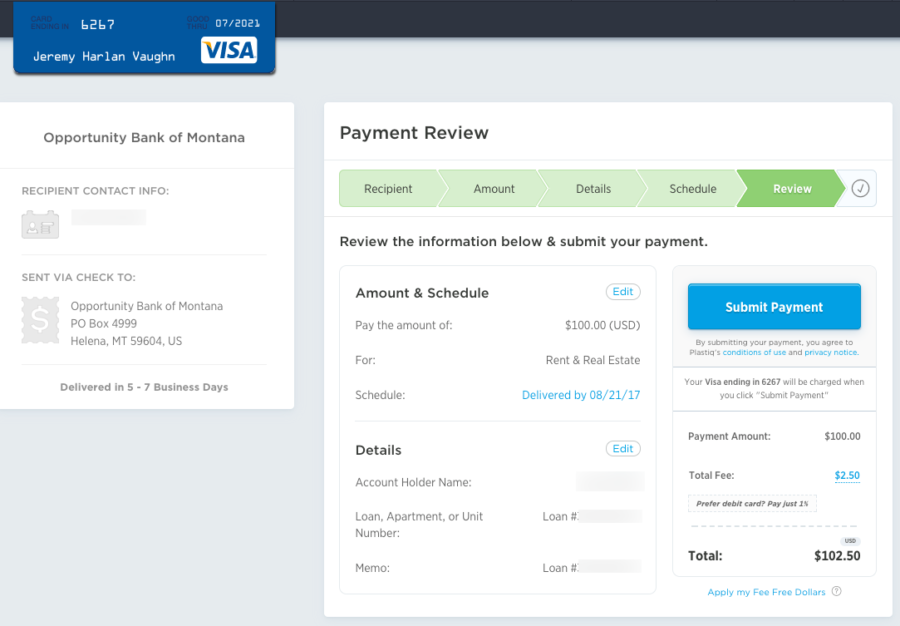

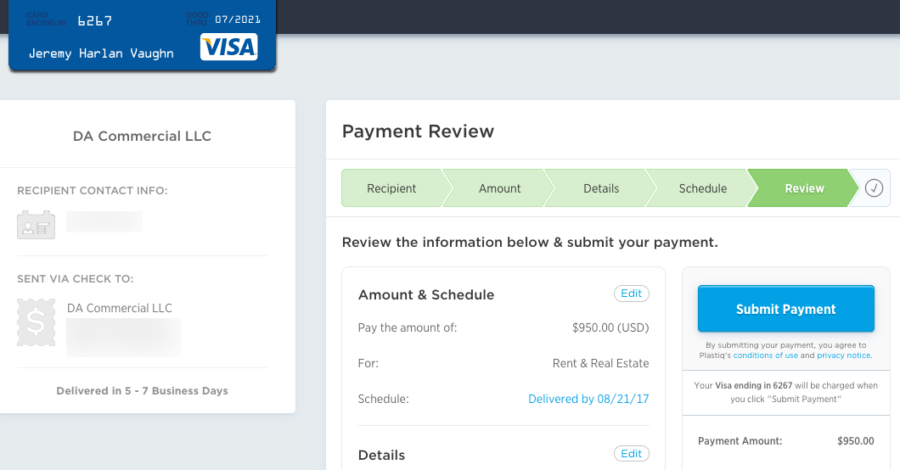

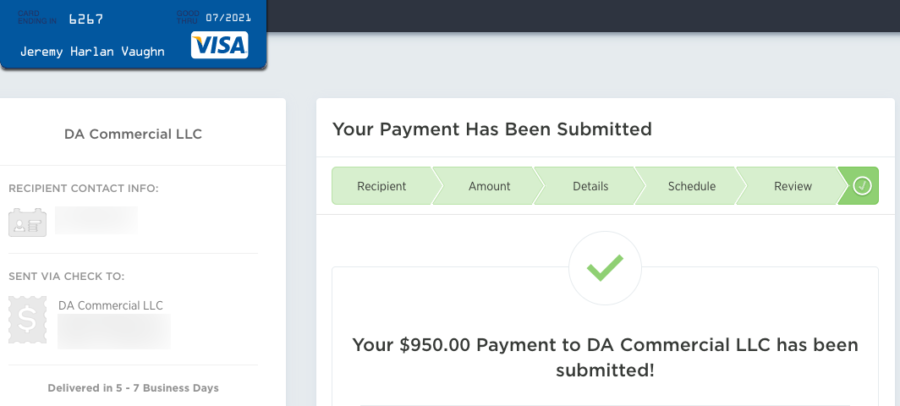

Plastiq is an online service that allows you to pay nearly any bill using a credit card. And now for the “gotchas:”

- There’s a 2.5% fee to send a bill payment

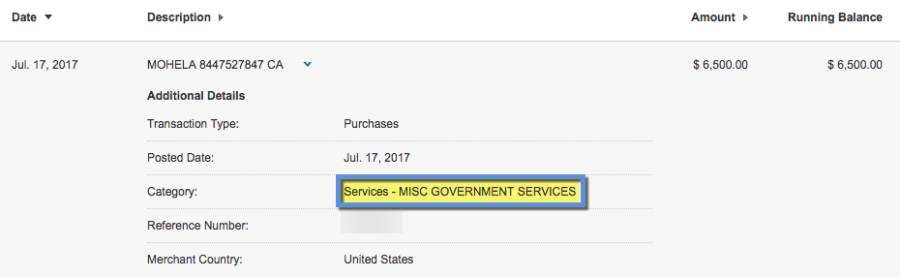

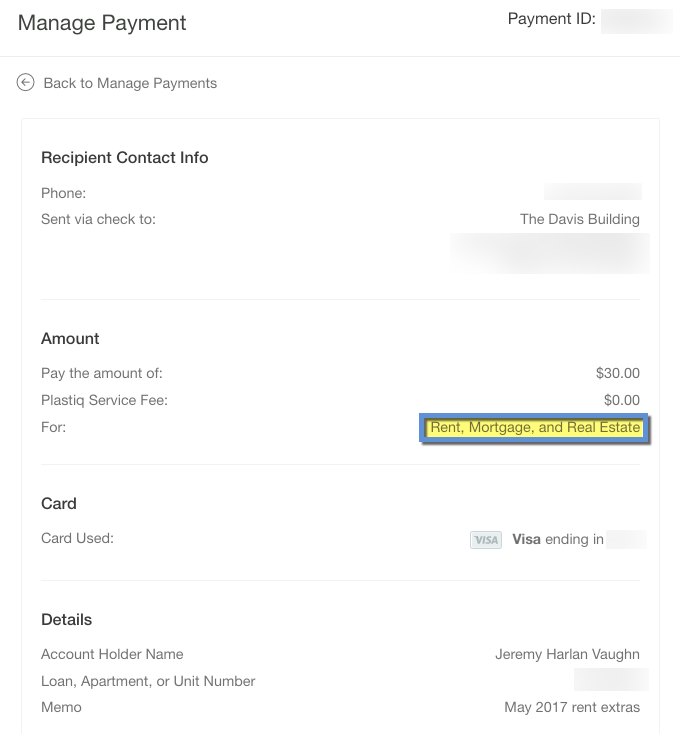

- You can’t make loan payments (rent, car note, etc.) with a Visa or Amex card, but residential rent and HOA fees are OK

- You CAN make loan payments with a Mastercard or Discover card

- Capital One cards currently don’t work in their system right now

- Most cards only earn 1 point or mile per $1 spent, which doesn’t make the fee worth it

That said, there are a lots of situations you’d want to use Plastiq despite the fee:

- To complete minimum spending requirements in literally seconds and earn a sign-up bonus

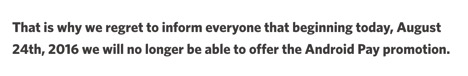

- When they run a promotion for free or discounted payments

- When paying the fee gives you wiggle room for unexpected expenses

- To reach a big spend bonus for a free hotel night/airline elite status credit, depending which card you have

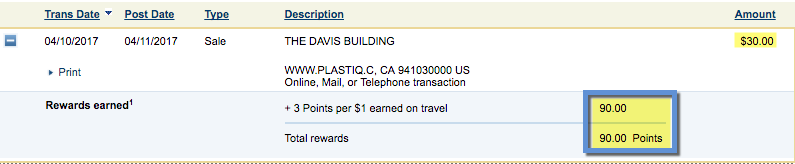

- If your card issuer is running a promotion for bonus miles/points/cash

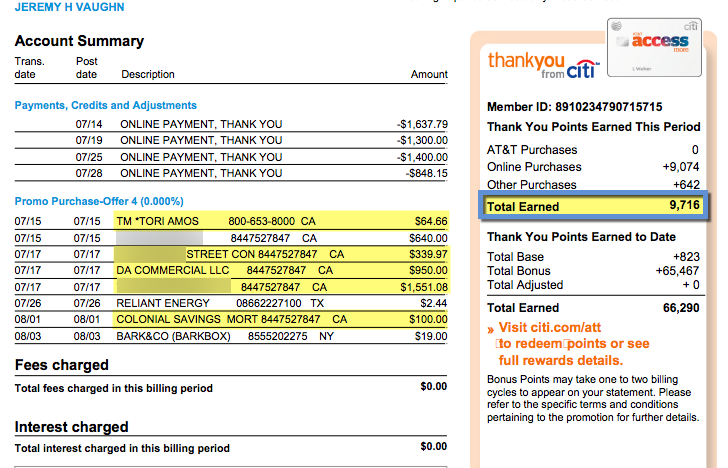

And there are two cards with a 2X earning rate that work with Plastiq. The first is the Amex Blue Business Plus, which earns 2X Amex Membership Rewards points on all purchases, up to $50,000 spent per calendar year. That’s cool, but many peeps don’t qualify for small business cards, or don’t want to pay personal bills with a business card.

I value bank points at 2 cents each, so earning 2X points per $1 spent is a 4% return.

If you maximize your per-point value, it can easily offset Plastiq’s fee. Like when you get an international long-haul flight in a premium class. For that reason, I’ve been using my Amex Blue Business Plus on Plastiq a lot – but as noted above, I can’t pay my mortgage or car payment.

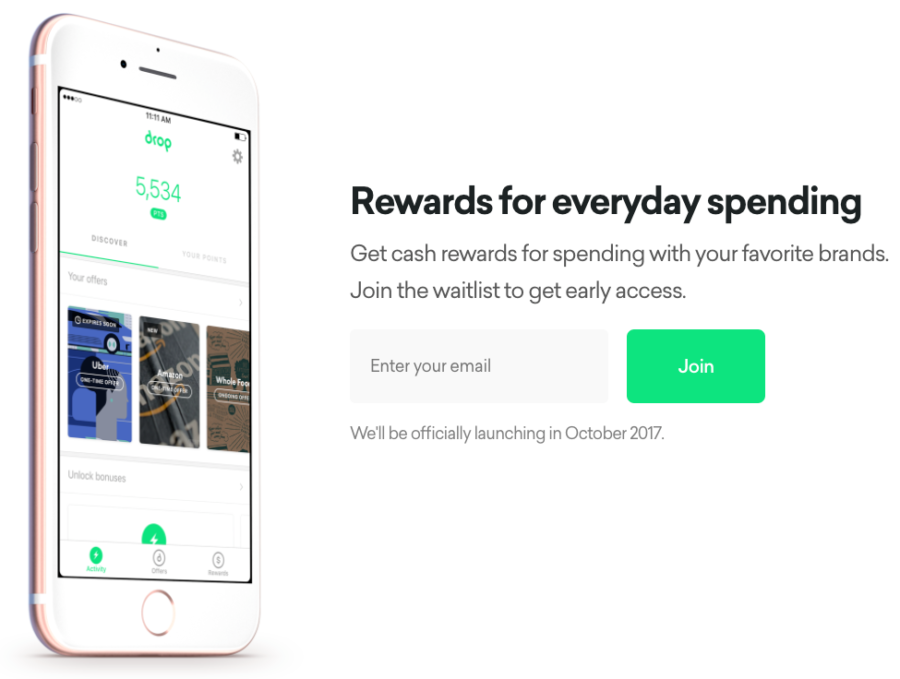

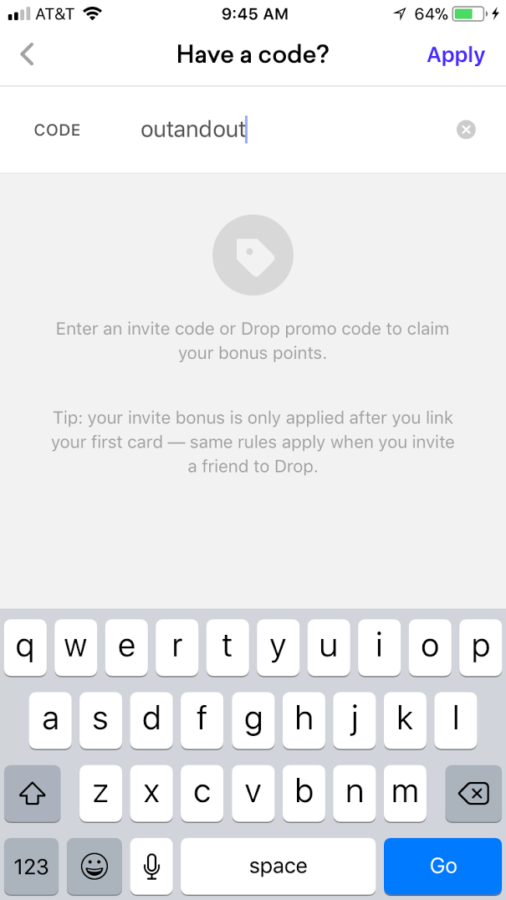

Enter the second option…