My little brother came to visit recently. We went to the mall because he wanted to buy a new pair of shoes – in cash. He’s one of those “sneakerheads” so his purchase was likely going to be around $100.

My little mind started wondering how to get some points out of the whole deal. Then I remembered MileagePlus X!

And because I have the Chase United Explorer card (see it here), I knew I could get a 20% mileage bonus on any gift card I purchased through the app – even if I didn’t pay with that card.

We went into a dozen stores – Nike, Finish Line, Journeys, Foot Locker, and a couple of department stores. I’m not much of a mall shopper, so my head was spinning. When he finally decided on a pair of Nikes at Finish Line, I licked my chops and bought a Nike gift card on the MPX app. But realized the second the transaction processed I was in the wrong store. Guh!

My brother paid cash and I… had a Nike gift card I couldn’t use. “It wasn’t that much,” I told myself. But then remembered… I could sell it online. Maybe that would make it OK – and at least break me even – with the points I’d earn in the mix.

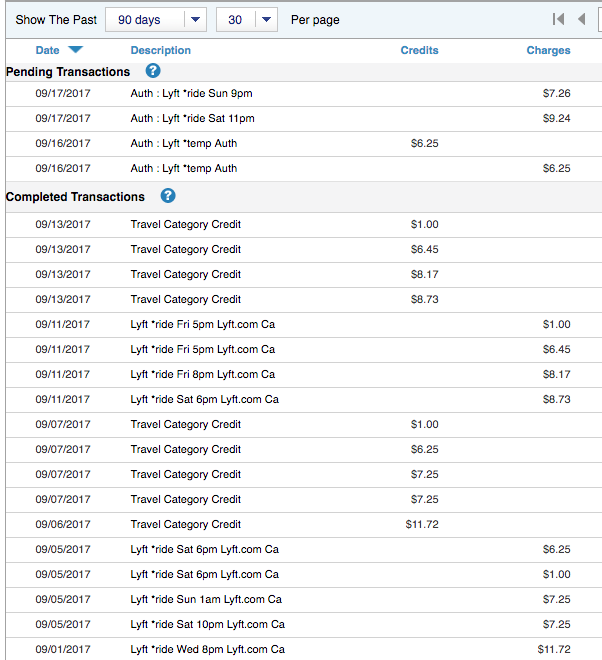

I ended up selling the gift card on Raise. Here’s how it went!