It occurred to me I only drive for a handful of reasons:

- To go to the gym

- To drop the dog off before I travel

- Costco runs every ~6 weeks

- To visit nearby places, like Fort Worth

Most of the time I walk or use Uber/Lyft. Because if I intend to drink, I don’t want to deal with parking (and possibly having to pay for it) or of course driving back unsafely. And I live so close to many of the places I frequent that I can walk.

I realized, surprisingly, there are lots of peeps in Dallas who don’t have cars. And I I was shocked by how extremely walkable certain parts of the city really are.

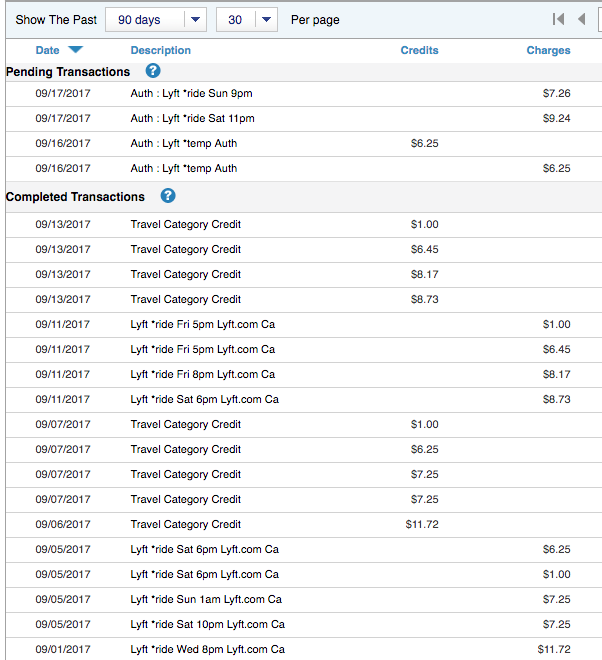

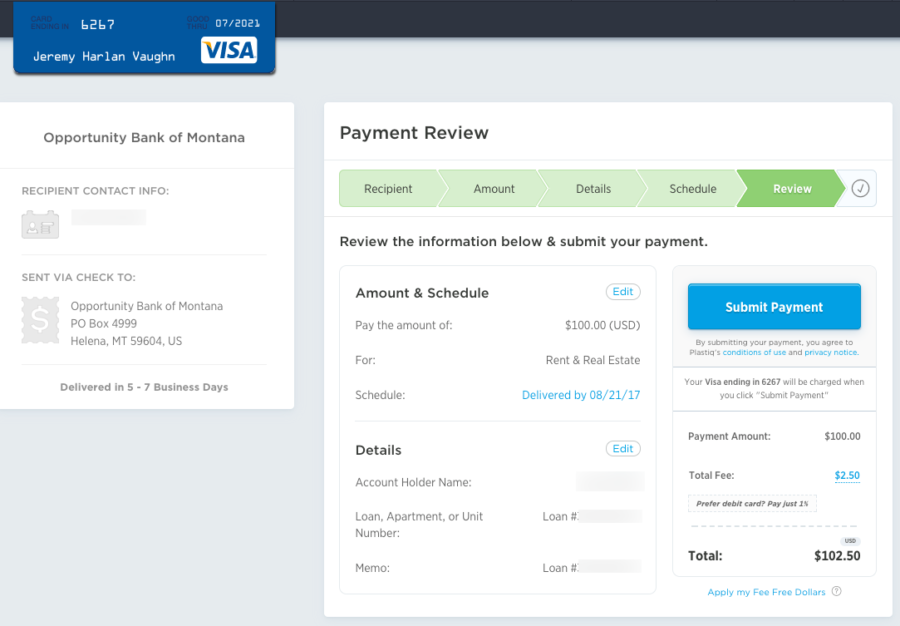

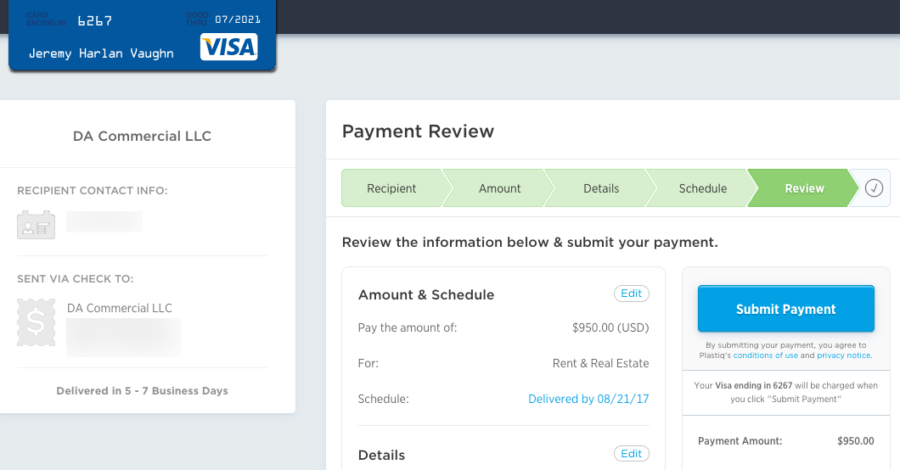

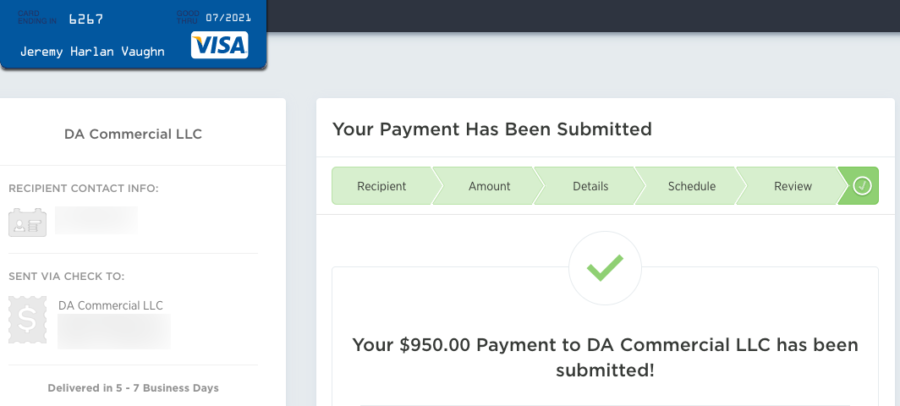

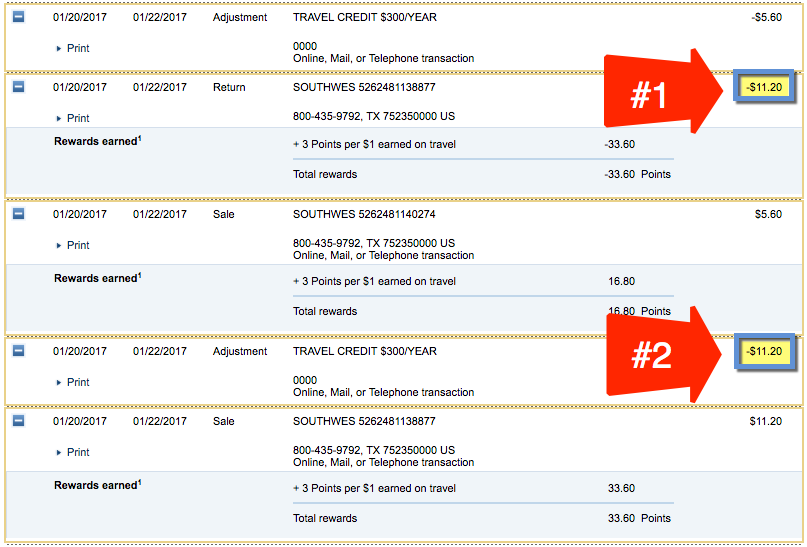

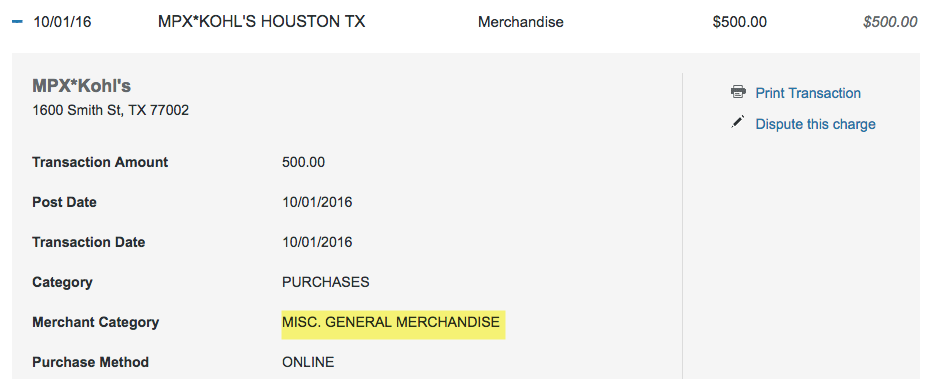

I’ve also been using the $325 travel credit from my US Bank Altitude Reserve card for Lyft rides lately (I prefer Lyft for many reasons). Then it hit me that I could subsidize $825 in Uber and Lyft rides thanks to travel credits of 3 of my premium cards. It got me thinking – are those credits enough to consider getting rid of my car?