A couple of days ago, I returned from a MUCH needed break slash reset in sunny Puerto Vallarta on the Pacific Ocean side of Mexico. A friend and I stayed 3 nights Hyatt Ziva Puerto Vallarta. She flew down from Chicago. And I flew from Dallas.

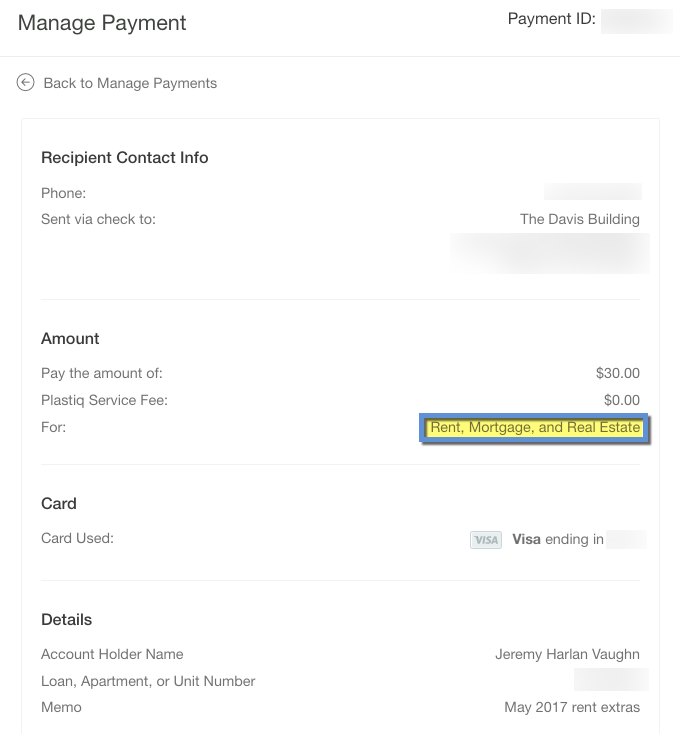

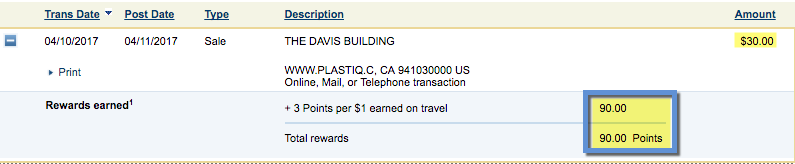

Out-of-pocket, I paid $90 in addition to 60,000 Hyatt points for the room and 15,000 British Airways Avios points for award flights on American. Here’s how I did it!

PV PLZ trip report index

- PV PLZ: How I Booked a $2,000+ Mexican Vacation for $90 With Points

- PV PLZ: Review of My Free Stay at the Hyatt Ziva Puerto Vallarta

- PV PLZ: Eating at All the Hyatt Ziva Puerto Vallarta Restaurants

- PV PLZ: Couples Massage at the Hyatt Ziva Puerto Vallarta Spa