq bill payments because the 2% cashback you’ll earn doesn’t stand up to the 2.5% fee.

But add in a Citi Prestige or ThankYou Premier, and you unlock the power to transfer to partners. Though the selection is thin, there’s absolutely no reason you can’t get stellar value with the 5 best ThankYou transfer partners:

- Avianca – cheap prices to Europe in Business Class, and around the US (depending on zone)

- Etihad – great deals on Brussels Airlines and American flights, if you can find award space

- Flying Blue – save on Delta flights, use Promo Awards for cheap flights to Europe

- Qantas – hidden gem for short flights on American, easy to hop around Australia

- Singapore – save your United or Alaska miles, or fly in Singapore First Class

And when you throw in the Rewards+ card to get 10% of your redeemed points back (up to 10,000 back per calendar year), using the Double Cash card for everyday purchases and Plastiq payments seems all the more worthwhile.

If turning my monthly bills into one fancy Business Class flight a year is all I get, that’s still worth it considering those flights can cost $1,000s. Plus, as a Mastercard, you can pay your mortgage and car note via Plastiq. So I’m switching most of my Plastiq bills over to the Double Cash card now. #myplan

So what do you think? Is it worthwhile to use the Double Cash card for Plastiq bill payments if you can combine the rewards with another ThankYou card?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Great piece of writing Harlan! I love your blog and I also believe Thankyou points are hugely under appreciated as other sites are probably paid by Chase to sell their cards. I would add Asia Miles to the mix of valuable transfer partners as they are great for One World flights. Plastiq with Citi Trifeca is a killer combination.

Great post! Enjoy your deep insights and strategies! Keep it up.

@Harlan,

One fee you forgot to include is the $95 AF on the Citi Premier (the DC and Rewards+ don’t have fees). I don’t know if it changes your calculations since I’m sure you use a fair number of Citi TY points as airline transfers, but it does make it a slight loss per your calculations ($18 in fact).

Yes! So I thought about that. The card is $0 the first year, then $95 afterward. But Citi is such good retention offers that I’ve always either had the fee waived, gotten statement credits, or had an offer to earn so many extra bonus points that it offset or more than covered the annual fee. So the real calculation would depend on if it’s your first year and if you got a retention offer in subsequent years. But yes, assuming you pay the fee and get no special offers, you are absolutely correct! Thank you for noting that!

Looks like all of your plastiq bills are paid with fee free dollars earned through referrals, so this is a different deal for you than for the people who sign up through your link.

Sometimes they are! But not always. My car note is $161 and my mortgage is $1,294, but I like round numbers so even with the fee, I know the number to enter that gets me to a round number. The only one I don’t change is my HOA fee, which is a set amount with no reason to add extra. With the others, I pay down my principal a little faster.

So no, it’s the same deal for me. I still think it’s worth it, even if the fee included.