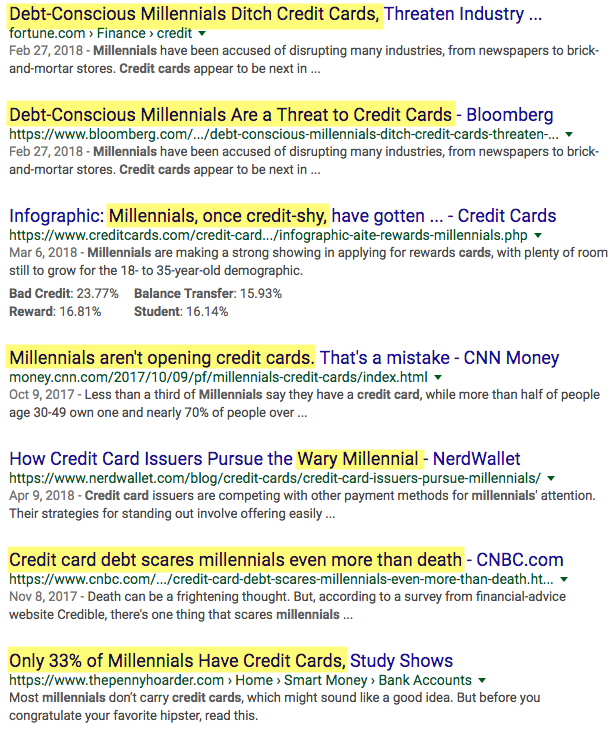

This one’s for peeps who think they can’t earn signup bonuses because the minimum spending requirements are too dang high.

When you think about, spending $3,000 (the usual spending requirement) is, of course, $1,000 per month for 3 months – or $250 per week. These cards tend to have the highest bonuses.

The problem with bank marketing is they throw out huge numbers and scare people off. But when you break it down, it appears way more manageable.

In any regard, there are plenty of cards with much lower minimum spending requirements. And some of them are genuine keepers!

Or rather, they look high – but most of them aren’t that bad once you break it down

Let’s look at 10 of the easiest signup bonuses you can earn.