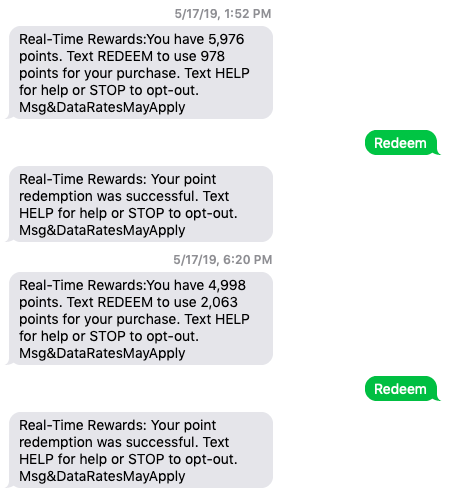

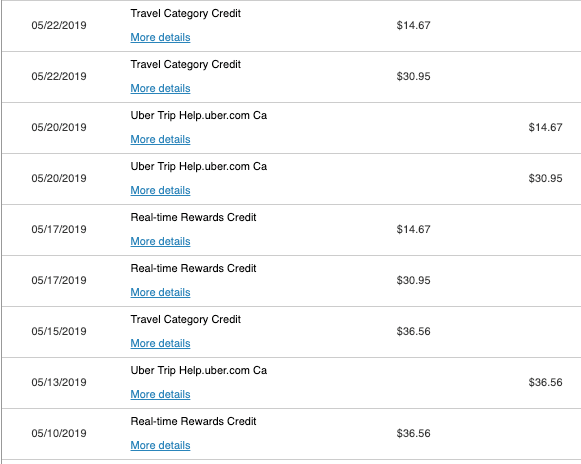

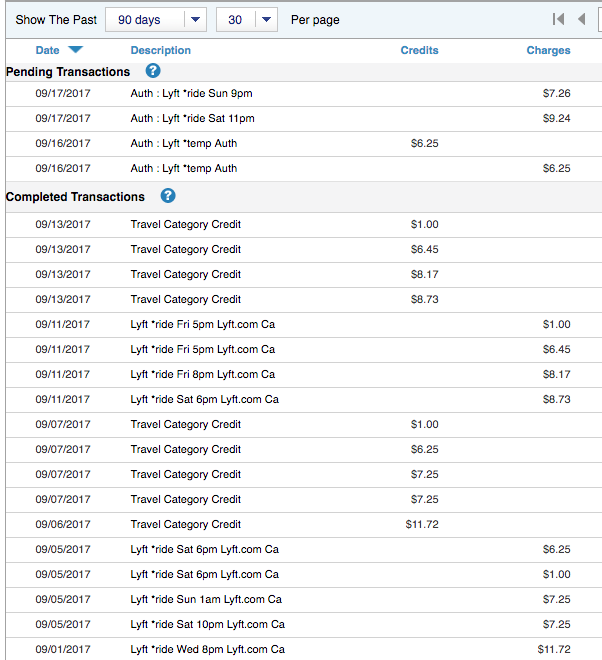

I’ve always said, “earn and burn.” Meaning earn your points and miles, then burn them in short order. I keep my points balances low – having 100,000 points is a good enough minimum cushion for me.

Because with that amount, I can get to most places in business class one-way (and to a few in business class round-trip). It’s also enough for me to begin planning a trip. And if I need more, I can start earning what I’ll need. Usually, the easiest way is to open a new credit card.

I’m accumulating points but have no idea how to use them

These days I can earn, but there’s no way to burn. I have a few cards I want, but keep waiting to apply for them. It feels pointless to have a storehouse of points and miles when most places are closed to Americans and there’s uncertainty about when we can travel again.

But my wanderlust is kicking up big time and I know when I’m able, I’ll be off like a rocket. 🚀

I’m torn between earning lots of points while I’m still in lockdown and waiting to see what happens. Who knows what devaluations and program changes are coming down the pipeline, especially with basically every airline and hotel chain massively struggling right now? It’s keeping me in a holding pattern. Not only with this topic, but with pretty much everything.