Also see:

- [EXPIRED] Hurry! ~$500 Moneymaker on Kitchen Appliances at Kohl’s With Discover It or Freedom

- Did You Do the Kohl’s Appliance Deal? Get Back $2 per Item!

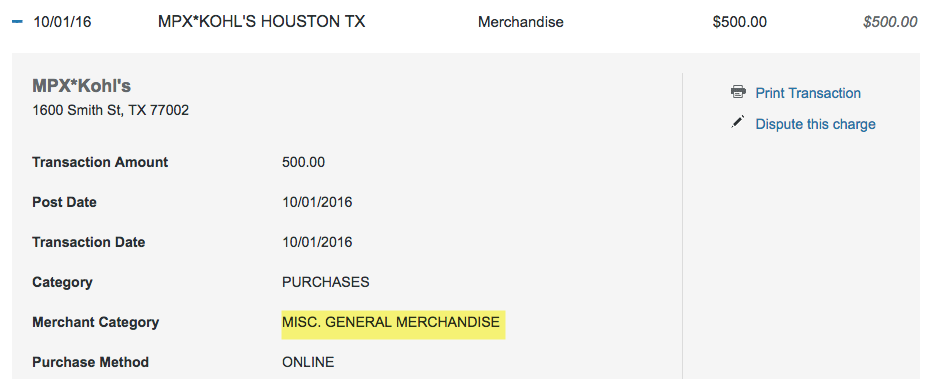

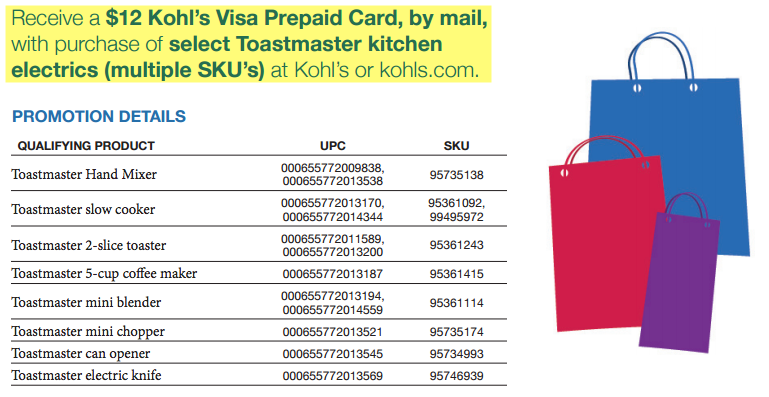

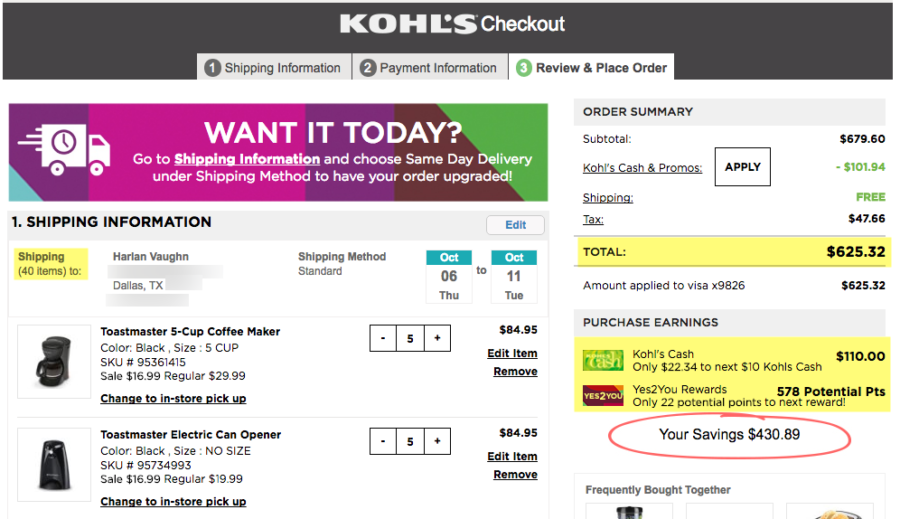

A few times per year, Kohl’s sells small kitchen appliances at a steep discount. With card category bonuses, shopping portals, promo codes, and rebates, it works out to better than free – especially if you can resell them. It’s the ultimate in deal stacking.

I ordered 40 appliances. (Do I sound crazy yet?)

While I’d love to say the whole thing went off without a hitch, that’s not exactly true. Here’s what I learned about stacking. And how it all turned out.