I was trolling around on the Citi website today and decided to look through my Citi AAdvantage Platinum Select Amex benefits. Lots of good things in there. I like this card because it’s an American Express card not issued by Amex and is no longer open for enrollment. I can use it for Amex Sync offers, Small Business Saturday, and possibly to load up my Serve account (haven’t gotten that far yet).

As I got to the “Shopping benefits” section, I noticed there was one for which I had to manually enroll in on the website.

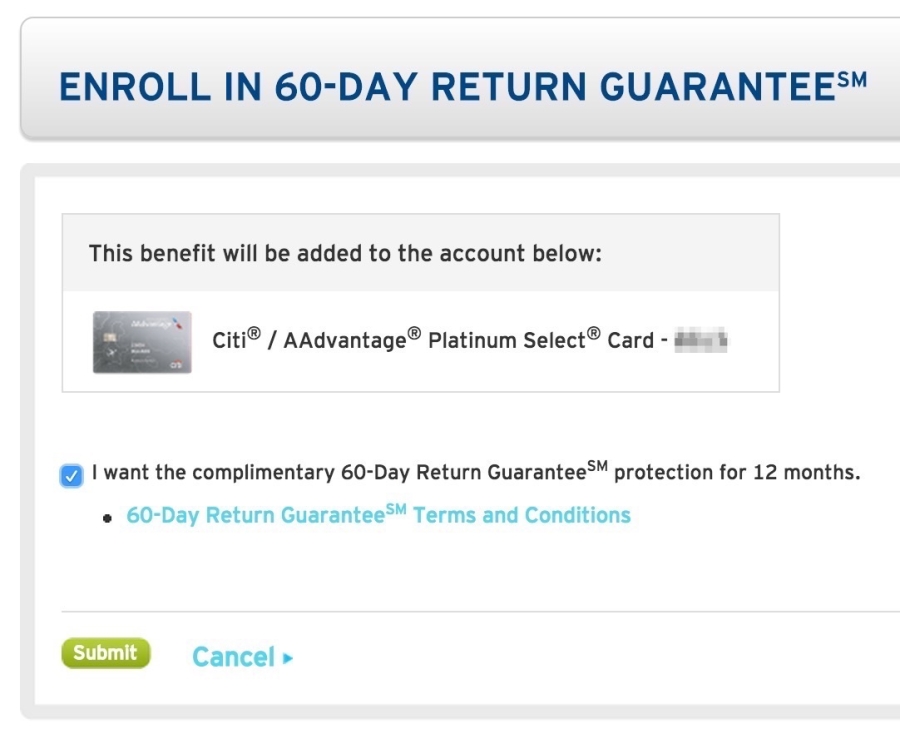

The 60-Day Return Guarantee program

There it was, hanging out there in the corner like a creep.

I clicked on it, and there was a little button that said “Enroll.” If I enrolled, it would be good for a year.

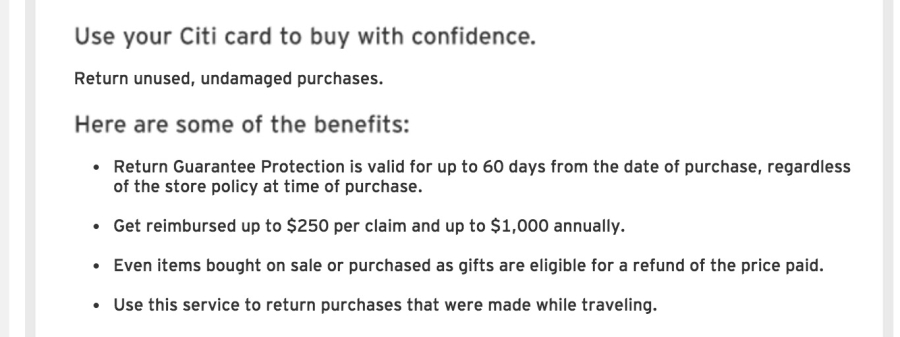

So I did it. Why not. Then I was told about the benefits:

The benefit is good for $250 per claim and up to $1,000 annually. Things returned must be new and unopened. Fair enough. Really not so shabby at all. But then I thought…

WHERE DO I SEND THE STUFF?

Apparently to their office in Ohio lol. But whatever. Then I was like… uhhhh… do I pay for the shipping (I think so)?

And then I started to think if I’d ever wanted to return something after a merchant’s return period had run out. Or what if I bought something while traveling and can’t get it back to the shop? Or what if the store doesn’t allow returns?

It hasn’t happened a lot, but here and there… yeah, definitely. Maybe once or twice a year. As long as I put the entire amount of the purchase on this card, I could return it and get the money back. Nice.

This is old news

So I thought I’d stumbled upon something new and exciting but nope. This thing’s been around since 2012. Practically Stone Age for the points and miles crowd.

I wanted to mention it here because I’d never heard of it in all my excavations about terms and conditions. Maybe it’s been around so long that it’s not mentioned any more? In any regard, it lives!

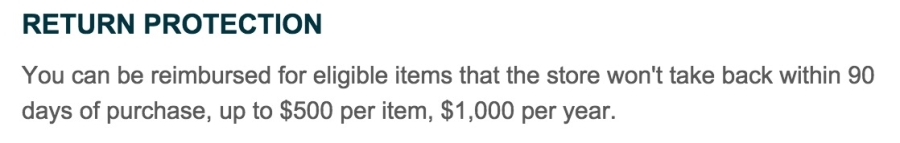

Discover, Chase Sapphire Preferred, and Chase Freedom all have similar programs. And the one for the Chase Sapphire Preferred, anyway, is up to $500 per item and you have 90 days to return it. A month more and double the protection that Citi offers.

However, I couldn’t find much online on the Chase website, so kudos to Citi for making it so easy to find and understand.

Also, apparently, you have to enroll manually for this benefit with Citi – it is not an automatic feature of Citi credit cards. So I wanted to toss it out there in case it might help someone and they’d like to enroll.

Bottom line

Citi has a program that I didn’t know about before today called the 60-Day Return Guarantee.

They’ve kinda hidden under the “Card Benefits” section of the their website, near the bottom. You have to find it and manually enroll to receive the benefit for 1 year for free.

Has anyone else, um, heard of this? Has anyone ever actually used this perk – or something similar offered by another credit card? How was your experience?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply