Also see:

- Seriously tempted by the 75,000 point Citi Hilton Visa offer

- My Top 5 Hilton Category 2 Hotels for Award Stays

- Yay! Just got Discover It and Citi Hilton 75K cards!

- Awesome Things, Value From Hilton and Hyatt Points, Win SPG Points, and a New Finance Blog

- Citi Offers to Compete With AMEX Offers “Soon”

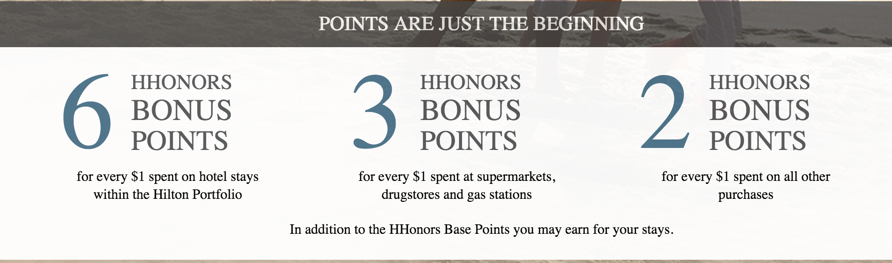

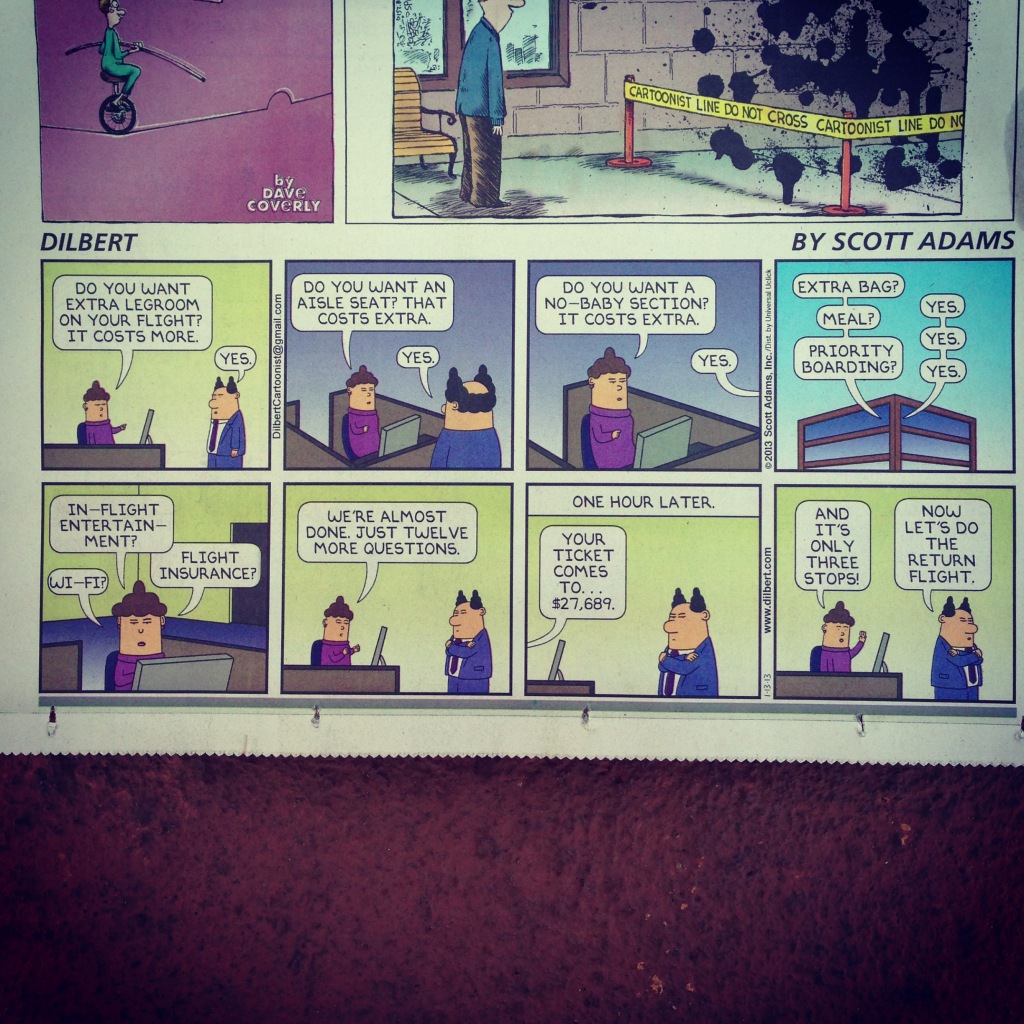

I chronicled my interest, growing fascination, and ultimate cave-in about the Citi Hilton Visa.

I’ve had the card for a sec now, and really like it. I wrote about the importance of having a no annual fee credit card, and this one might be a really good one to have.