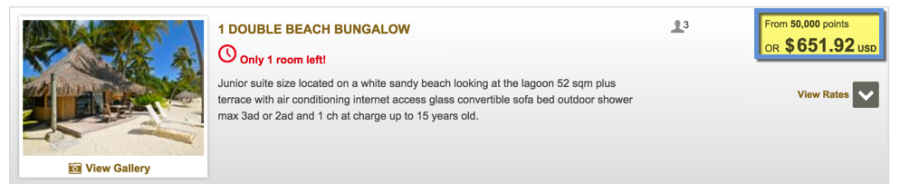

Hot off the heels of my trip to Barcy in January, I’ll be heading to the French Caribbean island of Martinique in February 2016!

There’s quite a good sale going on right now, and as I looked through the fares a few weeks ago, I thought wow, these will sell out quick!

But, they didn’t. And when I saw the fares start to increase, I pulled the trigger on this one.

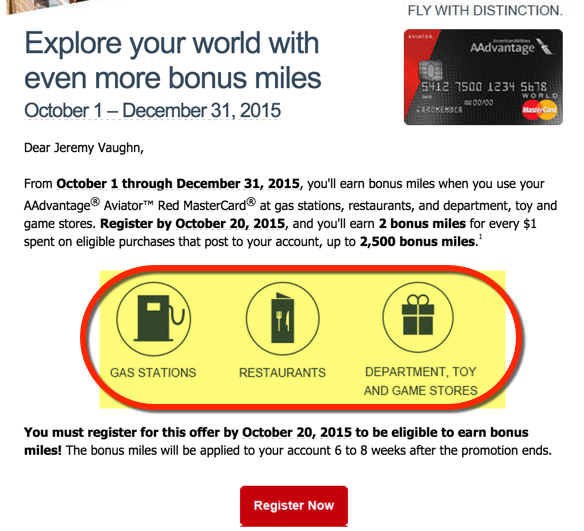

I usually wouldn’t book 2 trips so close together, but this sale, combined with the $250 airline credit on my new Citi Prestige card, formed a perfect storm of BOOK THE TRIP.