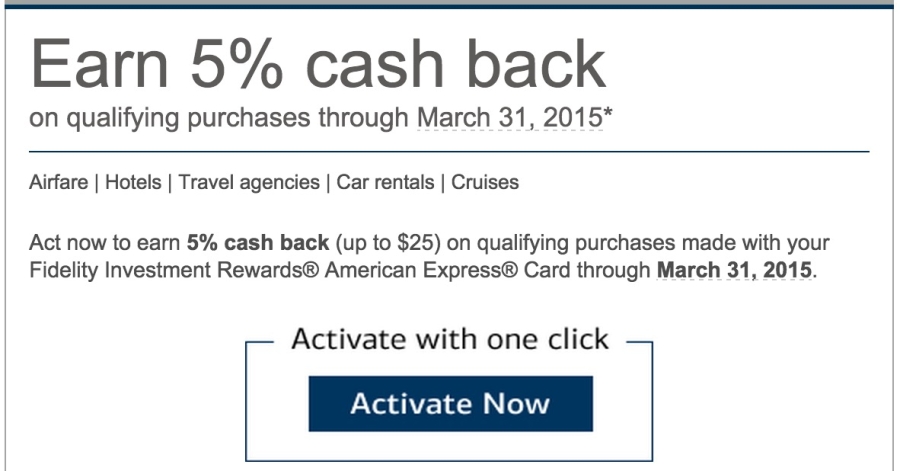

Who says the Fidelity American Express doesn’t ever have bonus offers?

Now, admittedly, this isn’t an earth-shattering bonus. It’s only offers a bonus for travel-related categories, and only up to $500 in spend until March 31st, 2015.

But, enrollment is easy (literally one click), and it seems like they’re targeting a lot of their cardholders for this.